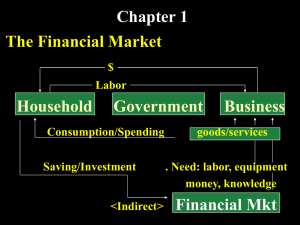

Chapter 1 INTRODUCTION TO CORPORATE FINANCE Brealey, Myers, and Allen Principles of Corporate Finance 11th Global Edition McGraw-Hill Education Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved. Topics Covered • Corporate Finance defined • Corporate (Company) • Finance – Financial Decisions • Corporate finance decisions: • Investment decision • Financing Decision The McGraw-Hill Companies, © 2014 1-1 CORPORATE INVESTMENT AND FINANCING DECISIONS • What Is a Corporation? • Legal entity, owned by shareholders • Can make contracts, carry on business, borrow, lend, sue, and be sued • Shareholders have limited liability and cannot be held personally responsible for corporation’s debts • Other forms of business organisations? • Sole proprietor, partnership, LLP, private company 1-3 CORPORATE FINANCE DECISIONS • Real Assets • Used to produce goods and services (income) • Tangible vs. intangible assets • Financial Assets/Securities • Financial claims on income generated by firm’s real assets • Securities-tradable on financial markets • Capital Budgeting/Capital Expenditure (CAPEX) • Decision to invest in tangible or intangible assets 1-4 1-1 CORPORATE INVESTMENT AND FINANCING DECISIONS • Corporate Finance decisions: • Investment Decision (What to invest in?) • Purchase of real assets • CAPEX- capital budgeting or expenditure decision • Financing Decision (How to pay for real assets?) • Sale of financial assets, equity, debt, retained earnings • Capital Structure • Choice between debt and equity financing 1-5 1-1 CORPORATE INVESTMENT AND FINANCING DECISIONS • Capital Budgeting Examples • Tangible Assets • i.e. Expanding stores • Intangible Assets • i.e. Research and development for new drug 1-6 TABLE 1.1 RECENT INVESTMENT/ FINANCING DECISIONS Company Recent Investment Decisions Boeing (U.S.) Delivers first Dreamliner after investing a Reinvests $1.7 billion of profits. reported $30 billion in development costs. Spends $7 billion to develop oil sands at Fort Spends $12 billion buying back shares. McMurray in Alberta. ExxonMobil (U.S.) GlaxoSmithKline (UK) LVMH (France) Procter & Gamble (U.S.) Tata Motors (India) Union Pacific (U.S.) Vale (Brazil) Walmart (U.S.) Recent Financing Decisions Spends $4 billion on research and development for new drugs. LVMH acquires the Italian Jeweler, Bulgari, for $5 billion. Spends $8 billion on advertising. Pays $3.2 billion as dividends. Opens a copper mine at Salobo in Brazil. The project cost nearly $2 million. Invests 12.7 billion, primarily to open 458 new stores around the world. Maintains credit lines with its banks that allow the company to borrow at any time up to $1.6 billion. Issues $5 billion of long-term bonds in order to repay short-term commercial paper borrowings. Pays for the acquisition with a mixture of cash and shares. Raises 100 billion Japanese yen by an issue of 5year bonds. Opens a plant in India to produce the world's Raises $400 million by the sale of new shares. cheapest car, the Nano. The facility costs $400 million. Invests $330 million in 100 new locomotives Repays $1.4 billion of debt. and 10,000 freight cars and chassis. 1-7 FIGURE 1.1 THE ROLE OF THE FINANCIAL MANAGER (2) (1) Financial manager Firm's operations (4a) Financial markets (4b) (3) (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors 1-8 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Stockholders Want Three Things • To maximize current wealth • To transform wealth into most desirable time pattern of consumption • To manage risk characteristics of chosen consumption plan 1-9 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Profit Maximization • Not a well-defined financial objective • Which year’s profits? • Shareholders will not welcome higher short-term profits if long-term profits are damaged • Company may increase future profits by cutting year’s dividend, investing freed-up cash in firm • Not in shareholders’ best interest if company earns less than opportunity cost of capital 1-10 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Shareholders desire wealth maximization • Managers have many constituencies, “stakeholders” • “Agency Problems” represent the conflict of interest between management and owners 1-11 1-2 THE FINANCIAL GOAL OF THE CORPORATION • The Investment Trade-off • Hurdle Rate/Cost of Capital • Minimum acceptable rate of return on investment • Opportunity Cost of Capital • Investing in a project eliminates other opportunities to use invested cash 1-12 FIGURE 1.2 THE INVESTMENT TRADE-OFF 1-13 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Agency Problems • Managers, acting as agents for stockholders, may act in their own interests rather than maximizing value • Stakeholder • Anyone with a financial interest in the firm • e.g. Steinhoff, 5/12/2017- more than R100 billion lost, ‘accounting irregularities’ government employees pension fund lost. 1-14 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Agency costs are incurred when: • Managers do not attempt to maximize firm value • Shareholders incur costs to monitor managers and constrain their actions 1-15 1-2 THE FINANCIAL GOAL OF THE CORPORATION • Tools to Ensure Management Pays Attention to the Value of the Firm • Manager’s actions subject to the scrutiny of board of directors • Shirkers are likely to find they are ousted by more energetic managers • Financial incentives provided, such as stock options 1-16 CONCEPT CHECK • Investment decision • Financing decision • Real assets • Financial assets/securities • Corporations (Public company) • Opportunity cost of capital • Financial goal of a company • Agency problems and corporate governance 1-17