Notes 9

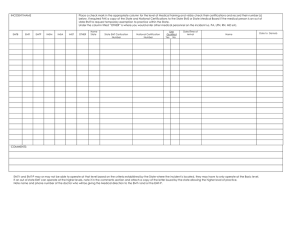

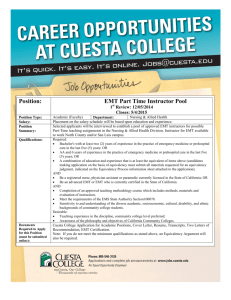

advertisement

Three Approaches to Security Selection • Technical Analysis • Fundamental Analysis – Economic Analysis – Industry Analysis – Company Analysis • Efficient Markets 1 Technical Analysis • Basic Philosophy and assumptions – Market value determined by supply and demand – Supply and demand are governed by rational and irrational factors – Prices move in trends that persist – Trends can be detected by analysis of the market • Dow Theory – Primary moves (tides) – Intermediate moves (waves) – Minor changes (ripples) 2 Technical Trading Rules • Contrary Opinion Rules – – – – The odd-lot theory Short sales theory Mutual Fund cash position Investment Advisory Opinions • Follow the Smart Money – The Confidence Index – Short sales by specialists 3 Other Market Sentiment Techniques • • • • • The advance-decline line Moving Averages Support and Resistance Levels Bar Charting Point and Figure Charts 4 Efficient Markets Hypothesis • A market in which prices fully reflect all known information is called efficient. • Four conditions – – – – homogeneous expectations frictionless markets Investors are price takers Maximize expected utility • A perfectly efficient market • Economically Efficient Market 5 Efficient Markets (Con’d) • Types of tests of EMT – Weak form tests – Semistrong form test – Strong form test • EMT and asset pricing models – For CAPM and APT to be true, markets have to be efficient – Problem of joint test6s 6 Return Predictability • Early Tests – Random walk tests – Filter trading rule tests • More recent tests – Random walk tests of Lo&McKinley – Long Horizon results • Schiller; Debondt and Thaler (bubles) – Return Patterns • Calendar effects – Size, P/E, BMV/ D/P effects 7 Event Studies • Stock Splits • Earnings Announcements • Initial Public Offerings • Tests for Private Information • Trading by Insiders • Performance of Professional portfolio managers 8