Role Description - AustralianSuper

advertisement

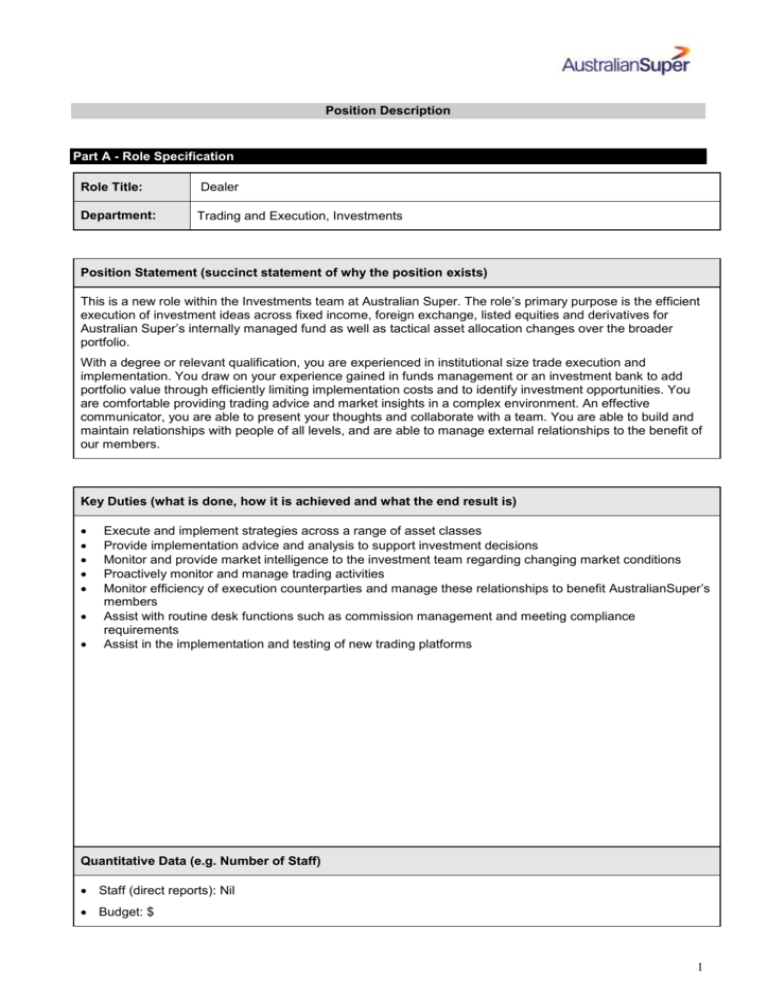

Position Description Part A - Role Specification Role Title: Dealer Department: Trading and Execution, Investments Position Statement (succinct statement of why the position exists) This is a new role within the Investments team at Australian Super. The role’s primary purpose is the efficient execution of investment ideas across fixed income, foreign exchange, listed equities and derivatives for Australian Super’s internally managed fund as well as tactical asset allocation changes over the broader portfolio. With a degree or relevant qualification, you are experienced in institutional size trade execution and implementation. You draw on your experience gained in funds management or an investment bank to add portfolio value through efficiently limiting implementation costs and to identify investment opportunities. You are comfortable providing trading advice and market insights in a complex environment. An effective communicator, you are able to present your thoughts and collaborate with a team. You are able to build and maintain relationships with people of all levels, and are able to manage external relationships to the benefit of our members. Key Duties (what is done, how it is achieved and what the end result is) Execute and implement strategies across a range of asset classes Provide implementation advice and analysis to support investment decisions Monitor and provide market intelligence to the investment team regarding changing market conditions Proactively monitor and manage trading activities Monitor efficiency of execution counterparties and manage these relationships to benefit AustralianSuper’s members Assist with routine desk functions such as commission management and meeting compliance requirements Assist in the implementation and testing of new trading platforms Quantitative Data (e.g. Number of Staff) Staff (direct reports): Nil Budget: $ 1 Part B - Person Specification Qualifications (indicate whether mandatory or desired) Tertiary qualifications in finance/economics/mathematics Desired Experience Profile: Two to five years experience in a trading role within funds management Experience in fixed income and foreign exchange. Derivative and OTC Swap experience would be beneficial Working knowledge of trading systems, counterparties, algorithms and typical compliance procedures Strong strategic, analytical and problem solving skills Strong collaborative and teamwork skills. Proactive in adapting trading and suggesting processes/procedure improvements in response to changing market conditions Excellent attention to detail Excellent people and relationship skills Ability to work with people at all levels, both internally and with external counterparties. 2 Part C – Required Competencies Competencies Profile (See Competency Dictionary for details) Competency Required Level (Developing/Effective/Strength) Shapes member experience Effective Technical competence Strength Business and industry awareness Effective Relationship–building and partnering Strength Embracing challenge Effective Informed and decisive judgement Effective Results delivery Strength Clarifying direction Effective Part D – Additional Information Additional Information This position description is indicative of the range of job requirements and accurately reflects the requirements of the role at the time of writing. Due to the nature of the work environment changes may occur to this role over time. The job comprises other duties as required. 3