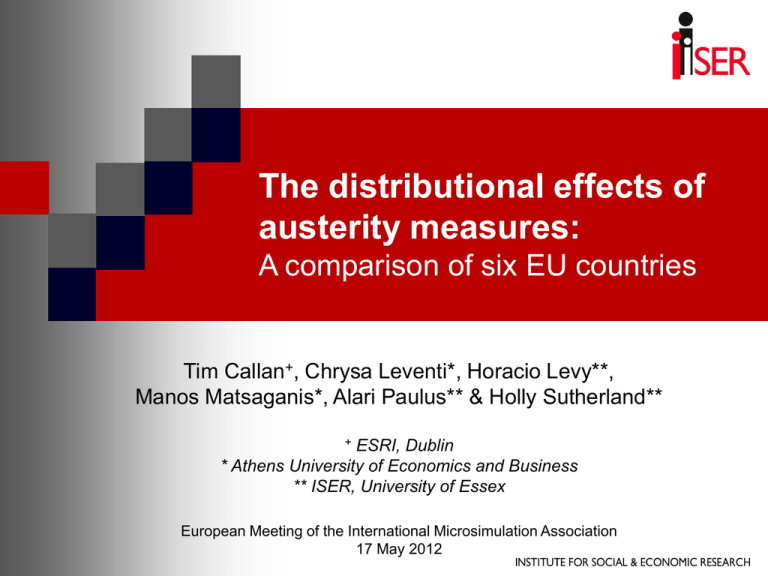

The distributional effects of austerity measures

advertisement

The distributional effects of austerity measures: A comparison of six EU countries Tim Callan+, Chrysa Leventi*, Horacio Levy**, Manos Matsaganis*, Alari Paulus** & Holly Sutherland** + ESRI, Dublin * Athens University of Economics and Business ** ISER, University of Essex European Meeting of the International Microsimulation Association 17 May 2012 Motivation The Greek austerity packages of 2010 and the public reaction to them: the need for dispassionate numbers Cross-country comparisons of size, composition and distributional effects Who is bearing the cost of austerity? A focus on the measures that: are sharp instruments in terms of their distributional effects have direct impact on household disposable income (and risk-ofpoverty) Scope of changes considered Direct taxes and employee/self employed social contributions Cash benefits Public sector pay cuts (except UK) Employer contributions and credited contributions (for fiscal consolidation analysis) Increases in indirect taxes (separately) Not cuts in public sector employment reductions in public services other reductions in public expenditure increases in other taxes that cannot be allocated to households second order and macro-economic effects Nor the other effects of the economic/financial crises Challenges of a comparative study Countries among those most affected: EE, IE, EL, PT, ES, UK What policy changes happened (are happening)? Which policy changes were “austerity measures”? In which period? What is the starting point? What is the counterfactual? (What can be simulated?) Our approach: All measures related to fiscal austerity until (mid-)2011 Counterfactual: continuing with pre-austerity policies (using statutory indexing rules) Model, data and assumptions EUROMOD – tax-benefit model for the EU (SWITCH for Ireland) Country Data source Austerity measures Counterfactual Estonia 2008 nat SILC 2009 2008 policies (no indexation, except pensions) Ireland 2008 nat SILC 2009-11 2008 policies (no indexation) Greece 2007 nat SILC 2010 2009 policies (no indexation) Spain 2007 nat SILC 2010-11 2009 policies (no indexation, except pensions) Portugal 2007 EU-SILC 2009-11 2008 (indexation of most components by CPI) UK 2008/9 FRS 2008 policies (official indexation) 2009-11 Population characteristics constant (referring to pre-crisis situation) Fiscal consolidation, % of baseline DPI 9 8.1 8 % of disposable income 7 6.2 6 5 4 2.2 3 2.7 3.0 1.9 2 1 0 -1 EE IE EL ES PT UK Public sector pay (net) Worker SIC Income taxes Benefits and pensions Employer SIC Credited SICs % of total fiscal consolidation Fiscal consolidation, % of total 80 70 60 50 40 30 20 10 0 -10 EE IE EL ES PT -20 Employer SIC (Self)-employee SIC Income taxes Benefits Public sector pay (net) Credited SICs UK Change as % disposable income Changes to income tax and SICs 2% 1% 0% -1% -2% -3% -4% -5% -6% -7% -8% -9% EE IE EL ES PT UK poorest 2 3 4 5 6 7 8 9 richest Change as % disposable income Changes to benefits and pensions 2% 1% 0% -1% -2% -3% -4% -5% -6% -7% -8% -9% EE IE EL ES PT UK poorest 2 3 4 5 6 7 8 9 richest Change in average disposable income, % 0 -2 % -4 -6 -8 -10 -12 income decile EE IE EL ES PT UK Change in average disposable income by hh types, % 0 3 2 1 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 -11 -12 -13 Estonia -1 -2 -3 -4 -5 -6 poorest 2 3 4 0 5 6 7 8 -1 -2 500.0% -3 0.0% -4 poorest 2 3 4 5 -1 -2 -3 -4 -5 3 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 Spain 6 7 8 9 richest Greece 0 poorest 2 9 richest 1 Ireland 4 5 6 7 8 9 richest poorest 2 3 4 1 Portugal 5 6 7 8 9 richest 6 7 8 9 richest UK 0 -1 -2 UK -3 -4 poorest 2 3 4 5 6 7 8 9 richest poorest 2 3 4 5 -500.0% All With children With elderly people Source: EUROMOD Change in income and VAT (% of dpi) 0% 0% Estonia 1% 0% Ireland 1% 2% 2% 3% Greece 2% 4% 3% 4% 6% 5% 4% 6% 8% 7% 5% 10% 8% 9% 6% 12% poorest 2 3 0.0% 4 richest 7% poorest 2 0% Spain 0.5% 3 4 richest 2.5% 4% 4 richest 4 richest UK 1.0% 2% 3% 3 0.5% 1.0% 2.0% 2 0.0% Portugal 1% 1.5% poorest 1.5% 2.0% 3.0% 2.5% 5% 3.0% 3.5% 6% 4.0% 4.5% 3.5% 7% poorest 2 3 4 richest fall in disposable income 4.0% poorest 2 3 4 richest fall in disposable income + VAT poorest 2 fiscal saving incl. VAT 3 Conclusions Effects on income up to mid 2011 Progressive in Greece (partly regressive tax cut, progressive pension and pay cuts); older people not protected Progressive in UK (top decile only, due to top income tax increases) U-shaped in Ireland (largest losses at top and bottom; progressive tax increases + pay cuts and regressive benefit cuts; pensions protected) Flat/progressive in Spain (regressive benefit cuts, mildly progressive tax increases and pay cuts) Flat/regressive in Estonia (regressive contribution increases, mildly progressive pay cuts); households with children pay more Regressive in Portugal (benefit cuts at low incomes) Adding increases to VAT reduces progressivity, especially in Greece and UK Policy choices and priorities vary notably Austerity is not over yet: more measures (e.g. UK, EL, IE) Thank you!