File

Evaluating a Company’s

External Environment

McGraw-Hill/Irwin Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Understanding the Factors that

Determine a Company’s Situation

Diagnosing a company’s situation has two facets

Assessing the company’s external or macroenvironment

Industry and competitive conditions

Forces acting to reshape this environment

Assessing the company’s internal or micro-environment

Market position and competitiveness

Competencies, capabilities, resource strengths and weaknesses, and competitiveness

3-2

Thinking Strategically About a

Company’s Macro-environment

3-3

Scanning the Macro Environment:

Environmental Analysis

Identifying external environmental variables that influence long-term decisions

3-4

Understanding Industry’s

Dominant Economic Features

Market size and growth rate

Number of rivals

Scope of competitive rivalry

Buyer needs and requirements

Degree of product differentiation

Product innovation

Supply/demand conditions

Pace of technological change

Economies of scale

Learning and experience curve effects

3-5

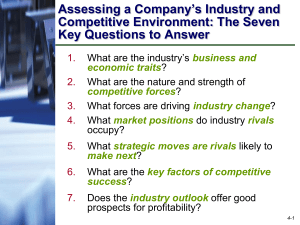

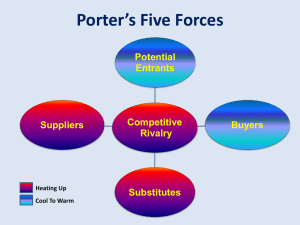

Industry Analysis

Objectives are to identify

Main sources of competitive forces

Strength of these forces

Key analytical tool

Five Forces Model of Competition

3-6

The Five Forces Model of Competition

3-7

Porter’s Five Forces: How to Do It

Step 1: Identify the specific competitive pressures associated with each of the five forces

Step 2: Evaluate the strength of each competitive force – fierce, strong, moderate to normal, or weak?

Step 3: Determine whether the collective strength of the five competitive forces is conducive to earning attractive profits

3-8

Threat of New Entrants

Threat of New Entrants decreases if barriers to entry are high

economies of scale are high

Threat of New

Entrants

capital requirements are high

incumbency advantages independent of size are high

customer loyalty is high

access to distribution channels

Bargaining

Power of

Suppliers is limited

government policy is restrictive

Rivalry Among

Competitors

Threat of

Substitution

Bargaining

Power of

Customers

3-9

Bargaining Power of Suppliers

Suppliers are likely to be powerful if:

Supplier industry dominated by a few firms

Suppliers’ products have few substitutes

Suppliers’ product is an

Bargaining

Power of

Suppliers important input

Suppliers’ products have high

Threat of New

Entrants

Rivalry Among

Competitors

Threat of

Substitution switching costs

Suppliers present a creible threat to integrate forward

Bargaining

Power of

Customers

3-10

Bargaining Power of Buyers

Buyers are likely to be powerfu l if:

They are concentrated or purchases are large relative to seller’s sales

Purchase accounts for a significant fraction of supplier’s

Threat of New

Entrants sales

Products are undifferentiated

Buyers face few switching

Bargaining

Power of

Suppliers costs

Buyer presents a credible threat to backward integration

Buyer is price sensitive

Rivalry Among

Competitors

Threat of

Substitution

Bargaining

Power of

Customers

3-11

Threat of Substitution

Threat of Subsitutes is stronger when …

There are many good substitutes readily available

Substitutes are attractively priced

The higher the quality and

Bargaining

Power of

Suppliers performance of substitutes

The lower the end user’s switching costs

End users grow more comfortable with using substitutes

Threat of New

Entrants

Rivalry Among

Competitors

Threat of

Substitution

Bargaining

Power of

Customers

3-12

Rivalry

Rivalry in an industry is stronger when …

Competitors are active in making fresh moves to improve market standing and

Threat of New

Entrants business performance

Slow market growth

Number of rivals increases and rivals are

Bargaining

Power of

Suppliers

Rivalry Among

Competitors

Bargaining

Power of

Customers of equal size and competitive capability

Buyer costs to switch brands are

Threat of

Substitution low

Industry conditions tempt rivals to use price cuts or other competitive weapons to boost volume

3-13

Strategic Implications of the Five Competitive Forces

Competitive environment is unattractive from the standpoint of earning good profits when

Rivalry is vigorous

Entry barriers are low and entry is likely

substitutes is strong

Suppliers and customers have considerable bargaining power

Competitive environment is ideal from a profit-making standpoint when

Rivalry is moderate

Entry barriers are high and no firm is likely to enter

Good substitutes do not exist

Suppliers and customers are in a weak bargaining position

3-14

Competitor Analysis

A firm’s best strategic moves are affected by

Current strategies of competitors

Future actions of competitors

Profiling key rivals involves gathering competitive intelligence about

Current strategies

Most recent actions and public announcements

Resource strengths and weaknesses

Efforts being made to improve their situation

Thinking and leadership styles of top executives

3-15

Competitor Analysis

Understanding what market positions do rivals occupy

One technique to reveal different competitive positions of industry rivals is strategic group mapping

A strategic group is a cluster of firms in an industry with similar competitive approaches and market positions

3-16

Example: Strategic Group Map of Selected Automobile Manufacturers

3-17

Key Factors for Competitive Success

Key Success Factors (KSFs) are competitive factors and attributes that affect every industry member’s ability to be competitively and financially successful

KSFs are those particular attributes that are so important that they spell the difference between

Profit and loss

Competitive success or failure

KSFs can relate to

Specific strategy elements

Product attributes

Resources

Competencies

Competitive capabilities

Market achievements

3-18

Common Types of Industry Key Success Factors

3-19

Example: KSFs for Bottled Water Industry

Access to distribution – to get a company’s brand stocked and favorably displayed in retail outlets

Image – to induce consumers to buy a particular company’s product

(brand name and attractiveness of packaging are key deciding factors)

Low-cost production capabilities – to keep selling prices competitive

Sufficient sales volume – to achieve scale economies in marketing expenditures

3-20

Example: KSFs for

Ready-to-Wear Apparel Industry

Appealing designs and color combinations – to create buyer appeal

Low-cost manufacturing efficiency – to keep selling prices competitive

Strong network of retailers/companyowned stores – to allow stores to keep best-selling items in stock

Clever advertising – to effectively convey a specific image to induce consumers to purchase a particular label

3-21

The degree to which an industry is attractive or unattractive is not the same for all industry participants or potential entrants.

The opportunities an industry presents depend partly on a company’s ability to capture them.

3-22