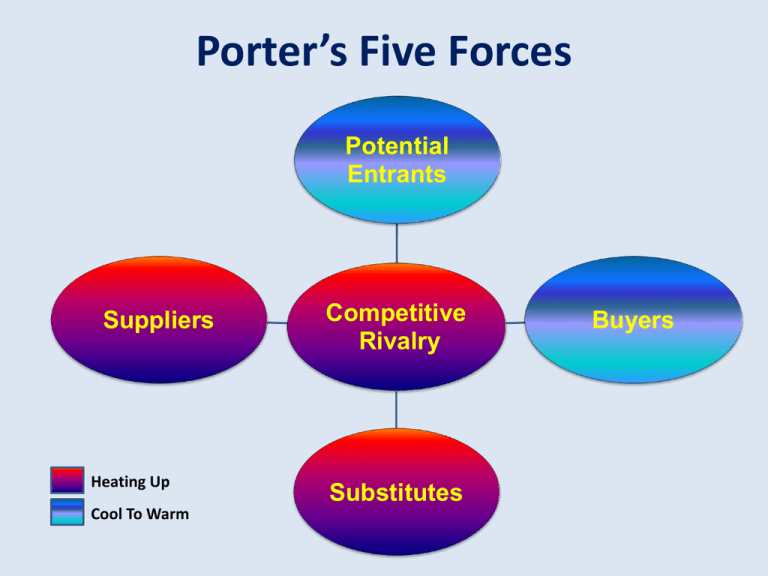

Porter`s 5 Forces – Whole Foods Market

advertisement

Porter’s Five Forces Potential Entrants Suppliers Heating Up Cool To Warm Competitive Rivalry Substitutes Buyers Porter’s 5 Forces – Whole Foods Market Forces Description Conventional Retailers Threat of Substitute Products Easy switch to the conventional retailers. Specialty stores built right in to their strategies. High Bargaining Power of Suppliers Largest food processors acquiring organic food producers. Only 1% of farmland used for organics. Medium to High Bargaining Power of Buyers For the most part, conventional retailers determine what we pay. Low Intensity of Competition Degree of commitment by the conventional retailers will determine the intensity. High Threat of New Entrants Entrants are already there! Their intensity of their pursuit of the natural/organic market is the question. Low – Medium Whole Foods Answer Forces Whole Foods Answer to the Competition The Result Threat of Substitute Products Acquisitions, taking on debt, reducing available cash. Hoping to get into new markets. Plans for new stores, varied floor plans. Slowing growth since 2000. Bargaining Power of Suppliers Use local suppliers. But only 1% of farmland being farms as organic. The big retailers are in a better position to deal with suppliers. Struggling to find beef and chicken suppliers. Intensity of Competition Growing and marketing organic foods runs 25 to 75% higher than conventional. Conventional retailers setting the price and gaining market share. Spend less(%) than the competition. Bargaining Power of Buyers For the most part, conventional retailers determine what we pay. At will. Threat of New Entrants Entrants are already there! Their intensity of their pursuit of the natural/organic market is the question. Already there. Changes in the Competitive Landscape Is it really to their benefit??? • Local, regional, independent, national, and specialty stores are all competitors. • CEO say it is a gateway for customers to try natural/organic foods or opportunity for the competition? Take a look at Store Sales Growth 2004 2005 2006 2007 2008 14.9% 12.8% 11.0% 7.1% ??? Sales growth has been cut in half since 2004! Changes in the Competitive Landscape Is it really to their benefit??? • We may be seeing a revolution in the food retailing business. • Supercenters – Marketplaces – Wholesale Clubs 2006 US Grocery Sales # of Stores Revenue in Billions $ Conventional Retailers 25% 5812 $377 Whole Foods 0.7% 188 $5.6 • Will the competition force Whole Foods to rethink their strategy?