the presentation

advertisement

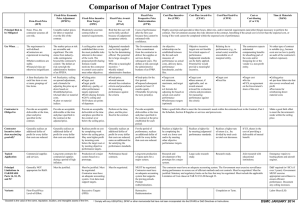

Negotiating Profit & Fee Breakout Session #304 Fred Schlich Date July 19, 2010 Time 4:00pm - 5:15pm 1 1 Negotiating Profit & Fee • Session Objective – Broad Discussion About of Concepts – Analytical Examination of a Number of Considerations for Negotiating Profit & Fee – Recognition of the Abstract Nature of Profit - No Formula that Guarantees Success • Session Outcome – Negotiators Enthusiastic About Tackling Profit and Fee 2 Negotiating Profit & Fee Working Definitions • Negotiation - Where There is Some Discussion of the Cost Elements – Competitive negotiations – Sole source – Contract changes • Profit - Part of the Price • Fee - In addition to Actual Costs 3 Profit & Fee Different Viewpoints • Economists - profit is the cost of utilizing industry investment and is necessary to attract industry into the transaction • Financial Analysts - seek a return on investment favorably compared to other potential investments • Accounting/Bookkeeping - revenue less cost equals the bottom line • FAR - potential enumeration over and above allowable costs – Motivate efficient and effective performance – Attract the best capabilities of qualified businesses 4 Profit Pricing Viewpoint • Direct Costs – Labor – Material – Other D irec t L abor M aterial I ndirec t C os t O ther D irec t C os ts • Indirect Costs G &A – Overhead – G&A P rofit • Profit 5 $ XXXXX $YYYYY s ubtotal direc t c os ts $ ZZZZZ % aaaaa s ubtotal w/indirec ts $ tttttttt $A A A A A s ubtotal$ T T T T T % bbbbb total c os ts$ C C C C $PPPP total $ P RI C E Negotiating Profit & Fee “The Dilemma” • Negotiators are “uncomfortable” or “uncertain” with Profit – Buyers compelled to minimize expense, profit takes the hit • Statutory Limits exert downward pressure – Sellers often are at a loss to fully explain proposed profit levels • Guidance is Vague, General, and Limited – or Overly Restrictive (Weighted Guidelines, etc.) • Industry is Reluctant to Disclose Actual Profit Information – Market Research is Speculative in Many Cases • Profit Reasonableness is Virtually Un-Auditable – Auditors can’t contribute much help • Profit is Almost Always Expressed as a Rate – Rates are less tangible than actual amounts • Negotiation of Profit and Fee is Done Last – Necessity to close the deal rushes meaningful discussion 6 Negotiating Profit & Fee “The Solution” • As With Cost Analysis, Break Profit Into Elements for Analysis – The FAR Describes a Structured Approach • Utilize the Market to Set Profit – Historical Data can be of Great Value • Think of Profit in Terms of the Total Amount – “How Much Will it Take to Attract and Motivate Industry into the Transaction” • Negotiate Profit or Fee First – Validate the assumptions that formed the basis for the profit agreement during cost analysis – Verify the profit agreement at the conclusion of negotiations against constraints or external limits • Profit is Always Negotiable – Don’t automatically default to a precedent 7 Profit Analysis Common Factors Other Factors Contractor Effort Material Acquisition Conversion of Direct Labor Conversion of Related Indirect Costs General Management Contract Cost Risk Federal Socio-Economic Programs Capital Investments Cost Control and Other Past Performance Independent Development 8 Far 15.404-4 Describes a Structured Approach to Profit Analysis Profit Analysis - Common Factors Contractor Effort – Material Acquisition - effort necessary to obtain parts, material, subcontracted items; consider the complexity of the items, number of purchase orders required, and complexity of subcontracts – Conversion of Direct Labor - direct contribution of labor to convert material, data, and subcontractor effort into contract requirements; consider diversity of the labor skills and supervision/coordination needed – Conversion of Related Indirect Costs - contribution of indirect effort; consider the extent and complexity of this contribution – General Management - contribution of Other Direct Costs and G&A expense; consider the extent and complexity of this contribution 9 Profit Analysis - Common Factors Contract Cost Risk - No Direct Correlation Between Contract Type and Appropriate Profit • FFP doesn’t equate to higher profit - cost risk is not always present • CPFF may deserve more profit due to the nature of the effort 10 Profit Analysis - Common Factors Federal Socio-Economic Programs – Greater profit opportunity should be provided contractors that have displayed unusual initiative in these programs Capital Investments – This factor takes into account the contribution of contractor investments to efficient and economical contract Cost-control and Other Past Accomplishments – Additional profit opportunities if a contractor has previously performed similar tasks effectively and economically. In addition, consideration should be given to productivity improvements, and other cost-reduction accomplishments that will benefit the Government in follow-on contracts Independent Development - relevant to contract end item 11 Profit Analysis - Weighted Guidelines Application DoD Developed • Weapons System Perspective Analysis • Performance risk – Technical – Management • Contract type risk • Facilities capital employed • Cost efficiency 12 Negotiating Award Fee Pool • Award Fee - Should Not Be Subject to Ordinary Profit Analysis – Ultimately the result of subjectively evaluated performance – Size of pool not influenced by anticipated contractor effort, contract cost risk, etc. • Pool is Based on What Potential Fee Will Motivate Exceptional Performance – Base verses Award Portion of Pool – Consistency and predictability effect how much influence will award fee will provide • Award Fee Should be Used in Highly Specialized Situations 13 Negotiating Profit Time and Material or Labor Hours • Each Unit or Hour Contains All Cost Elements – – – – – Labor Indirect Costs Profit Material – Treatment Varies ODCs and Travel – Treatment Vaires • T&M Profit Varies Directly with Cost – Conceptually very close to Cost Plus Percentage of Cost • Profit Negotiation – By Task, Project, or Effort – By Labor Category – Variable Profit? • Negotiation Could Include Concepts Considered in Any Profit Discussion 14 Negotiating Profit & Fee Breakout Session #304 Fred Schlich Date July 19, 2010 Time 4:00pm - 5:15pm 15 15