Investing for retirement

advertisement

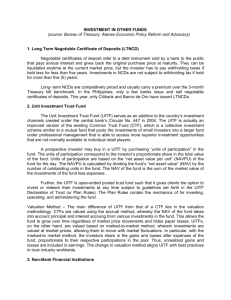

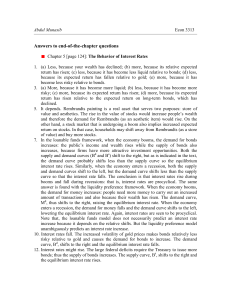

Investing for retirement The Anti Free Lunch Bob Black Life401.com Three parts 1. Bad and Ugly 2. Tools 3. Portfolio Sad but true The Bad and The Ugly Broker Conflict Annuities Churning Pushing under writings Pump and dump Not fiduciaries Inflation Free lunch Manipulation Black Pools Ponzi Mutual fund Analysis by Forbes • • • • • • Non-Taxable Account Taxable Account Expense Ratio .90% Expense Ratio .90% Transaction Costs 1.44% Transaction Costs 1.44% Cash Drag .83% Cash Drag .83% Tax Cost 1.00% Total Costs 3.17% Total Costs 4.17% The Bad and the Ugly 2 • • • • • • • • • Mutual fund success 30% How clients drive bad outcomes How funds come and go Mutual fund survivorship ( Review of Finance ) 20% Lower when dropped funds are included Mutual fund broker commission 2.3 % – 5.75% Style (The herd) Stock picking letters ( Like a tout at the track ) Reversion to the mean • Horace Secrist 1933 • Harold Hotelling Real interest rates Interest and inflation (1970 to 1980 105.8%) Inflation in Weimar Republic Fixed Income Securities Banks - Checking, CDs, Safety Box TIPS – Insurance not a good investment Everbank Foreign Currency CD everbank.com Foreign Bonds Bond Funds Tax Free Municipal Bonds or Funds Bond Fundamentals • • • • • • • Maturity date Yield to maturity Discount / Premium Callable Taxable Revenue source http://screener.finance.yahoo.com/bonds.html REITs It represents ownership of property Depreciation Tax advantage Use all of the stock tools to pick Look at their properties Royalty Trusts 99% Oil and Gas SDT,CRT,SBR,SJT,BPT,CHKR,PER,ROYT Not actively managed Earnings distributed Depletion tax advantage Will run out Think of it as an energy cost insurance policy LPs • • • • • • • Nearly all oil related Use deprecation to show little income Pay a good dividend Basis is reduced by: dividend-income Usually mid stream pipeline Tax deferred Must be inherited to avoid big tax hit Gold • Does not keep up with inflation • Costs to own • Not productive • Is insurance against rapid inflation Why buy stocks? Indirect ways to own stocks • Mutual funds • • Good Bad Managed Lower outcomes, tax • Closed end funds (Also works for bonds) • • • • Good Managed Buy at a discount Not driven by their owners Tax Efficient • Bad Sell at a discount Indirect ways to own stocks 2 • ETFs Good Tax Efficient Low cost Do as well as the market Bad Not managed • • • Good Tax Efficient Low cost May do better than the market • Bad Added risk of the model • • • • Smart Beta ETFs • AAII Recommended ETF Portfolio • • • • • • • • • As of June 30, 2014 Weight YTD 2013 Expense Guggenheim S&P equal weight 500 RSP Guggenheim MidCap 400 Pure value RFV Guggenheim SmallCap 600 Pure Value RZV iShares MSCI Frontier 100 FM Vanguard REIT index VNQ Performance 40% 20% 20% 10% 10% 100% 8.4 6.5 2.9 9.9 17.7 7.7 35.6 38.3 45.1 25.6 2.4 33.7 .40 .35 .35 .79 .10 For Comparison S&P 500 SPY 100% 7.1 32.2 .09 Diverse portfolio • • • • • • • 53% 8 3% 20% 12% 3% 1% Broad US stock market: REITs Royalty Trusts International Fixed income limited Partnerships Gold and Silver Retirement Assent Allocation No debt: House, car etc. Emergency Fund – Three months 20-40% Fixed when rates are market rates 50-70% Equities 5-15% Specialties REITs, Closed end Funds, Royalty Trusts 0-2% Gambles Do not have blinders Risk Civilization Collapses -Guns, ammunition and food Inflation – Commodities, foreign stocks and bonds, manufacture of things that will appreciate and short term securities Deflation - Longer term bonds, money and not Commodities Expropriation – Investments outside of the US Formerly only a risk in third world countries Rules Understand it or don’t do it Know the source of the money Be bold when others are fearful and be fearful when others are bold Never give a Broker control Use only FINRA Brokers and SEC Advisors Do not buy Annuities