Bibliography - GoZips.uakron.edu

advertisement

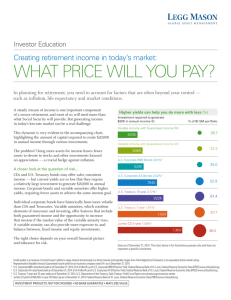

Title: Are the movements of stocks, bonds, and housing linked? Research question: Why do stock, bonds, and housing prices move in opposite directions in relation to interest rates? Abstract: One of the key ideas in monetary economics is that the prices of investments tend to move in the opposite direction as interest rates. Does this hold for all types of investments, ie: stocks, bonds, housing, gold, and other investment media. Is there a direct correlation between stocks, bonds and housing prices, and do they move in the same direction? Can an economist predict the movement of one by looking at the aggregate of the others in relation to interest rates? What if any impact does government monetary and fiscal policy play? Data Sources: 1. Federal Reserve Bank – Federal Funds Rates from January 1990 until October 2008. 2. Federal Reserve Bank – Multiple Bond yields from 1970 to 2006 3. S&P P/E Yield – Compares the S&P 500 yield to the T-Bill Annotated Bibliography Bernanke, Ben S. Housing, Housing Finance, and Monetary Policy. Speech: At the Federal Reserve Bank of Kansas City's Economic Symposium, Jackson Hole, Wyoming. August 31, 2007. This speech by Federal Reserve Bank Chairman Ben Bernanke gives a historical overview of the financing of the housing market from private and public lending institutions. It incorporates the ideas of interest rates, stock yields, and inflation. Campbell, J. Y. "The Econometrics of Financial Markets." Macroeconomic Dynamics 2, no. 4 (1998). This article focuses exclusively on asset pricing in the stock, bond, and foreign exchange markets. The information provided is heavy and adds very little to the overall idea of the paper. Campbella, Sean D., Morris A. Davisb, Joshua Gallina, and Robert F. Martina. "What Moves Housing Markets: A Variance Decomposition of the Rent-Price Ratio."Federal Reserve Board and b University of Wisconsin-Madison, October, 2008. This is an application of the dynamic Gordon growth model to the housing market in 23 U.S. metropolitan areas, the four Census regions, and the nation from 1975 to 2007. The model allows the rent-price ratio at each date to be split into the expected present discounted values of rent growth, real interest rates, and a housing premium over real rates. These results are similar to those found for stocks and bonds. Chen, Liu. "Economic Forces and the Stock Market." The Journal of Business 59, no. 3 (1986): 383. This applies risk-reward formulae to the financial markets which systematically affect stock market returns: the spread between long and short interest rates, expected and unexpected inflation, industrial production, and the spread between high-grade and low-grade bonds. DeBondt, W. F. M. "Does the Stock Market Overreact." The Journal of Finance 40, no. 3 (1985): 793. Information on price-earnings ratios and the idea that stocks with extremely low P/E ratios earn relatively more interest (risk reward) than stocks with high P/E ratios. Helps to apply P/E ideas to housing markets. Gogerty, Nick. T-Bill Vs. S&P 500 Earnings Yield, 1936-2007. http://seekingalpha.com/article/80580-t-bill-vs-s-p-500-earnings-yield-1936-2007 This is a data interpretation of the S&P 500 and its 3.3% yield over approximately 70 years. This article Provides data to help determine a fair market value of S&P 500 stocks and describes its position as an over valued index. Harris, J. K. "The Effect of Real Rates of Interest on Housing Prices." The Journal of Real Estate Finance and Economics 2, no. 1 (1989): 47. This study examines the role of appreciation expectations in overcoming the negative effects of nominal mortgage interest rates on house prices. Expectations of future appreciation are important determinants of house sales prices remaining influential during periods of declining and moderating real prices, not just when prices are rising. The real rate of interest. as viewed by the homebuyer. is the mechanism for affecting change in housing price levels. Because the nominal interest rate is slow to reflect changes in expectations, these real rates vary over time. This ebb and flow of real interest rates appears to explain market price levels. Liu, C. H. "The Integration of the Real Estate Market and the Stock Market." The Journal of Real Estate Finance and Economics 3, no. 3 (1990). The current study investigates whether the commercial real estate market is segmented from the stock market using the framework of Jorion and Schwartz (1986). Evidence is found to support the hypothesis that segmentation does exist as the result of indirect barriers such as the cost, amount, and quality of information for real estate rather than legal constraints. However, this evidence is contingent on whether real estate returns are computed with appraised values or imputed sale prices and on which market proxy is chosen. Piazzesi. Monika. "Bond Yields and the Federal Reserve." Journal of Political Economy 113, no. 2 (2005): 311. This paper recognizes that Bond yields respond to policy decisions by the Federal Reserve and vice versa the FOMC adjusts the federal funds rate accordingly. This paper applies a model to bond prices in order to determine the volatility of bond prices and why the volatility of yields is "snake shaped," which the model explains as policy inertia. Piazzesi, Monika. "Housing, Consumption and Asset Pricing." Journal of Financial Economics 83, no. 3 (2007): 531. This paper seems to be integral to my main question which are better investments in a volatile market. This paper includes a model for housing which claims to be able to predict that the housing share can be used to forecast excess returns on stocks. This would imply a direct correlation between stock yield and the housing markets. Piazzesi, Monika and Martin Schneider. "Equilibrium Yield Curves."University of Chicago Graduate School of Business, Date posted: October 27, 2006. This paper considers how the role of inflation as a leading business-cycle indicator affects the pricing of nominal bonds. We examine a representative agent asset pricing model with recursive utility preferences and exogenous consumption growth and inflation. We solve for yields under various assumptions on the evolution of investor beliefs. If inflation is bad news for consumption growth, the nominal yield curve slopes up. Moreover, the level of nominal interest rates and term spreads are high in times when inflation news are harder to interpret. This is relevant for periods such as the early 1980s, when the joint dynamics of inflation and growth was not well understood. Summers, L. H. "Inflation, the Stock Market, and Owner-Occupied Housing." American Economic Review 71, no. 2 (1981): 429. This paper suggests that the increase in the value of housing and a decrease in corporate capital may have a direct relationship in inflation. The paper theorizes that in the long run changes in inflation and taxation lead to changes in capital stock. The application of these ideas will help determine if in fact there are separate movements of stock, bond, and housing prices; and what if any factors tie these moves together.