Preparing for a Savings or Investment Program

advertisement

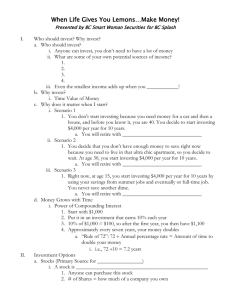

Preparing for a Savings or Investment Program Carl Johnson Financial Literacy Jenks High School Pay Yourself First! People often save or invest after expenses are paid…Sometimes there is nothing left over! Try this approach Decide on an amount to save…Pay that amount first…Consider it as a bill you owe yourself Pay your living expenses Use any money left over for fun stuff Employer Sponsored Retirement Plans Most employers offer retirement plans, such a s a 401K, or a 403B Take advantage of these! Amounts are pre-deducted out of your paycheck Many employers match what you put in This is very important as you get older, as it will supplement your Social Security Elective Savings Programs You can also arrange with a mutual fund or brokerage firm to take an amount each month and invest it You can set it up automatically so you don’t have to think about it It is an easy way to fund a traditional IRA or Roth IRA Gifts, Inheritances and Windfalls What would you do with money gifts or inheritances? It has to be a choice! The Long Term Value of Investments Even if you have just a small amount of money, it is still considered to be a good decision if you invest Small amounts add up over time because of the time value of money The increase in an amount of money due to interest earned Safety and Risk Safety and Risk have specific meanings in the financial world Safety means that the chance of losing your money in an investment is fairly small Risk indicates that you cannot be certain about the profit of your investment You can choose investments that are safe, risky or in-between Safe investments will usually have a low rate of return Speculative investments are considered to be high risk and could earn a large profit in a short time The disadvantage is that at any time you could lose most or all your investment Safety and Risk Your attitude toward risk will vary according to your circumstances When young, you may be willing to take more risks than when you are older Without risk, it is impossible to obtain returns that make investments grow Five Components of Risk Inflation Interest Rates Business Failure Financial Market Global Investment Inflation Inflation is the general rise in prices that affect everyone Investing your money can help you stay ahead of inflation However, during times of rapid inflation, the rate of return may not be able to stay up with the inflation rate You lose buying power and your money will buy less! Some investments will give you more protection Common stocks vs. T-bills Inflation Rate Risk If you put your money in an investment that gives you a fixed rate, the value of your of investment will go down if interest rates go up! If you have to sell bonds, you will get less than originally paid Business Failure Risk This type of risk applies to common stock, preferred stock and corporate bonds When you buy stock, you are investing in a particular company You are betting that the company will be successful It can fail, according to the market and supply and demand, etc… Lower profits mean lower dividends Distribution of money, stock or other property to shareholders Your best protection is to do your homework on companies in which you want to invest You might want to also invest in more than one company Financial Market Risk The prices of investments can also be affected by the overall state of the financial markets Factors which affect financial markets are social and political conditions Ex. Oil in the Middle East Global Investment Risk Global mutual funds are a better investment that individual international stocks due to risk factors in the global marketplace Global mutual funds are offered by U.S. firms and specialize in companies that operate in another region of the world A mutual fund includes stocks and bonds from many companies and may offer more safety than one company’s stocks and bonds Investment Income The safest and most predictable investments include Certificates of Deposit (CD’s) U.S. Savings Bonds U.S. Treasury Bills With these programs, you will know the interest rate and how much income you will receive on a certain date High risk investments would include: Commodities Options Precious Metals and Gems Collectibles Investment Growth The best opportunities for growth usually comes from common stocks and growth stocks A growth stock is a common stock issued by a corporation The type of stock has the potential to earn above- average profits in comparison to corporate stocks Growth companies usually reinvest their stock rather than pay dividends Retained earnings are profits that a company reinvests Investment Liquidity A final factor to consider when choosing investments is investment liquidity The ability to buy or sell an investment quickly without substantially reducing its value A passbook savings account is an example of a high-liquidity investment because you can withdraw all of your money immediately An investment in real estate is usually a low-liquidity investment