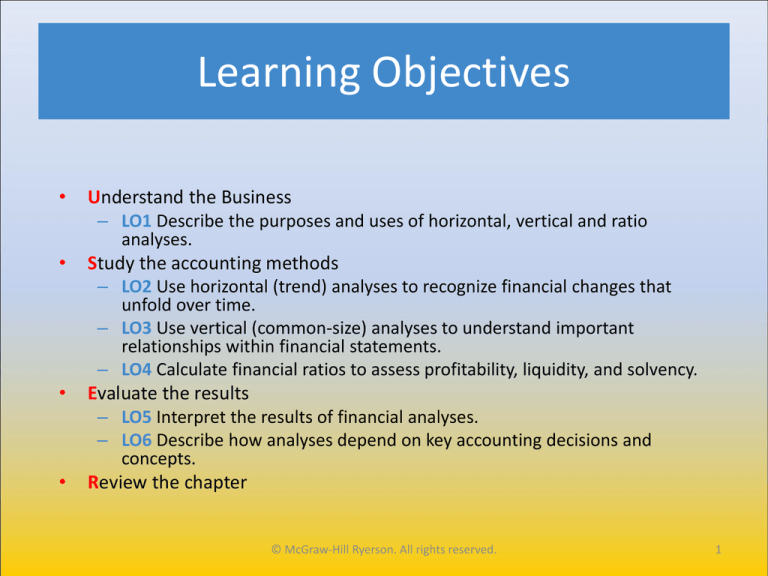

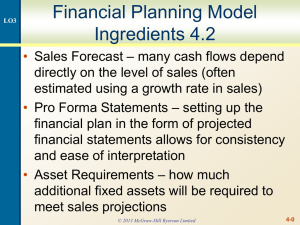

Learning Objectives

•

Understand the Business

– LO1 Describe the purposes and uses of horizontal, vertical and ratio

analyses.

•

Study the accounting methods

– LO2 Use horizontal (trend) analyses to recognize financial changes that

unfold over time.

– LO3 Use vertical (common-size) analyses to understand important

relationships within financial statements.

– LO4 Calculate financial ratios to assess profitability, liquidity, and solvency.

•

Evaluate the results

– LO5 Interpret the results of financial analyses.

– LO6 Describe how analyses depend on key accounting decisions and

concepts.

•

Review the chapter

© McGraw-Hill Ryerson. All rights reserved.

1

Interpreting Horizontal Analyses

• Horizontal analysis of The Home Depot’s balance

sheet shows the company did not significantly grow

or decline in 2009.

• Total assets decreased 0.7%.

• Horizontal analysis of The Home Depot’s income

statement shows net sales fell by 7%, probably a

result of the slowdown in the global economy.

LO5

© McGraw-Hill Ryerson. All rights reserved.

2

Interpreting Vertical Analyses

• Vertical analysis for The Home Depot’s balance sheet

shows the company has shifted from debt to equity.

– Debt was 57% and equity 43% in 2008.

– Debt was 53% and equity 47% in 2009.

• Vertical analysis of The Home Depot’s income

statement shows Cost of Goods Sold and Operating

Expenses are the important determinants of the

company’s profitability.

LO5

© McGraw-Hill Ryerson. All rights reserved.

3

Interpreting Ratio Analyses

Profitability Ratios

1. Net Profit Margin

2. Gross Profit Percentage

LO5

The Home Depot was able to cut costs enough to

increase net income more than the decline of Net

Sales Revenue. This allowed net profit margin to

increase in 2009.

The slight increase means The Home Depot

made slightly more gross profit on each dollar of

sales in 2009; possible due to higher selling

prices or lower unit costs.

© McGraw-Hill Ryerson. All rights reserved.

4

3. Asset Turnover

4. Fixed Asset Turnover

5. Return on Equity

LO5

The asset turnover ratio suggest assets did not

generate sales as efficiently in 2009 as in the

previous year.

The amount of sales generated by fixed assets

decreased in 2009. This is unfavourable, but

understandable because 2009 was a difficult year

for retailers. In comparison, Rona (a competitor)

had a better ratio of 5.53.

The Home Depot’s ROE increased in part because

of the increase in shareholders’ equity to finance

debt repayment mentioned earlier. The Home

Depot was able to cut operating expenses enough

to increase net income, which increased ROE.

© McGraw-Hill Ryerson. All rights reserved.

5

6. Earnings per Share

EPS increased along with the increase in ROE.

7. Quality of Income

8. Price/Earnings (P/E) Ratio

LO5

The Home Depot’s ratio is much greater than

1.0 , meaning operations are producing positive

results. Most cash based business have high

quality of income ratios because their sales are

collected in cash immediately.

The P/E ratio increased slightly. In 2009

investors are willing to pay 17.3 times earning to

buy one share. In comparison, Rona (a

competitor) had a lower P/E ratio of 14.0.

© McGraw-Hill Ryerson. All rights reserved.

6

Liquidity Ratios

9. Receivables Turnover

10. Inventory Turnover

11. Current Ratio

This ratio is not meaningful for businesses that

make most sales for cash like The Home Depot.

Although the economy was weak in 2009, The

Home Depot was able to maintain the inventory

turnover and days to sell ratios.

The current ratio increased from 2008 to 2009.

In this industry a current ratio greater than 1.0 is

acceptable, The Home Depot’s current ratio

appears strong.

12. Quick Ratio

The quick ratio also increased. In this industry a

low quick ratio is common.

LO5

© McGraw-Hill Ryerson. All rights reserved.

7

Solvency Ratios

13. Debt to Assets

This ratio shows the proportion of total assets

financed by creditors. The higher the ratio, the

riskier the financing strategy. In 2009, The Home

Depot relied less on creditors and more on

shareholders.

14. Times Interest Earned

Times Interest Earned above 1.0 indicates that

net income is sufficient to cover the company’s

interest expense. The Home Depot’s ratio of 5.9

is more than enough to pay interest expense.

15. Capital Acquisitions Ratio

LO5

This ratio shows that The Home Depot was able

to pay for all purchases of property, plant and

equipment using cash generated from

operating activities.

© McGraw-Hill Ryerson. All rights reserved.

8