Taxes For Teens

advertisement

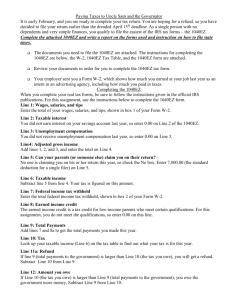

Taxes for Teens USING THE IRS “1040EZ” FORM Do You Know… A. What form do most teens use to file their federal taxes? 1. 1040A 2. 1040EZ 3. 2040A 4. 2040EZ Do You Know… B. What form do you get from your employer at the end of the tax year if you had federal tax withheld from your paycheck? 1. V-1 2. V-2 3. W-1 4. W-2 Do You Know… C. Where can you most likely NOT get the 1040EZ form? 1. Local Library 2. Post Office 3. School Library 4. Online In this lesson, you will learn 1. Who can file the 1040EZ form, 2. What a W-2 form is, and 3. How to file the 1040EZ form. 1040EZ Form The 1040 EZ form offers quick and easy tax filing to some Americans. Click on the link below to see the 1040EZ form. 1040EZ FORM Who should use the 1040 EZ? Your filing status is single or married filing jointly. You do not claim any dependents. You do not claim any adjustments to income . You had only wages, salaries, tips, taxable scholarship or fellowship grants. your taxable interest was not over $1,500. Your taxable income is less than $100,000. 1040EZ is Simple to File The one-page form has four short sections: Personal Information 2. Sources of Income 3. Payments, credits and tax 4. Calculating refunds and amounts due 1. Where do you get the 1040EZ form? Local Library. U.S. Post Offices Banks. Online When is the filing deadline for taxes? Usually April 15 of the following year. The W-2 Form What is W-2 Form? Your employer issues you a W-2 if you had federal tax withheld from your paycheck. W-2 reports the total amount of tax withheld. You will receive one W-2 form for each job you worked at during the year. Sample W-2 Form Real World Business Chicago, IL 60640 16,680.24 1,728.00 16,680.24 1034.16 16,680.24 241.92 D Irma Money 2301 South Jackson Chicago, IL 60640 2000.00 Samples and Practice Next we will take a look at how to complete the form. Then you will get to fill out your own. Click the link to see a completed Sample 1040EZ Using the following, let’s practice 1040EZ A instruction book blank 1040EZ form. Sample W-2 Sample completed 1040EZ Now it is your turn to try! Print your name, address and Social Security Number. Using the sample W-2 form, complete the Income section and calculate your taxable income. Complete the payments and tax section and then go to the booklet (sheet) provided in the handouts to calculate your tax. Continued Find out whether you will get a refund (Line 11a) or you owe money to IRS (Line 12). If you are getting a refund, you can have your refund mailed to you or directly deposited into your bank account. If you owe money, you have to write a check. Be sure to sign your return and add in additional information as required. Good Luck!! Do You Know… A. What form do most teens use to file their federal taxes? 1. 1040A 2. 1040EZ 3. 2040A 4. 2040EZ 2 Do You Know… B. What form do you get from your employer at the end of the tax year if you had federal tax withheld from your paycheck? 1. V-1 2. V-2 3. W-1 4. W-2 4 Do You Know… C. Where can you most likely NOT get the 1040EZ form? 1. Local Library 2. Post Office 3. School Library 4. Online 3 Resources 1040EZ Forms 1040EZ Instructions Video Instructions on Filing 1040EZ Sample More W2 Form forms from the IRS