Recap: UIP, PPP, and Exchange Rates

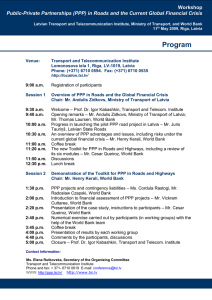

advertisement

Recap: UIP, PPP, and Exchange Rates Roberto Chang February 2012 Covered Interest Parity • A consequence of arbitrage • It provides a link between interest rates, the spot exchange rate, and the forward exchange rate: 1 + i$ = (1+i€)*(F$/€ /E$/€) Uncovered Interest Parity • Based on the assumption that investors care only about expected returns • Gives a link between interest rates, the spot exchange rate, and the expected future exchange rate: 1 + i$ = (1+i€)*(Ee$/€ /E$/€) From UIP to a Theory of Exchange Rates • From UIP, 1 + i$ = (1+i€)*(Ee$/€ /E$/€) we get E$/€ = Ee$/€ *(1 + i$ )/ (1+i€) • This says that we understand the current exchange rate if we understand interest rates and the expected future exchange rate. Law of One Price • The LOOP says that a particular good must sell at the same price in different locations, when the price is quoted in a common currency: Pjeans,$ = Pjeans,€*E$/€ Purchasing Power Parity • PPP is like LOOP but applied to baskets of goods and services (i.e. the typical consumer basket): P$ = P€*E$/€ • The price of the said baskets is usually what we mean by the price level. • PPP is a reasonable assumption about the long run From PPP to Long Run Exchange Rates • From PPP, P$ = P€*E$/€ one gets E$/€ = P$/ P€ • Hence the (long run) exchange rate is given by the (long run) ratio of price levels. • Next question: what determines price levels?