Budgets & Financial Records

advertisement

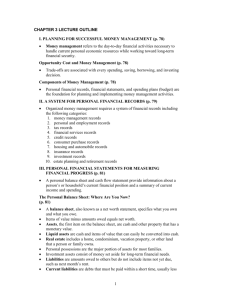

Budgets & Financial Records Chapter 8 Lesson 8.1 – Budgeting and Record Keeping Lesson 8.2 – Legal Documents and Filing Systems Importance of Financial Planning Financial planning begins with budgeting and good record keeping. A financial plan is an orderly program for spending, saving, and investing the money you earn. Disposable income is the money you have left to spend or save after taxes have been paid. Financial planning helps you. . . Determine and evaluate your options for using your money. Make sure you use your limited funds for the things you want most. Prevent careless and wasteful spending. Organize your financial resources so that you can maintain a plan of personal financial fitness. Avoid money worries by planning your saving, spending, and borrowing to stay within your financial means. Budgeting A budget is a spending and savings plan based on your expected income and expenses. Income must equal (or exceed) expenses Budgeting helps you plan your spending and saving so you won’t have to borrow money to meet your daily needs. Steps in Preparing a Budget 1. Estimate total expected income 2. Plan your budget for a specific period of time. Decide how much your want to save Experts recommend saving 10% of disposable income 3. Estimate your expenses 4. Balance your budget Adjust your plan to make sure it balances A Typical Monthly Budget Example on page 210 in book Income Savings Expenses Fixed expenses – costs you are obligated to pay at specific times Variable expenses – costs that vary in amount and type Practice budget worksheet Personal Records Good records make budgeting and long-range planning easier These records are basis for income tax returns, credit applications, and other financial forms Four types of personal records you should keep: 1. 2. 3. 4. Income and expense records Statement of net worth Personal property inventory Tax records Records of Income and Expenses Income W-2 Forms Bank statements Statements from Investment Companies Expenses Charitable contributions Medical bills Work-related expenses Other expense receipts Statement of Net Worth Lists assets and liabilities Difference is your net worth If your assets are greater than your liabilities, you are solvent If your assets are less than your liabilities, you are insolvent Personal Property Inventory List of all valuable items you own Should list their purchase price and approximate current values Personal property includes: Clothing Furniture Appliances Anything of value inside of your home Important to safeguard the inventory Tax Records Should keep copies of: Tax returns W-2 forms Receipts verifying income and expenses Keep records for three years Legal Documents Contracts A legally enforceable agreement between two or more parties to do or not to do something Credit Plans Mortgages Rental agreements Agreements Express agreements Can be oral or written, terms have been agreed upon between the parties in words Written agreements Implied agreements Unwritten agreement where you have agreed to something simply by doing it Elements of Contract Agreement Consideration Contractual Capacity Legality Genuine Assent Legal Form Valid, Void and Voidable Contracts Valid Contracts that contain all the essential elements Legally enforceable May become unenforceable if time limit for filing suit runs out Void Contracts that re missing one or more elements Not enforceable in a court of law Voidable Contract that can legally be avoided by one of the parties If that party chooses avoidance, or disaffirms, it will not be enforced Consumer Responsibilities 1. Understand all clauses and terms contained in the agreement. 2. Keep a copy of the agreement. 3. Be sure the agreement is dated correctly. 4. Be sure all blank spaces are filled in or marked out and that no changes have been made after you have signed it. 5. Be sure all terms agreed upon are written clearly. 6. Be sure all dates, amounts, and other numbers are correct and written clearly. 7. Be sure proper disclosure is made by the seller. 8. Be sure all cancellations and adjustments are made in accordance with the contract. Negotiable Instruments An unconditional written promise to pay a specified sum of money upon demand of the holder. To be collectible it must: 1. Be in writing and signed by the maker. 2. Must contain an unconditional promise to pay a definite amount of money. 3. Must be payable upon demand or on a fixed future date. 4. Must be payable to the order of a particular person or the holder of the note. 5. Must be delivered to the payee. More on Negotiable Instruments Most common form – a check Another form – promissory note Maker – the person who creates and signs the note Payee – the person to whom the note is made payable Co-signer – a person who promises to pay the note if the maker fails to pay Warranties Also called a guarantee Statement about a product’s qualities or performance that the seller assures the buyer are true. May be in writing or assumed ALL products contain implied warranties Filing Systems for Personal Records Paper Filing System Electronic Record Keeping Spreadsheets Databases