Personal And Family Finance

EOC Test Review w/ Answers

updated

2010

1

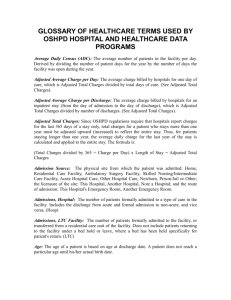

Figure sales tax

2

Calculate unit price

3

Sale price discount with sales tax

4

Calculate %

multiply and is smaller than

original number unless it is over a

100% to start with like 110%

5

Insurance what does 10/20/10

mean?

6

Better Business Bureau—

Consumer Protection Agencies

7

1.1 The term ____ means to use resources

effectlively to achieve goals and solve

problems.

A.

B.

C.

D.

Decision

Long term goals

Management

Trade-off

Answer: C

8

1.1 The term ___ means the steps one

takes to make the best decision.

A.

B.

C.

D.

Decision-making process

Goals

Priorities

Short term goals

Answer: A

9

1.1 The term ___ means an exchange of one thing in

return for another, such as, riding a bike in college

because you know that after you graduate you will be able

to afford a car therefore keeping your expenses low in

college.

A.

B.

C.

D.

C

Goals

Needs

Trade-off

Wants

10

1.2 Which is the first step in the

decision making process?

A.

B.

C.

D.

C

Act on the decision

Identify available resources

Identify the decision to be made

Evaluate the results of the decision

11

1.3 A person who might have a positive

influence on your decisions could be:

A.

B.

C.

D.

Your best friend

Your parents

A national sports figure

All of the above

D

12

1.4 The correct steps of a SMART goal

are:

A. Smart, measurable, accurate, real time, timeless

B. Specific, measurable, attainable, realistic, time

bound

C. Setting a goal, making it right, attacking it, run

with it, tackle it

D. Seasonal, marketable, abstaining, right, tellable

B

13

2.1 The term ___ means forms of reward for employment

beyond salary, including health insurance, vacation and

holiday time, and retirement plans

A.

B.

C.

D.

Career

Comp time

Fringe benefits

Job sharing

C

14

2.1 The term ___ means a summary of your

qualifications for a job

A.

B.

C.

D.

Entrepreneur

Interview

References

Resume

D

15

2.2 In order to make an informed career

decision, a high school student will want to:

• a. commit to a profession that requires a

college degree

• b. choose a career that offers the amount of

money desired

• c. develop personal goals, complete an

interest inventory, and research careers

• d. choose a training program that will

guarantee employment after the course work

is completed

C

16

2.3 Salary, location and environment, and

benefits are factors to consider when:

• a. determining your cost of living

expenses

• b. evaluating a job offer

• c. researching future career

opportunities

• d. estimating annual income

B

17

2.4.2 A resume should describe a job

seeker’s ___.

A.

B.

C.

D.

Age and marital status

Medical history

Police record, if any

Volunteer activities

D

18

2.4.2 Helpful hints for preparing a

resume include:

A.

B.

C.

D.

Exaggerate when possible

Proofread for spelling and grammar

The longer your resume the better

Try not to show self-confidence

B

19

2.4 All of the following are tips to

follow when completing a job

application EXCEPT:

A. Complete in blue or black ink

B. Write legibly

C. Take your information on a notecard with

you

D. Leave blanks if the information is not

applicable to you

D

20

2.5 Attributes that will make a positive

impression during a job interview are:

A. Bragging about your accomplishments

B. Explaining why you are a better applicant

than the other applicants

C. Dressing in your favorite casual clothes

D. Using your very best manners

D

21

2.6 Work related forms that should be

completed when hired include all of the

following EXCEPT:

A.

B.

C.

D.

W4

Medical

Income tax return

Life insurance

C

22

2.7 Identify an example of an entry level

job in the consumer and management

field:

A.

B.

C.

D.

A

Bank teller

Consumer affairs director

Consumer safety inspector

Financial planner

23

3.1 The term ___ means legal action which

requires a portion of a person's income to be

with held from their paycheck to repay a debt

A.

B.

C.

D.

Deductions

Garnishment

Net pay

Overtime

B

24

3.1 The term ___ means amount of money taken from

an employee's gross pay for taxes, insurance, Social

Security, and other benefits

A.

B.

C.

D.

Deductions

Direct deposit

Gross pay

Net Pay

A

25

3.1 The term ___ means the amount of

income left after taxes and other

deductions are taken out

A.

B.

C.

D.

Direct Deposit

Gross Pay

Net Pay

Overtime

C

26

3.2 The method of paying

employees that is the most secure

from theft or loss is:

A.

B.

C.

D.

Indirect deposit

Paycheck

Direct deposit

cash

C

27

3.3 If you receive a salary, you can determine

how much gross and net pay you will earn in a

year by looking at one pay stub and:

A. Dividing the figures for gross and net pay by the

number of pay periods during the year

B. Multiplying the difference between gross and

net pay by the number of pay periods during

the year

C. Multiplying the figures for gross and net pay by

the number of pay periods during the year

D. Multiplying the sum of the gross and net pay by

the number of pay periods during the year

C

28

3.4 FICA taxes are another name

for:

A.

B.

C.

D.

Excise taxes

Income taxes

Property tax

Social Security tax

D

29

3.4 By January 31, your employer will send you

Form ___ showing your total earnings for the year

and total amount of taxes withheld.

A. 1040

B. 1099

C. W-2

D. W-4

C

30

3.5 The purpose of Form ___ is to specify

the number of allowances you are

claiming.

A.

B.

C.

D.

1040

1099

W-2

W-4

D

31

3.5 The purpose of Form __ is to

verify that an employee has the

right to be employed in the U.S.

A.

B.

C.

D.

W-2

W-4

1099

I-9

D

32

3.5 The purpose of Form __ is to show how

much interest you were paid by the bank.

A.

B.

C.

D.

1040

1040 EZ

1099

W-4

C

33

4.1 The term ___ means the amount of

time it takes for money to double in value.

A.

B.

C.

D.

70-20-10 rule

Check 21

Inflation

Rule of 72

D

34

4.1 The term ___ means those checks issued by a

depositor but not yet reported on a bank

statement.

A. Check 21

B. Fixed expenses

C. Outstanding Check

D. Overdraft

C

35

4.1 The term ___ means lack of sufficient

funds to cover the full amount of the check

A.

B.

C.

D.

Overdraft

Outstanding Check

Rule of 72

Reconcile

A

36

4.1 The term ___ means an orderly program

for spending, saving, and investing the money

you earn to achieve desired goals.

A.

B.

C.

D.

Spending Plan

Financial plan

Investment risks

Overdraft

B

37

4.1 The term ___ means a cash management tool

in which 70% of income is spent, 20% is saved, and

10% is invested.

A. Rule of 72

B. 70-20-10 rule

C. Check 21

D. Investment risks

B

38

4.1 The term ___ means when a written check is

electronically transferred and funds are immediately

withdrawn from the account; similar to a debit card.

A.

B.

C.

D.

70-20-10 rule

Check 21

Rule of 72

Outstanding check

B

39

4.2 A financial goal will contain

the following elements:

A. Time bound, measurement, life cycle

B. Specific, measurable, attainable,

realistic, time bound

C. Realistic, needs, wants, values

D. Attainable, realistic, time bound,

specific

B

40

4.2 One element of a financial goal is missing in the

example below. Which one is it?

“I will save $150 each month to go on a vacation

in one year.”

A.

B.

C.

D.

Time Bound

Specific

Attainable

Measurable

A

41

4.2 Financial goals are

accomplished because of:

A.

B.

C.

D.

luck

coincidence

financial planning

financial goals cannot realistically be

accomplished

C

42

4.3 A spending plan is comprised of which of

the following three sections?

A.

B.

C.

D.

Income, expenses and liabilities

Income, expenses and taxes

Income, expenses, and net gain/loss

Income, expenses and net worth

statement

C

43

4.3 What is the first step that should be

completed when creating a spending plan?

A.

B.

C.

D.

B

Implement and control

Tracking of current income and expenses

Make adjustments to spending

Allocate money to income and expense

categories

44

4.3 If expenses were to exceed income on

a spending plan, what would be a

financially smart solution?

A.

B.

C.

D.

Decrease expenses

Use a credit card more often

Earn less income

Increase purchases

A

45

4.4 Funds deposited in a federally insured

account (FDIC) are protected against loss for

up to:

A.

B.

C.

D.

$50,000.00

$1,000,000.00

$250,000.00

$10,000.00

C

46

4.4 When comparing and contrasting Credit

Unions and Commercial Banks, it could be said

that credit unions:

A. Are a very profitable depository institution

B. Are insured by the FDIC

C. Have members that possess a common bond

such as people who live, work or attend school

in a well defined geographical area

D. Provide loans at a higher interest rate and

savings instruments with a lower rates

C

47

4.5 Check 21 has made it possible

for:

A. Float time to increase

B. Writing a check to be processed as quickly as

a debit card

C. The possibility of check fraud to be

eliminated

D. Direct deposit to be the preferred method of

receiving your check

B

48

4.5 The term ____ means to bring a bank

statement and your own record into agreement

A. Reconcile

B. Spending plan

C. Financial plan

D. Overdraft

A

49

4.6 When comparing and contrasting savings

and investing, which of the following is true?

A. Savings is used to pay for long-term

goals, while investing is used to pay for

emergencies

B. Savings is less liquid than investing

C. Savings provides the foundation for

financial security, while investing is used

to pay for long-term goals, such as

retirement

D. All of the above

C

50

4.6 Why is it important to save

money in liquid (easy to access)

assets?

A. To provide easily accessible money in

case of an emergency

B. To provide a foundation for financial

security

C. To help pay for unanticipated expenses

D. All of the above

D

51

4.6 The factors that affect the time value

of money are ________________.

A. amount of money, length of time, and

interest rate

B. the return or profit generated by savings

and investing

C. the price of money and the age an

individual began investing.

D. goals, trade-offs, and opportunity costs.

A

52

4.6 If you want to see how long it will take for your

money to double,what is the formula you would

follow?

A.

B.

C.

D.

72/interest rate

Interest rate/72

Amount of money/72

72/number of years

A

53

4.7 A growth fund (investment) seeks stock

whose prices are likely to:

A.

B.

C.

D.

Fall

Stay the same

Rise

Have their risk increase

C

54

4.7 Which would be considered an

income investment?

A. A stock that reinvests it’s income

B. A stock that pays its stockholders

dividends or interest payments

C. A stock that is high risk

D. A stock that might go public

B

55

5.1 The term ___ means temporary

continued coverage of health insurance due

to loss of employment.

A.

B.

C.

D.

Cobra

Exclusion

Rider

Co-insurance

A

56

5.1 The term ___ means a person named in an

insurance policy to receive the money from the policy

once the conditions of the policy have been met.

A. Insurance risk

B. Policy Holder

C. Beneficiary

D. Rider

C

57

5.1 The term ___ means request given to an

insurance provider to recover a cost of a loss.

A.

B.

C.

D.

Co-pay]

Co-insurance

Exclusion

Claim

D

58

5.1 The term ___ means specific items

not covered in an insurance policy.

A.

B.

C.

D.

Liability

Exclusion

Co-pay

Deductible

B

59

5.1 The term ___ means an

unexpected financial loss.

A.

B.

C.

D.

Insurance risk

Insurance

Policy

Rider

A

60

5.1 The term ___ means protection against

financial loss.

A.

B.

C.

D.

Policy

Insurance

Beneficiary

COBRA

B

61

5.2 What effects the amount of an

insurance premium?

A.

B.

C.

D.

Type of insurance

Terms of insurance policy

Amount of deductible

All of the above

D

62

5.2 Which of the following is a type of insurance

that can be purchased that can protect you from

financial loss?

A.

B.

C.

D.

Stock market losses

Health care expenses

Maintaining the price of your home

Protecting your job

B

63

5.2 The type of insurance that is the minimum

required by law for automobiles is:

A.

B.

C.

D.

Medical payment insurance

Physical damage insurance

Liability insurance

Uninsured and underinsured motorist

insurance

C

64

5.2 Two types of insurance

included in a homeowner’s policy

are:

A.

B.

C.

D.

C

Medical and death benefit

Fire and flood

Property and liability

Collision and comprehensive

65

5.2 To protect future income and money,

home owner’s insurance should be written

so that it covers:

A.

B.

C.

D.

The next owner of the property\

Replacement cost of the property

Any improvements to the property

Lawns, trees, and shrubs

B

66

5.3 Life insurance should be

purchased when:

A.

B.

C.

D.

Individual has dependents

Individual reaches the age of 50

Individual flies in an airplane

Individual gets their first job

A

67

5.2 Perils that are covered in a

homeowner’s policy would

include:

A. Lightening, falling trees, tornadoes

B. Someone slipping and falling on your icy

sidewalk

C. Arson caused by the homeowner

D. Carpet stained by a spill

A

68

5.3 Which insurance is likely to be

needed by a college student?

A.

B.

C.

D.

Homeowners

Renters

Flood insurance

Life insurance

B

69

6.1 The term ___ means criminal activity to

fraudulently acquire personal information

A.

B.

C.

D.

Co-sign

Phishing

Default

Bankruptcy

B

70

6.1 The term ___ means a numerical

rating based on a person's credit history

that represents their credit worthiness.

A.

B.

C.

D.

Character

Capacity

Credit Rating

Credit Score

D

71

6.1 The term ___ means failure to repay a

debt.

A.

B.

C.

D.

Credit

Default

Phishing

Bankruptcy

B

72

6.1 The term ___ means legal process that

allows someone deeply in debt to create a

plan to repay their debts.

A.

B.

C.

D.

Bankruptcy

Capacity

Credit

Condition

A

73

6.1 The term ___ means a record of

whether or not a person has paid his or her

bills on time in the past.

A.

B.

C.

D.

Capital

Default

Credit

Credit history

D

74

6.2 If a credit card is used properly,

what benefits does it have for the

cardholder?

A. The cardholder will pay higher interest

rates on other forms of credit

B. The cardholder will develop a positive

credit history

C. The cardholder will develop a negative

credit history

D. There are no benefits for the

B cardholder

75

6.6 Only making the minimum

payment on a credit card every

month will:

A. only pay a small percentage of the

total balance owed

B. make the final amount paid

substantially higher than the amount

initially charged to the card

C. result in slow progress towards paying

off the total balance on the card

D. All of the above

D

76

6.1 What is credit?

A. Money allocated to a specific account for

future use by the consumer without borrowing

B. Goods, services, or money received in

exchange for a promise to pay a definite sum

of money at a future date

C. The ability and willingness of an individual to

pay back a loan as perceived by the lender

D. An individual’s character, capital, capacity,

collateral, and conditions

B

77

2.3 Steven is considering taking a job with a company that is

offering gym memberships, flexible hours, repayment of

education loans, merchandise discounts, and childcare. These

components of

the job offer are called:

a. fringe benefits

b. job perks

c. work incentives

d. competitive hiring practices

A

78

6.3 Payday loans are often difficult for

consumers to pay back because:

A. they forget the due date

B. the entire amount is due on the due

date

C. they make payments in installments

D. None of the above

D

79

6.4 What is a way for a consumer to

develop a negative credit history?

A.

B.

C.

D.

Pay bills consistently and on time

Keep number of credit inquiries low

Have a criminal record

Hold a low number of credit/store

cards

C

80

6.4 A consumer will develop a

positive credit history if they

(best answer):

A. Maintain reasonable amounts of

unused credit

B. Pay phone and utility bills on time

C. Pay cash for the majority of purchases

D. All of the above

A

81

6.5 According to the Federal Truth in Lending Act,

where must the terms and conditions of credit

cards be posted?

A.

B.

C.

D.

B

On the back of the credit card

In the Schumer box

On the credit card’s Web site only

They do not need to be posted

82

6.7 Driver’s licenses, social security

numbers, account numbers, and copies of

bills may be used by someone to:

A.

B.

C.

D.

Open a credit card account

Obtain a loan

Get a driver’s license

All of the above

D

83

6.8 Which item should not be carried with

you on a regular basis?

A.

B.

C.

D.

Driver’s license

Utility bills

Pin number

Social security card/number

D

84

6.9 If you are a victim of identity

theft, what should you do?

A.

B.

C.

D.

Close affected account

File a police report

Contact the credit report agencies

All of the above

D

85

7.1The term ___ means comparing

products and prices in different stores

before making a purchase

A.

B.

C.

D.

Comparison

Impulse buying

Warranty

Contract

A

86

7.1 The term ___ means the price of an item

per ounce, pound, or other accepted unit of

measure.

A.

B.

C.

D.

Comparison shopping

Impulse buying

Unit pricing

Warranty

C

87

6.2 Discuss consumer rights and

responsibilities

The right to be heard

The right to safety

The right to be informed

The right to choose

To make an informed decision

To treat merchandise with care

To pay your debts

To demand reliable products

88

7.3 Review types of advertising

•

•

•

•

•

•

Bait and switch

Sex appeal

Testimonials

Propaganda

Bandwagon

attention getter

89

7.4 A pair of shoes that costs $10

and is on sale for 10% off would

cost you how much?

A.

B.

C.

D.

$1

$5

$9.90

$9

D

90

7.5 Comparison shopping factors

• Discuss:

– unit pricing

– Quality

– warranty

91

7.6 Consumer protection agencies

• Consumer protection agency

• FTC

• Magazine: Consumer Report

92

7.7 Warranties and Contracts

93

8.1Terms

•

•

•

•

•

•

•

•

•

•

•

•

•

1. Closing costs fees paid by the buyer or seller at the time the purchase of the

house is finalized

2. Deed the legal document by which the title is transferred from one person to

another

3. Down payment initial cash payment paid when buying an item on credit

4. Equity the difference between the value of property and the amount owed for

that property

5. Foreclosure a legal proceeding in which the creditor either sells or

repossesses property for failure to repay a debt

6. Lease a legal document a lessee signs when agreeing to rent housing for a

specified period of time; also for an automobile

7. Lessee someone who pays rent to use or occupy property owned by someone

else; also known as tenant

8. Lessor a person who owns a property and rents it to someone else; also know

as landlord

9. Lien a claim upon property to satisfy a debt

10. Mortgage long term home loan

11. Security Deposit a fee paid by a lessee/tenant to cover the cost of any future

damage that may be caused to the unit

12. Sublet to move out of a rental unit before the lease is up and rent the unit to

someone else while retaining legal responsibility for the lease

94

13. Title legal document showing ownership of a vehicle

8.2 Reasons for renting, leasing,

buying

A. Renting/Leasing

A. Easier and faster to move

B. No financial obligation

C. Know each month exactly what you owe

B. Buying

A.

B.

C.

D.

Harder to move

Equity

Responsible for upkeep

Pride in ownership

95

8.3 Methods for purchasing home

96

8.4 Basic components of lease

97

8.5 Reasons for public

transportation verses buying or

leasing a vehicle

• For using public transportation:

– No insurance on vehicle

– No upkeep

– No payments

• Against using public transportation:

– Can go when you want

– Available when needed

98