Credit works against me when… - Citizens for Responsible Lending

advertisement

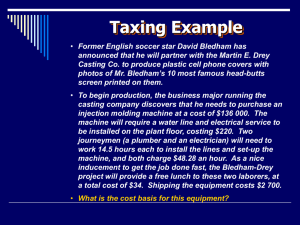

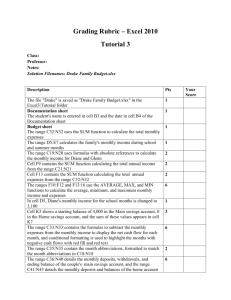

How Credit Works Against Me Citizens For Responsible Lending www.citizensforresponsiblelending.org How Credit Works Against Me Think of credit like Warfarin. When needed, a little thins your blood and will save your life. But just a little too much can kill you. How Credit Works Against Me Credit is appealing because of our generally optimistic nature. We believe that in the near future our income will increase and expenses will decrease. Unfortunately life seldom works out the way we optimistically believe it will. How Credit Works Against Me Credit works against me by ◦decreasing my checking account and savings account balances more than I would have without using the credit, and ◦also may reduce my equity. Credit works against me when… Repayment is larger than the amount I have available now The amount I have to pay to the credit account is equal to or greater than the amount of money I have available after I pay my bills each month. ◦ This eliminates monthly deposit to checking and savings ◦ It takes money out of existing balances of checking and savings ◦ Unexpected expenses may result in late payment fees, reducing available money even further ◦ May need to refinance credit at a higher rate plus additional loan fees ◦ May have to take out home equity loan to cancel credit card loan Credit works against me when… I use Credit to buy more than I need Buy a family pack of beef because it is on sale, then make larger meals or more meals with beef Buy a boat without budgeting for all the stuff that goes with it: gas, equipment, and meals away from home Buy a large gas grill and start eating steak three times a week Buy a larger TV or other electronics when existing one still works **None of these purchases will reduce my regular expenses** Credit works against me when… Credit wipes out the savings initially realized The interest and fees on a credit account may result in paying more than the retail price or wipe out the savings initially realized Buy something on sale but paying with a loan ends up being more than the savings ◦ Buy a $6000 car (originally $6500) with 5-year loan at 6.5% interest = $7044 final cost for car Buy something on a credit card ends up costing more than the original retail price ◦ Buy a $1500 TV on the store credit card (20% interest rate), take 12 months to pay off TV = $1667.40 final cost for the TV Buy anything on a “same as cash” interest-free loan BUT miss payments, causing late fees and higher interest rate charged Who do I get credit from? Every time I get a product or service before it’s paid for someone, somehow is using credit that I have to pay for and usually at a high rate of interest. Who do I get credit from? Financial cards Credit Card (even when paid in full when the No money down bill comes) No money down, 2 years to pay ◦ Credit card with 5% off your first purchase No interest and 2 years to pay (“same as ◦ Credit card with 2 years with no interest ◦ Credit card with 5% cash back on every purchase Store offers Debit Card cash”) How Credit Works Against Me Recap Credit is like Warfarin: it must be used wisely Credit is used because of our optimistic nature Credit works against me when: ◦ Repayment is larger than the amount I have available now ◦ I use Credit to buy more than I need ◦ Credit won’t reduce my regular expenses ◦ Credit wipes out the savings initially realized Recognize who I get credit from How Credit Works Against Me Credit works against me by decreasing my checking account and savings account balances more than I would have without using credit and also may reduce my equity.