Optimal Risky Portfolio

advertisement

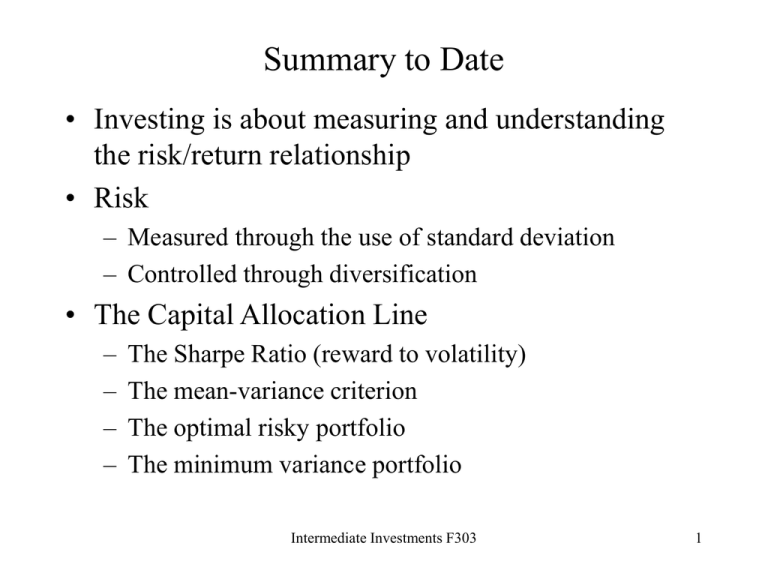

Summary to Date • Investing is about measuring and understanding the risk/return relationship • Risk – Measured through the use of standard deviation – Controlled through diversification • The Capital Allocation Line – – – – The Sharpe Ratio (reward to volatility) The mean-variance criterion The optimal risky portfolio The minimum variance portfolio Intermediate Investments F303 1 Summary to Date • While the return of a portfolio made up of two assets is simply the weighted average, the standard deviation is only a weighted average if the assets are perfectly correlated • Otherwise, the standard deviation is something less than the weighted average, showing the benefits of diversification! Intermediate Investments F303 2 The Optimal Risky Portfolio • Optimal Risky Portfolio (p. 200 has an error) WA = (RPA) * (VARZ) – (RPZ)(SDA)(SDB)(RhoAZ) --------------------------------------------------------------------------(RPA)*(VARZ) + (RPZ)*(VARA) -(RPA+RPZ)(SDA)(SDZ)(RhoAZ) Intermediate Investments F303 3 The Minimum Variance Portfolio • Minimum Variance Portfolio (p. 197) WA = (VARZ) – (SDA)(SDZ)(RhoAZ) -----------------------------------------------------(VARZ) + (VARA) – 2(SDA)(SDZ)(RhoAZ) Intermediate Investments F303 4