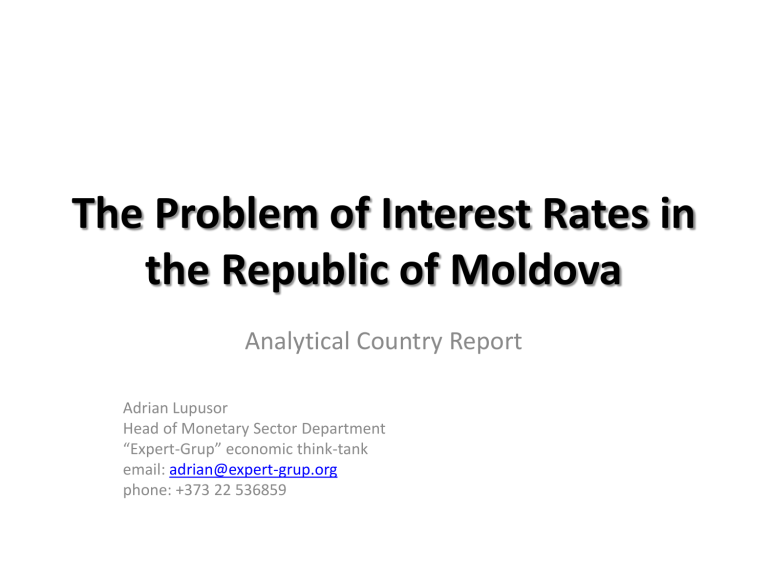

The Problem of Interest Rates in the Republic of Moldova

The Problem of Interest Rates in the Republic of Moldova

Analytical Country Report

Adrian Lupusor

Head of Monetary Sector Department

“Expert-Grup” economic think-tank email: adrian@expert-grup.org

phone: +373 22 536859

Defining the Gravity of the Problem

Real lending rates have always been among the highest in Central and Eastern Europe

Real lending rate (nominal minus GDP deflator), average 2005-2010, %

GEO

ALB

MDA

AZE

HRV

ROM

CZE

HUN

SVK

SVN

BGR

MNE

BIH

LTU

LVA

EST

RUS

UKR

BLR

-5 0 5 10 15

Source: World Bank

Access to financing is identified as one of the most problematic factors for doing business

Ease of access to loans ranking, Global Competitiveness Index 2011-2012

GEO

LVA

ROM

HRV

RUS

HUN

SVN

MDA

LTU

ALB

BIH

UKR

MNE

BGR

SVK

EST

CZE

AZE

POL

0 20 40 60 80 100 120 140

Source: World Economic Forum

Though much lower than pre-crisis levels the difference between nominal and real lending interest rates denotes a strong inflationary environment

45

40

35

30

25

20

The share of bank loans to GDP, nominal and real interest rates for bank credits in national currency, %

Bank loans to GDP Nominal lending rate Real lending rate

25.2

27.5 29.1

29.5

32.0

31.5

34.5

40.2

39.8

41.6

33.9

38.0

15

10

5

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

(e)

Source: National Bank of Moldova and own calculations

Lending interest rates have traditionally been higher for households than for firms

Monthly lending interest rates, average, for credits to companies and households, %

Source: National Bank of Moldova

Main reasons of this discrepancy

1. Firms are more creditworthy as they are able to provide more collateral;

2. The strong spike in the share of nonperforming loans in total banks’ credits was mainly driven by consumer loans;

3. Central bank’s credit facility which provided access to long-term loans at preferential interest rate

The Main Credit Costs Determinants

The Main Components of Lending

Interest Rates

Factor no. 1: High Costs of Financing

Real Deposit Interest Rates, average 2005-2010, %

-5 -3 -1

MDA

ALB

GEO

HUN

EST

HRV

MNE

ROM

BGR

LVA

BLR

SVN

AZE

CZE

LTU

BIH

1

Source: World Bank

3 5

Factors driving up the costs of financing banks’ balance sheets

1. Low level of disposable income in Moldova which limits households’ savings;

2. Limited confidence in Moldovan banks;

3. High macroeconomic uncertainty;

4. Poor spectrum of saving instruments.

Poor access to long-term resources => maturity mismatch => banks are forced to keep their balance sheets as liquid as possible

Bank liquid reserves to bank assets ratio (%)

SVK

ROM

MDA

HRV

ALB

CZE

BLR

SVN

EST

LVA

UKR

LTU

AZE

GEO

RUS

HUN

BGR

POL

0 0.05

Source: World Bank

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

Factor no. 2: Poor Competition and

Low Banking Sector Efficiency

Share of foreign owned banks' assets in total banking assets, 2010, %

Source: EBRD

Moldovan banking system is one of the most inefficient in the region

Profit Efficiency Scores in Central Eastern Europe, 2008

Source: Lupusor and Babin (2011)

Factor no. 3: High Risk Premiums

Risk premiums on lending (lending rate minus T-bills rate)

GEO

AZE

ROM

MDA

MNE

ALB

BGR

LVA

CZE

SVN

LTU

HUN

POL

0

Source: World Bank

5 10 15 20

Main causes fueling the risk premiums

• Macroeconomic instability amplified by political instability, especially starting in 2009 and continuing onwards.

• Poor lenders’ rights and burdensome procedures for collateral execution which favor the debtor.

• Absence of well-functioning credit information

(history) bureaus.

• Poor management of most companies applying for bank credits and low quality credit applications.

• Maturity mismatch problem

Consequence: The of banking loan portfolios in

Moldova has traditionally been one of the highest among the region

Share of non-performing loans in total gross loans, average 2005-2010, %

MDA

ROM

MNE

LTU

POL

LVA

ALB

HRV

RUS

BIH

HUN

SVK

BGR

CZE

GEO

BLR

EST

SVN

0 2 4 6 8 10

Source: World Bank

Central Bank’s Action to Reduce the

Lending Interest Rates

Three important notes

1. The reduction of credit costs is not the primary prerogative of the National Bank of

Moldova (NBM) due to its IT strategy.

2. NBM has a very limited range of instruments which could be used for making interest rates more affordable.

3. NBM is a net debtor of the banking system and not a net lender.

Main instruments used:

1. Monetary policy inertia: NBM adjusts its policy rate to macroeconomic news very slowly;

2. Keeping an accommodative monetary policy stance;

3. Long-term credit facility for commercial banks

4. In 2011, NBM set the required reserves rate at

0% for deposits with maturities longer than two years.

Outcomes of High Interest Rates

Problem

The main outcome: narrow access of firms and households to banking credits

The share of bank credits in GDP, average for the period 2005-2010, %

Source: World Bank

Poor intermediation function of commercial banks due to:

1. shrinking demand for loans due to their low affordability

2. banks’ preference to lend to companies with better credit histories

SMEs are strongly disadvantaged: whereas SME sector account for about 98% of the total number of enterprises and 59% of total employment, it received only 31% of total banking loans in 2010.

Paradox: high liquidity levels paralleled with low banking sector penetration

Correlation between the banking liquidity and the share of banking credits in GDP, average for the period 2005-2010, %

Source: World Bank and own calculations

The Global Competitiveness Index confirms the lending rates issue in Moldova

• Access to financing is constantly recognized as one of the most problematic factor for doing business in Moldova

• Moldova’s rank according to the ease of access to loans, in fact, decreased in comparison with the pre-crisis level: 102 nd place out of 134 according to the 2008-2009 issue, compared to 109 th place out of 142 in the 2011-2012 issue.