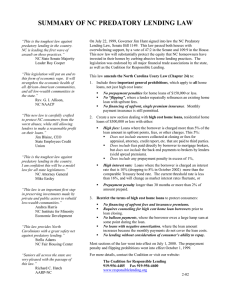

Signs of a Predatory Car Title Loan

advertisement

Signs of Predatory Lending What to Watch Out For When You’re Shopping for a Loan Signs of Predatory Lending Car Title Lending Abuses Families risk losing their cars to these predatory short-term loans. www.responsiblelending.org Signs of Predatory Lending Car Title Lending Abuses Sign #1: High Interest Rates Car title lenders often express the cost of their loans as fees for a short-term loan. For example, a title loan may cost $25 per $100 loan for a 30-day period. This equates to an annual interest rate of 300%, and the short-term due date for the entire loan plus the fee usually forces the borrower to take out back-to-back loans. www.responsiblelending.org Signs of Predatory Lending Car Title Lending Abuses Sign #2: Short Due Date. Car title loans are generally due in one month. Because the borrower cannot pay the loan off in such time, most are caught in a cycle of repeat loans that put them in a worse financial position than when they first borrowed. www.responsiblelending.org Signs of Predatory Lending Car Title Lending Abuses Sign #3: Vehicle at Risk. Title lenders secure their loans by holding the title of the borrower’s vehicle. If the borrower does not pay off the loan when it’s due, the lender can take possession of the borrower’s vehicle. www.responsiblelending.org Signs of Predatory Lending Car Title Lending Abuses Sign #4: Cycle of Debt. Car title borrowers frequently end up in a cycle of long-term, high-cost debt. In Missouri, for example, the state auditor found that, on average, car title lenders make 3.5 times more renewal loans than new loans each month. www.responsiblelending.org