Scotiabank Presentation – Week 6

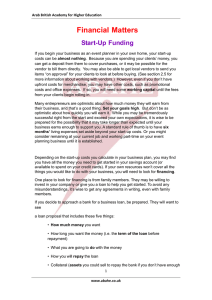

advertisement

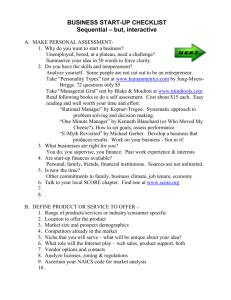

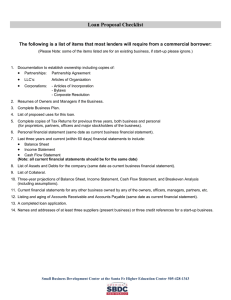

The Starting Line for business 1 Successful entrepreneurs are: Ambitious…want more out of life Motivated…to achieve goals Passionate… about what they do Visionaries…see future opportunities Disciplined…to work long hours & manage many tasks Good planners & problem solvers Identify the tools in your toolbox. Do you need to go shopping or do some need to be sharpened? 2 Market Research – do your homework! Measure twice, cut once…..it will pay dividends in the end! Who exactly is your customer? How strong is demand for your product/service? Where do people currently buy? How much $ will customers pay? How big is the market? What trends are taking place in your industry? Who are your main competitors? What attracts customers to your competitors? 3 Market Research (Secondary) Secondary researches involves collecting information about your industry. Statistics Canada (statcan.gc.ca) The federal government’s largest site for business (strategis.gc.ca/bis) Economic Development Office Small Business Enterprise Centre Potential suppliers Canadian Federation of Independent Business (cfib.ca) Canadian Youth Business Foundation (www.cybf.ca) Industry associations 4 Find advisors Small business owners can’t know everything. These advisors will support you and fill in knowledge gaps for you Commercial Lawyer Accountant Small Business Banker Professional Business Coach Volunteer Business Mentor Investigate & choose your business structure Speak to an accountant and lawyer to find the best way to structure your business given the nature of your company and your personal circumstances Raise start-up funds Determine how much money you’ll need to launch Review the top sources of start-up financing Identify available personal resources How much money do you need? Based on your plans, calculate capital costs. Next, calculate how much you’ll need for operating costs per month. Your start-up budget includes your capital costs + six-months of operating costs. Be sure to add a 10% contingency fund. Where to get the money Personal funds ‘Love Capital’ Partners Investors Financial Institution Government Programs Non- Profit Organizations Advance Sales 7 How do financial institutions make lending decisions? The 5 C’s of credit: Character….your personal credit report Capacity….repayment ability Capital….your skin in the game Collateral….loan security Conditions….of the borrower and the market Canadian Small Business Financing Act (CSBFA) Federal Loans Program This is a loan program designed to increase institutional funding to new and existing businesses to improve loan access to stimulate the economy and create jobs. The CSBFA program is administrated through the financial institutions lending decision process adding an additional guarantee to increase the lenders security, reducing their risk. Some benefits include…. Limited personal liability – 25% Limits the interest rate from the lender Can finance; buildings/land, commercial vehicles, hotel or restaurant, computer equipment or software, production equipment Can NOT finance; goodwill, working capital, inventory, franchise fees, R&D Final advice “Credit is King” – follow the 5 C’s of Credit NETWORK!!!! Give your new business plenty of time to grow Invest in learning new skills to run your business Over-estimate your start-up expenses, under-estimate sales Find experienced advisors Be unique in your marketplace Do your market research by asking your customers lots of questions Write a Business Plan! 10 Thank you! Our online program E-Learning for business will help you acquire new skills & guide your business development. Need help? Visit your branch or scotiabank.com QUESTIONS? 11