ERISA Section 408(b)(2) Fee Disclosures

advertisement

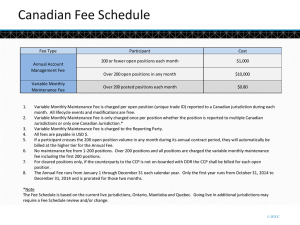

Important Pension Changes From D.C. - What Do You Need to Know? Marcia S. Wagner, Esq. Transforming the Retirement System Regulatory landscape is changing. DOL is rolling out new rules for 2012. ◦ Fee disclosures for plan sponsors ◦ Participant-level fee disclosures ◦ Participant investment advice Proposed Rulemaking DOL Interaction with White House ◦ Working with White House’s Middle Class Task Force ◦ Coordinated actions to improve retirement security 2 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 3 DOL Finalizes Participant Fee Disclosure Regulations DOL issues final reg’s on Oct. 14, 2010. ◦ DOL press release explained that existing law did not require plans to provide necessary information. ◦ New rule requires comparison of plan’s investments. Types of plans covered ◦ New reg’s apply to DC plans with participantdirected investments. ◦ Covers plan even if not designed to comply with ERISA Section 404(c). Coverage of participants ◦ New reg’s apply to all eligible employees. 4 Annual and Quarterly Disclosure of Plan-Related Information Must disclose general info about plan. ◦ Must include explanation of general admin. service fees and individual expenses on annual basis. ◦ Must disclose dollar amount of fees/expenses charged to participant accounts on quarterly basis. Disclosure only required for fees/expenses not embedded in expenses of investments. ◦ If service provider only receives indirect compensation from investments, provider’s fees are not subject to this disclosure requirement. ◦ But must disclose that a portion of general admin. service fees is paid from expenses of investments. 5 Annual Disclosure of Investment-Related Information Must disclose fee and performance-related info for plan’s investment alternatives. ◦ This disclosure must be in comparative format. ◦ Must be provided on annual basis. Required information for disclosure in comparative format includes: ◦ ◦ ◦ ◦ Name and type of investment option Investment performance data Benchmark performance data Total annual operating expenses for each investment and any extra shareholder-type fees. ◦ Internet website address 6 Other Requirements Info that must be available upon request ◦ Prospectuses, shareholder reports and financial statements provided to plan. Form of disclosure ◦ Must be understood by average participant. Impact on sponsor’s other fiduciary duties ◦ No relief for duty to prudently select/monitor plan’s providers and investments. ◦ New reg’s modify ERISA 404(c) disclosures. Effective date ◦ Plan years beginning on or after Nov. 1, 2011. ◦ Initial disclosures due May 31, 2012 for calendar year plans. 7 Potential Impact Automatic delivery of fund prospectuses will no longer be required under ERISA 404(c). RIA fees presumably must be disclosed on annual and quarterly basis as “general administrative” fee. Plan participants are likely to scrutinize plan’s investments and fees, impacting sponsors and advisors. Educate your plan participants before disclosure. 8 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 9 How Can Inv. Advice Be Conflicted? Non-fiduciary provider receives variable compensation from plan’s investments. ◦ Broker-dealer receives different 12b-1 fees. ◦ Fund platform offers proprietary funds to plan clients. Provider has incentive to steer participants. ◦ Can not provide fiduciary advice to participants. ◦ Conflicted advice triggers prohibited transaction (PT). ◦ PT occurs even if advice provided in good faith. 10 DOL Final Rules for Participant Advice Pension Protection Act included statutory exemption for participant-level advice. ◦ Fiduciary Adviser must be RIA, bank, insurer or brokerdealer. ◦ Eligible Investment Advice Arrangement must have: (1) Fee-Leveling (Fiduciary Adviser’s fees do not vary) (2) Computer Model certified by expert. Other conditions for exemption. ◦ Authorization from separate plan fiduciary. ◦ Annual review by independent auditor. ◦ Advance notice to participants with disclosures for fees and material affiliations of parties (i.e., conflicts). 11 Fee-Leveling Arrangement Fiduciary Adviser’s fee must not vary. ◦ Fiduciary Adviser’s employee/rep must receive level compensation. ◦ Fiduciary Adviser’s affiliate may receive variable compensation. Example: ABC Fund Platform for Plan Clients ◦ Plan invests in ABC Funds and third party funds. ◦ ABC Fund Manager cannot give participant advice (due to incentive to steer participants to ABC Funds). ◦ New affiliate, ABC Fiduciary Adviser, is created to provide advice to participants. ◦ DOL imposes fee-leveling on ABC Fiduciary Adviser. ◦ But ABC Fund Manager can earn compensation that varies with participants’ allocation decisions. 12 Computer Model Arrangement Advice must be from computer model. ◦ Model must be certified by investment expert. ◦ Must consider participant’s personal info. ◦ Fiduciary Adviser may receive variable compensation. Does DOL favor index funds? ◦ Proposed rules suggested that model should favor cheapest menu option in each asset class. ◦ Fortunately, DOL backed away from this approach. Can a Computer Model be used for IRAs? ◦ DOL permits it. ◦ But are Computer Models capable of advising IRA owners? DOL rules become effective on Dec. 27, 2011. 13 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 14 When Are Service Providers Conflicted? Plan sponsor is looking for provider of administrative services. Provider offers two options: ◦ Services ordered a la carte: ◦ Pre-packaged services and menu: $10,000.00 $ 4,000.00 Plan sponsor may incorrectly conclude pre-packaged option is best for participants. ◦ Doesn’t realize that provider receives “hidden” compensation from funds and fund managers. ◦ Full compensation may be more than $10,000. ◦ Hidden cost is actually shifted to participants. Provider has incentive to steer uninformed clients to more profitable option. 15 Retirement Security Initiative Improving transparency of 401(k) fees. ◦ Administration’s goal is to make sure workers and plan sponsors are getting services at a fair price. ◦ Pushing to “finalize” interim final reg’s this year. Rationale for interim 408(b)(2) reg’s. ◦ DOL efforts to educate plan sponsors about 401(k) plan fees started with Nov’ 97 hearing. ◦ Plan sponsors still not asking the right questions. ◦ DOL will now require providers to furnish the fee info sponsors should be requesting. 16 Covered Providers and Disclosures Covered Service Providers ◦ Fiduciaries (including ERISA fiduciary or RIA). ◦ Providers of recordkeeping and brokerage services. ◦ Providers of accounting, actuarial, legal and other professional services if they receive indirect fees. Required to disclose compensation in writing. ◦ Must be provided before entering into contract. ◦ Formal contract not required. ◦ Indirect compensation requires more detailed disclosure. ◦ Service-by-service disclosure of fees is generally not required. 17 Disclosure of Compensation Format and manner of disclosure ◦ Dollar amount, formula, percentage of plan assets, per capita charge, or any other reasonable method. ◦ Whether fees will be billed or deducted and any other manner of receipt must be disclosed. Compensation shared among related parties ◦ Generally, compensation paid to affiliates or subcontractors does not have to be disclosed. ◦ But must disclose if payment flows to related party on transactional basis (e.g., commissions, 12b-1 fees). Special Rules for Platform Providers ◦ Must provide basic fee information for each investment alternative. ◦ Requirement can be met by passing through fund prospectuses. 18 Timing of 408(b)(2) Disclosures Required Deadlines ◦ Disclosure must be made reasonably in advance of starting or renewing services. ◦ Changes to info must be made no later than 60 days after provider becomes aware of change. ◦ Erroneous info will not result in violation if provider has acted in good faith and with diligence. ◦ Errors and omissions must be disclosed within 30 days after coming to light. 19 Prohibited Transactions and Interim 408(b)(2) Regulations If provider fails to make disclosure, plan’s payment of fees is a prohibited transaction. ◦ Disclosure failures can be cured. ◦ Plan must make written request for information, and provider must respond within 90 days. ◦ Refusal or inability to comply with request requires plan fiduciary to notify DOL. No fiduciary conflicts permitted. ◦ 408(b)(2) disclosure does not cure self-dealing violations. Outlook ◦ Effective date delayed from July 16, 2011 to April 1, 2012. 20 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 21 DOL’s Campaign to Expose Conflicts DOL Strategy ◦ Roll out new fee disclosure rules. ◦ Impose fiduciary status on more providers. ◦ Force non-fiduciary advisors to make disclaimers. DOL releases proposed reg’s on Oct. 21, 2010. ◦ Broadens “investment advice fiduciary” definition. ◦ Withdrawn on September 19, 2011. ◦ To be re-proposed with more input from public. 22 Overview of Existing Definition If you provide investment advice, you are automatically deemed a fiduciary. DOL’s current definition for investment advice is based on 5-factor test: ◦ ◦ ◦ ◦ Advice on value or advisability of investments, that is provided on a regular basis, pursuant to a mutual agreement or understanding, that such services will serve as a primary basis for investment decisions, and ◦ that individualized advice will be based on the particular needs of the plan. 23 Overview of DOL’s Initial Proposal Existing Definition ◦ Advice may be investment advice if it is primary basis for plan decisions and given on regular basis. DOL’s Initial Proposal ◦ Include any advice that may be considered by plan. ◦ May include casual advice or one-time advice. ◦ Non-fiduciary advisors must make disclaimer: (1) advisor is acting as seller of securities. (2) advisor’s interests are adverse to client. (3) advice is not impartial. 24 Potential Impact on Providers Non-Fiduciary Advisors ◦ Would need to change service model. ◦ Must disclose they are not providing impartial advice. ◦ Or they could accept fiduciary status and become subject to ERISA. Re-proposed Rule in 2012 ◦ New definition to include individualized advice only. ◦ Will be similar in approach to DOL’s initial proposal. ◦ DOL is coordinating with SEC. 25 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 26 Background on Target Date Funds Popular default investment vehicle for 401(k) plans. Typically, formed as open-end investment companies registered under the Inv. Co. Act. Defining characteristic – “glide path” which determines the overall asset mix of the fund. Performance issues in 2008 raise concerns, especially for near-term TDFs. ◦ Based on SEC analysis, the average loss for TDFs with a 2010 target date was -25%. ◦ Individual TDF losses as high as -41%. 27 Recent Developments for TDFs DOL and SEC at Senate Special Committee on Aging hearing on TDFs (Oct. 28, 2009). ◦ Investor Bulletin jointly released by DOL and SEC. ◦ DOL’s fiduciary checklist on TDFs is pending. SEC proposal for TDF advertising materials. ◦ If name has target date, “tag line” disclosure needed. ◦ Advertising must include glide path information. On Nov. 30, 2010, DOL proposes rules on TDF disclosures for participants, amending: ◦ QDIA reg’s issued under PPA of 2006 ◦ Participant-level fee disclosure reg’s that were finalized on Oct. 14, 2010 but are not yet effective. 28 DOL’s Proposed Changes to QDIA Reg’s Background on QDIA Reg’s ◦ Participant deemed to be directing investment to default choice if QDIA requirements are met. ◦ Default investment must be a QDIA, and QDIA notices must be provided to participants. DOL proposes change to QDIA notice for TDFs. ◦ Explanation and illustration of TDF’s glide path. ◦ Relevance of target date (e.g., 2030) in TDF name. ◦ Disclaimer that TDF may lose money after retirement. DOL also proposes general changes to QDIA notice (even if not a TDF). 29 DOL’s Proposed Changes to Participant-Level Fee Disclosure Reg’s Background (recap) ◦ New rules will require disclosure of plan-related fees and annual comparative chart for plan’s investments. DOL proposes change to annual comparative chart for TDFs (even if not a QDIA). ◦ Must include appendix with additional TDF info. ◦ Same info as required for QDIA notice. Informal follow-up guidance from DOL ◦ TDF prospectus is unlikely to satisfy QDIA notice and annual comparative chart requirements, as proposed. ◦ DOL will not provide “model” target date disclosures. 30 Conflicts of Interest in TDFs Conflicts arise when a “fund of funds” invests in affiliated underlying funds. ◦ Conflicts are permitted because fund managers are carved out from ERISA’s fiduciary requirements. Are fund managers ever subject to ERISA? ◦ Firm requested clarification on scope of carve-out. ◦ In Adv. Op. 2009-04A (Avatar Associates), DOL declined to rule that the TDF managers are fiduciaries. Implications of DOL guidance ◦ Plan sponsors are alone in their fiduciary obligation. ◦ Must ensure TDFs (and underlying funds) are appropriate plan investments. 31 Congressional Proposal for TDFs Senator Kohl announced his intent to introduce new legislation (Dec. 2009). ◦ Concerns over high fees, low performance or excessive risk in many TDFs. ◦ Would impose ERISA fiduciary status on TDF managers when TDF used as QDIA in 401(k) plans. Senator Kohl’s proposal differs from DOL approach to improve disclosures to employers and participants. 32 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 33 Retirement Security and Annuitization Obama Administration believes lifetime income options facilitate retirement security. ◦ Initiative to reduce barriers to annuitization of 401(k) plan assets. ◦ DOL / IRS issued a joint release with requests for information on Feb 2, 2010. ◦ RFI addresses education, disclosure, tax rules, selection of annuity providers, 404(c) and QDIAs. The Retirement Security Project ◦ Released 2 white papers on DC plan annuitization. ◦ Proposed use of annuities as default investment. 34 Other Recent Developments in DC Plan Annuitization Two types of legislative proposals. ◦ Encourage annuitization with tax breaks: Lifetime Pension Annuity for You Act, Retirement Security for Life Act. ◦ Annual disclosure of what 401(k) plan balance would be worth as annuity: Lifetime Income Disclosure Act. IRS addressed qualification requirements for DC plans in PLR 200951039. ◦ Variable group annuity investment options ◦ No “surprise” interpretations on age 70 ½ minimum distribution and QJSA rules. 35 Lifetime Income Hearing by Senate Special Committee on Aging Senate hearing held on June 16, 2010. ◦ The Retirement Challenge: Making Savings Last a Lifetime. ◦ Start of legislative debate on lifetime income options. DOL and Treasury provide early analysis on RFI concerning lifetime income options. ◦ More than 800 responses to RFI. ◦ Concerns expressed against government takeover of 401(k) plans. ◦ DOL and Senator Kohl clarify that there is no interest in mandating lifetime income options. 36 Joint Hearing by DOL, IRS and Treasury in September 2010 Purpose is to investigate 5 focused topics. 2 areas of general policy-related interest. ◦ Specific concerns raised by participants. ◦ Alternative designs of in-plan and distribution lifetime income options. 3 areas of specific interest. ◦ Fostering “education” to help participants make informed retirement income decisions. ◦ Disclosure of account balances as monthly income streams. ◦ Modifying fiduciary safe harbor for selection of issuer or product. 37 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 38 Automatic IRA Legislation Proposed Automatic IRA Act introduced in both Senate and House in 2010. Re-introduced to Senate in 2011. Would require employers to make automatic payroll contributions to employees’ IRAs. Originally proposed in 2011 FY Budget by Obama Administration. 39 2011 Bill for Automatic IRAs Senator Bingaman (D-NM) introduced bill on Sept. 14, 2011. Phase-in for Covered Employers ◦ 1st Year: Only large employers with 100+ employees would be covered. ◦ 2nd Year: Employers with 50+ employees ◦ 3rd Year: Employers with 25+employees ◦ 4th Year: Employers with 10+ employees 40 Overview of Proposed Legislation Automatic IRA Act of 2011 ◦ After phase-in period, employers with 10 or more employees must set up Auto IRAs. ◦ Covers all employees who are age 18 with 3 months. ◦ Choice of Traditional or Roth IRA (Roth is default). ◦ Investment firms not required to sell Auto IRAs. ◦ 3 investment options only, which must be low-cost. Related Tax Penalties and Incentives ◦ Noncompliance results in$100-per-employee penalty. ◦ New tax credit for small employers of $250 for startup costs, and $1,000 tax credit for 401(k) plans. 41 Outlook for Automatic IRAs Proposal was originally named Automatic Workplace Pensions initiative. ◦ Included in Administration’s 2011 FY Budget. ◦ Repeated in 2012 FY Budget. Automatic IRA legislation remains high priority for Obama Administration. 42 1. 2. 3. 4. 5. 6. 7. 8. Fee Disclosures to Participants Participant Investment Advice 408(b)(2) Disclosures Broader “Fiduciary” Definition Default Investments - TDFs Lifetime Income Options Automatic IRA Legislation A Game Plan for Clients 43 Final and Proposed Rules Will Impact Many Plan Clients 408(b)(2) Fee Disclosures ◦ Providers must furnish detailed fee disclosures by April 1, 2012. ◦ Will also impact plan sponsors directly. Plan sponsors have duty to ensure plan’s fees are reasonable under ERISA. ◦ Duty will extend to fee information included in providers’ 408(b)(2) disclosures. ◦ Sponsors are likely to need assistance in light of complexity of plan arrangements. ◦ Advisors can assist in prudent evaluation of fees and, if necessary, in search for alternative arrangements. 44 Fee Disclosures to Participants Many participants may be caught off guard by fee disclosures under the new rules. ◦ New rules become effective May 31, 2012 for calendar year plans. Advisors can help plan sponsors prepare. ◦ Discuss with plan’s recordkeeper and determine impact of new rules on existing fee disclosures. ◦ Meet with participants and review fee information through educational sessions. ◦ If sponsor has fee-related concerns, remind sponsor that its fiduciary review process can be enhanced. 45 Target Date Disclosures Provide meaningful TDF disclosures to participants as a “best practice” right now. ◦ Provide key information about TDF’s glide path, landing point and potential volatility. Also facilitate sponsor’s prudent review of the plan’s TDF series. ◦ Assist in the fiduciary review of the “fund of funds” structure, glide path, underlying funds and risk. ◦ Special review of TDFs for participants in or nearing retirement (e.g., 2015 TDF). 46 Broader “Fiduciary” Definition DOL proposal likely to pressure advisors to provide fiduciary services for level fees. ◦ Advisors unwilling to serve plan clients on these terms may be forced out of retirement space. Advisors, especially non-fiduciaries, should re-evaluate business model for plan clients. ◦ Explore working with recordkeeping platforms that have ability to offer level payouts. ◦ Explore use of ERISA fee recapture accounts to ensure advisor retains level fee only. ◦ Consider becoming “dual registrant” and charge level asset-based fee as RIA. ◦ No easy “one size fits all” solution for firms. 47 Important Pension Changes From D.C. - What Do You Need to Know? Marcia S. Wagner, Esq. 99 Summer Street, 13th Floor Boston, MA 02110 Tel: (617) 357-5200 Fax: (617) 357-5250 Website: www.wagnerlawgroup.com marcia@wagnerlawgroup.com A0064360 48