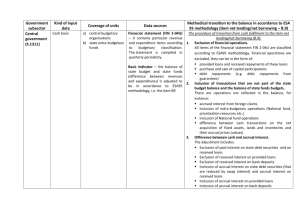

Government accounting and chart of accounts

advertisement

Sailendra Pattanayak, FAD International Monetary Fund Key Elements of an Accounting Framework Accounting basis – cash or accrual Budget classification and chart of accounts General Ledger and subsidiary records Accounting process (manual or computerized) and outputs Accounting policies Reporting entity Financial statements/reports Skilled personnel is important resource to implement the above 2 Accounting Framework in a Typical LIC – Main Issues Manual book keeping No ledger-based double entry system Lack of a comprehensive chart of accounts (or a detailed coding system with various segments) Substantial delay in annual accounts preparation Lack of clarity on the ‘reporting entity’ concept for consolidation of annual accounts Lack of clear methodology and accounting policies/standards for financial statements/reports 3 Cash Basis Accounting Transactions are recognized only when the related cash receipts and payments occur 4 Accrual Basis Accounting Flows are recorded at the time economic values are created, transformed, exchanged, transferred, or extinguished – GFSM 2001 A basis of accounting under which transactions and other events are recognized when they occur (and not only when cash or its equivalent is received or paid) - IFAC Public Sector Committee 5 Basis of Recording Government Financial Operations Cash based accounts: Revenue / expenditure transactions are recognized only when cash flow results Ignores liabilities until due for payment Ignores non-cash operations altering stock of government assets and/or liabilities Needs to be supplemented by memoranda items to bring to light economic flows escaping the accounts Accrual based accounts: Economic flows are recorded at the time economic value is created, transformed, exchanged, transferred, or extinguished. All economic flows (not just cash flows) are recorded. At the heart of accrual based accounts are the criteria adopted for recognizing an economic flow. Imprecise and non-transparent recognition criteria will compromise the integrity of accrual based accounts 6 Basis of Recording Government Financial Operations Modified Accrual based Accounts: The term modified accrual basis, no longer defined as a formal, distinct accounting basis, is generally used to imply relaxed standards for recognition of economic flows. Modified accrual basis is commonly employed: To enhance cash based accounting by accounting for certain operations like expenditure commitments before cash flow results To provide a migration path from cash-based to accrual based accounting systems Modified Cash based Accounts: This term is used to describe accounting systems under which cash- based accounts are “kept open” for some days/months beyond the close of the year to take on board transactions in pipeline at the time of year-end 7 Accounts Keeping Process and Outputs STEPS RECORDS Collect Source Documents -- Vouchers -- Bank Statements -- Transfer entrees Record in Journals Post General Ledger Post Subsidiary Ledgers Prepare Trial Balance Daily bank statements Register of checks Payment vouchers Revenue receipts Transfer entrees General / Special Journals General Ledger Subsidiary Ledgers Trial Balance Prepare Correction Entrees Prepare Financial Statements Consolidated Financial Statements 8 Government Financial Statements Annual Government Financial Statements Final Government accounts duly certified by the independent Supreme Audit Institution (SAI), together with a comprehensive audit report on the regularity, integrity, and propriety of government fiscal operations Government accounts should, at the minimum consist of : Under cash based accounting: Statement on sources, allocations, and use of cash resources – Finance Accounts Statement on approved budget estimates and actuals – Budget Execution Accounts/Appropriation Accounts Under accrual based accounting: Statement of Government Operations Statement of Other Economic Flows Balance sheet Statement of Sources and Uses of Cash Budget Execution/Appropriation Accounts 9 Chart of Accounts Countries do not always have a chart of accounts That means that they do not have a proper general ledger system Occasionally, some transactions are recorded in one system, and other transactions are recorded in another system Without a COA and ledger system, the accounting framework can be considered to be lacking in basic accounting discipline and controls The reliability and accuracy of the accounting system can be in doubt 10 Chart Of Accounts – what it is Logical framework for recording and reporting financial information Modern systems include budget classification fully in COA COA can accommodate progressive move to accrual accounting Asset and liability accounts in addition to revenue and expense accounts The Chart of Accounts needs to meet the business requirement of the Government COA forms core of the information to be generated and tracked in a GFMIS 11 Budget Classification and Chart of Accounts BC = revenue, expenditure & borrowings COA = BC + asset, liability and equity accounts COA also includes any internal management classification such as departments, cost centers, regions. GFSM 2001 should be followed when developing budget classification Uniform budget classification system, at all levels of government (e.g. Brazil, India) – helps in general government reporting. 12 Budget Classifications GFSM requires Economic and Functional Classifications Salary, goods and services, grants, subsidies are economic classifications Education, health, defense, are functions Other Classifications Countries usually also have administrative classification — ministries and departments Other classifications may include: programs, fund, geographic location, etc. 13 Account Type Revenue and expense type Asset, liability type Net-worth/Equity type Revenue and expense accounts are netted off at year- end and the surplus/deficit is transferred to Networth/equity Asset liability account balances are carried forward to next year 14 Year-end Processes First step is to extract a trial balance (TB) Modern computerized systems produce TB automatically A trial balance is a list of all account balances in the general ledger Once the TB is obtained, the balances should be reviewed to ensure that there are no obvious mistakes, etc. If double-entry has been followed, the trial balance must be in balance, i.e., total debits must equal total credits All revenue and expense type accounts are then written off to the net-worth/equity accounts, etc. The remaining account balances relate to assets and liabilities and constitute the closing balance sheet for this year This is also the opening balance sheet for next year 15 Cash Basis: Cash Flow Statement Part 1 Cash flows from operating activities Receipts Taxes ... ... ... Social contributions ... ... ... Grants ... ... ... Other revenues... ... ... Total Receipts Continued... 16 Cash Basis: Cash Flow Statement Part 1 Cash flows from operating activities Payments Wages and allowances ... ... ... Goods and Services ... ... ... Interest payments Subsidies ... ... ... Grants… … … Social benefits ... ... ... Other expenditures ... ... ... Total Payments Net cash flows from operating activities 17 Cash Basis: Cash Flow Statement Part 2 Cash flows from investment activities Acquisition of fixed assets Buildings and structures ... Inventories Strategic stocks ... Valuables Non-productive assets Land ... Less proceeds from sale of assets Net cash flows from investment activities 18 Cash basis: Cash flow statement-Part 3 Cash flows from financing activities Proceeds from domestic borrowing ... Proceeds from foreign borrowing ... Less repayment of borrowing Net cash flows from financing activities Net increase / decrease in cash Opening cash balance Closing cash balance 19 Accrual Basis - the Analytic Framework Net operating balance = Revenue – expense Net lending/borrowing = Net operating balance –net acquisition of non-financial assets Net worth =Asset- liability Closing net worth = Opening net worth + Net operating balance + other economic flows 20 FLOWS GFSM 2001 ANALYTIC FRAMEWORK TRANSACTIONS Revenue minus OPENING BALANCE SHEET Expense = NET OPERATING BALANCE minus Nonfinancial Assets Nonfinancial Assets OTHER ECONOMIC FLOWS Holding Gains Other Changes in & Losses the Volume of Assets CLOSING BALANCE SHEET Nonfinancial Assets Nonfinancial Assets Nonfinancial Assets Financial Assets Financial Assets Financial Assets Liabilities Liabilities Liabilities = NET LENDING/ BORROWING Financial Assets Financial Assets • cash • other financial assets minus Liabilities Liabilities Net Worth Net Worth Changes in Net Worth 21 GFSM 2001 Statements Statement of Government Operations Statement of Sources and Uses of Cash Statement of Other Economic Flows Balance Sheet 22 GFSM 2001 Analytical Balances Statement of Government Operations shows the following measures of government performance: Net/gross operating balance Net lending/borrowing Statement of Sources and Uses of Cash shows the following measures of government performance: Cash flows from operating activities Cash surplus/deficit Cash flows from financing activities other than cash Net change in the stock of cash Statement of Other Economic Flows shows: Total change in net worth due to holding gains/ losses and other changes in volume of assets Balance Sheet shows: Net worth 23 24