02-Acural-cash - Welcome to Prospect Learning

advertisement

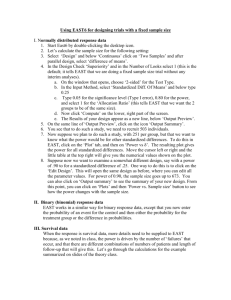

Use of Accrual vs Cash Systems of Accounting Ted Mitchell Accountants • Seek to match costs and revenues over time • You buy a pastry machine for $7,200 and it is expected to make pastry for 2 years • A cash system of reporting would write off the $7,200 as an expense in the first week • Huge losses being reported in the first week and inflated returns for next 23 weeks • An accrual system divides the $7,200 cost of the machine into 24 charges of $300 each and reports the expense as $300 cost a week to provide a more realistic view of the amount being earned each week Start up Costs for 1 Month Fixed expense Rent for Month $2,000 Utilities $500 per month You will have inescapable fixed overhead costs of $2,500 every month Or $625 in cash each week Start up Costs for 1st Month Fixed Monthly Cost Minimum Sunk or Start up Maximum Sunk or Start up Buy a Coffee Maker $3,000 $6,000 Buy Furniture $2,000 $4,000 Total $5,000 $10,000 Rent for Month $2,000 Utilities $500 per month You will sink between $5,000 and $10,000 into the business in the first month Start up Costs for 1st Month Fixed Cost Minimum Cost in Month 1 Maximum Cost in Month 1 $2,000 $2,000 $2,000 Utilities $500 per month $500 $500 Coffee Maker $3,000 $6,000 Furniture $2,000 $4,000 Total $7,500 $12,500 Rent for Month You will spend between $7,500 and $12,500 in cash into the business in the first month Starting Biz-Cafe • You get $25,000 • You will spend $7,500 to $12,500 for equipment and rent to run for 1 month and quit the business • Leaves $17,500 to $12,500 to hire employees, buy coffee and cups, do advertising, etc. • Given the start up costs can you make a profit in one month? • Your Accountant is Using an Accrual system! Accrual System • Can spread the reported cost of the coffee machine and the furniture out over a five year time frame • But there is still the cash outflow when the things are bought Cost for per month with hopes to run for 60 months (5 years) Fixed Sunk in month 1 Allocated Sunk in Allocated by 5 year month 1 by 5 year Depreciat Deprecia t Rent for Month $2,000 $2,000 $2,000 $2,000 $2,000 Utilities $500 $500 $500 $500 $500 Coffee Maker $3,000 $50 $6,000 $100 Furniture $2,000 $33.33 $4,000 $66.67 Total $15,000 $2,583 $20,000 $2,667 Using Depreciation to match costs to revenues over time The monthly cost is reported between $2,583 and $2,667 a month Cash Flow is NOT • The same as the Amount as the Profit Flow over any given reporting period • Daily, weekly, monthly, annual Difference between Cash and Accrual Reporting • Cash Reporting is simpler but makes the profit picture for the first week, month, year, etc. look terrible • Depreciation makes the profit picture in the first month look considerably better • But the actual hit on the cash reserves is still real Depreciation is not a fund of money for replacement. • Accrual accounting is a procedure for matching costs and revenues over time! Cash Flow Report in the Game • Is the Checkbook: • Is usually out of sync with the monthly revenue and the profit flow • Accrual system to try to match costs and revenues so that shareholders have a better understanding about the return on their investment The Profit Flows in the game • are reported in • 1) The Monthly Income Statement • 2) The Monthly Balance Sheet Starting Biz-Cafe • You get $25,000 • Depreciation gives us the false sense of cash profits by trying to match costs and revenues over 60 months • But the game goes for a maximum of 16 weeks • Your inescapable costs are reported to be between $2,583 and $2,667 per month! • But Decisions are weekly! You as Marketing managers will find • The classic monthly accural-based Accounting Reports – Balance sheet (important for retained earnings) – Income statement • To be inadequate for making profitable marketing decisions • You will be wanting a weekly marketing performance report that Two very useable weekly reports • The Dashboard Report • And • The Weekly Sales Receipts Report You will want to build a weekly marketing manager’s report • On a spreadsheet • constructed for the reporting of a weekly marketing performance It will include: • Price, Demand, Revenues, Cost of Goods Sold, Gross Profit, Direct Marketing Expenses for the Week and Marketing Profit! Any Questions • 1) What is an accrual system of reporting • 2) Why is it used rather than a cash flow for reporting profit • 3) What is the cash flow report in the game? • 4) What are the accrual reports on profits • 5) Why a weekly marketing report is needed?