CF Breakfast Group Presentation May 2013

Control Framework

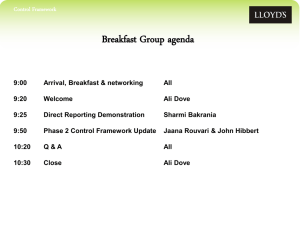

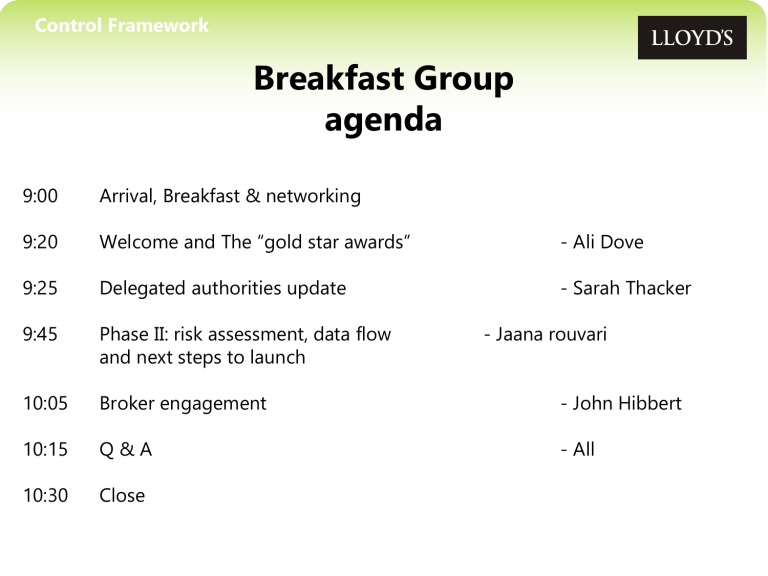

Breakfast Group agenda

9:00 Arrival, Breakfast & networking

9:20 Welcome and The “gold star awards”

9:25

9:45

Delegated authorities update

Phase II: risk assessment, data flow and next steps to launch

10:05 Broker engagement

10:15 Q & A

10:30 Close

- Ali Dove

- Sarah Thacker

- Jaana rouvari

- John Hibbert

- All

Control Framework

Lloyd’s market gold star awards…

ALTERRA

BRIT

MONTPELIER

NEWLINE

SPORTSCOVER

TRAVELERS

ASCOT

MARKEL

LIBERTY

< Picture to go here >

Should Lloyd’s Mandate the CH reporting standards?

Sarah Thacker, Lloyd’s Delegated Authorities

21 May 2013

© Lloyd’s

The consultation

► Representatives from DUC, BACG, BOLT,

DUM, Lloyd’s country managers and

Xchanging were consulted

► Stakeholders were told that there had been a request to mandate the reporting standards in a response to the proposed roll-out of the control framework to coverholders

► Stakeholders were asked if they thought the reporting standards should be mandated on coverholders because of the control framework

► They were also asked for general comments around mandating the reporting standards on coverholders

© Lloyd’s 4

Issues with mandating,

London

► Changes only typically take place annually at renewal

► Underwriters are largely not aware of the standards, their usefulness and importance

► Many London stakeholders still do not have systems to put this data into

5 © Lloyd’s

Issues with mandating, coverholders

► Domestic carriers typically collect this sort of data as a bi-product of processes, this is asking for something extra

► Customised versions of off-the-shelf systems mean charges for implementing standards

► Over time, as coverholders change systems so these issues are likely to be reduced

► Retail agents at the start of the chain need to collect the data

► Coverholders want to be asked for the same thing by all syndicates; but this is not what was proposed

6 © Lloyd’s

The reporting standards and the DATA control framework

1. Information Requirements

The reporting standards ≠ the data items in the control framework

Control framework is what to capture and the controls, reporting standards is what to send into London

The red fields in the standards are not all in the control framework

The control framework includes Lloyd’s data which a coverholder would not know

The control framework includes data which London already knows

Examples – risk codes, year of account

Examples – Currency if always $; state if always Florida, Contract Type

7 © Lloyd’s

The reporting standards and the DATA control framework

2. Risk model

Risk 1 – requirements are not understood

Risk 2 – data capture is inadequate

Will mandating help?

The reporting standards ≠ control framework so may confuse

Risk 5 – data is lost and cannot be recovered

Would help to explain, but see above may confuse and would not give the full picture

Risk 3 – data is processed incorrectly No

Risk 4 – data is corrupt No

No

8 © Lloyd’s

The reporting standards and the control framework

Control Framework continued

Summary Will mandating help?

3. Apply risk model

4. Identify and document key controls

Each data item to be risk assessed and prioritised

Identify and document the controls mitigating the risks

No

Might be an example of a control…

5. Gather evidence Gather evidence of controls No

6. Provide assurance This is about assuring

Lloyd’s that controls are in place

No

9 © Lloyd’s

Lloyd’s should not mandate the coverholder reporting standards at this time

► Limited understanding of standards amongst London stakeholders, and insufficient current take-up for this to be accepted in London

► Costs for coverholders seen as prohibitive

► Information to be mandated is unclear

– reporting standards ≠ data control framework

► Will not deliver the requirements of the

Data Control Framework

<

Picture to go here

>

10 © Lloyd’s

What next?

► The proposal to mandate the reporting standards on coverholders has been rejected.

► But

► There are still other activities separate to the Control Framework project which can be pursued.

<

Picture to go here

>

11 © Lloyd’s

Audit Scope review

► Market project with reps from DUC,

DUM, BACG, BOLT and Lloyd’s:-

Charles Rowley, Steve Hart, Patricia

Beaton, Dan Lott, Ian Whitehead and

Sarah Thacker

► Scope is currently being reviewed

► Plan for draft in summer and final version in autumn

► This will be followed by training/education for auditors

<

Picture to go here

>

12 © Lloyd’s

Audit Scope Review

Initial recommendation for questions RE control

Framework

► How do you determine where the risk is located for entry onto your system?

► How would you risk locate for a policyholder in your country insuring a property in another country?

► How would you determine the location of risk for a policy holder outside your country but insuring property in your country?

► How do you determine what is the tax liability for the insured or insurer?

► Does this entry drive the bordereaux or is this entered manually onto a spreadsheet?

► Are you aware and use Crystal/Risk locator

Tool?

► Note, these are draft only……

<

Picture to go here

>

13 © Lloyd’s

Data and technology

► BAU work with market promoting and educating on data and reporting standards

► Reporting standards are mandatory for new coverholders

► Brokers to be encouraged to provide all data to leads and followers via IMR or similar in a spread-sheet or other useable format

► Conversations with Xchanging around how they can help

► Working with market stakeholders to promote use of technology, automation and XML

14 © Lloyd’s

Education

► Application process could be amended, for example, coverholders could be asked to complete Crystal Assist

► Coverholder Toolkit includes information about data and reporting which can be enhanced when next updated

► Information can be put in Delegated

Authorities Area on Lloyd’s web pages

► Promote use of Crystal and Risk Locator Tool at coverholder events

15 © Lloyd’s

Control Framework phase ii Update

Coverholder risk assessment

Data flow and controls

Next steps to launch

Future meetings

Control Framework

Coverholder risk assessment

Complexity of business written

Binding Authority -

Single or multiple territories

Principal Regional

Complexity

Nature of operations

Coverholder

Resources and information provided

Use of Lloyd’s

Tools

Lines of Business Premium written

Historic Issues

Use of Lloyd’s coverholder reporting standards

Control Framework

Dataflow and controls

Coverholder Premium

TPA Claims

Broker

Lloyd’s

Coverholder reporting standards

Purpose:

To ensure required information is provided for premium and claims processing purposes

Managing agent

Lloyd’s

Control

Framework

‘Green Book’

Purpose:

To ensure tax and regulatory information at source meets the minimum requirements and is of good quality

A/S

ECF

XIS

XCS

Premium

Claims

Lloyd’s

Control Framework

Information

Data is captured/ manipulated/ held

Control Framework

Next steps to launch of phase ii

Lessons learnt

Tool kit & market group consultation

Phase II communications approach

Delegated

Authorities engaged

Control Framework

Next steps to launch of phase ii

Finalise Lloyd’s tool kit:

Phase II road map

Coverholder risk assessment guidance notes

Data items spreadsheet adapted for phase II

Broker/ coverholder leaflet

Control Framework Standard presentation for phase II

‘Board’ sign-off wording

Phase II FAQs

Guidance on what good looks like

Look for these @ lloyds.com/controlframework in July

Control Framework

Next step to launch of phase ii

Your contacts for phase II

Scheduled meetings for phase II

Initial 1-2-1 meetings within the first 3 months

Follow up meetings on request

Regular status reports from managing agents

The LAUNCH event

Control Framework

Future meetings

From July..

Project update

Delegated Authorities update

Broker engagement update

Managing agent/ broker/ other presentation

Control Framework

Update on broker engagement

John Hibbert

Control Framework

Progress so far

LIIBA endorsement of project framework

Individual broker meetings undertaken

• Millers

• Towers Watson

• Willis

• Cooper Gay

• Crispin Speers

• Integro

• Decus

• THB

• Bell and Clements

Control Framework

Next steps

Establish broker working group

• LIIBA and BIBA members

Present to BOLT meeting 2 nd July

Communicate to the wider broking community through Phase II Launch in

July

Individual Managing Agent/broker meetings