International Markets Lloyd`s Overview

advertisement

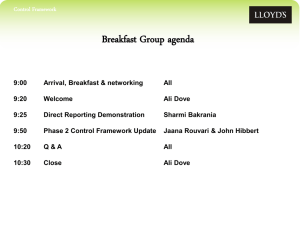

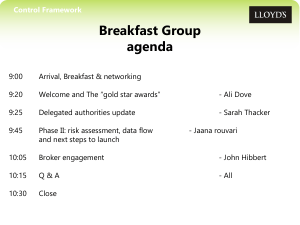

< Picture to go here > Lloyd’s: An Overview of the Market Keith Stern: UK Regional Manager October 2014 © Lloyd’s 1 Agenda • History • Market Structure • Financial Strength • Financial Results • Global Reach • Uk insurance market & Lloyd’s • Accessing the market • Coverholders • Events • questions 2 © Lloyd’s History < Picture to go here > © Lloyd’s 2012 From Coffee House… First known reference to Edward Lloyd’s coffee house in Tower Street (London Gazette 18-21 February 1688) © Lloyd’s 2012 …To every type of Insurance 1877 1906 1911 1969 © Lloyd’s 2012 PIPER ALPHA 1988 EXXON VALDEZ 1989 HURRICANES 1989 ASBESTOS 1980s- 1990s © Lloyd’s …and an appetite for unusual risks requiring innovative solutions © Lloyd’s 2012 The Lloyd’s market is known for its specialist expertise… 8 8 © Lloyd’s 2012 Market Structure < Picture to go here > © Lloyd’s 2012 Lloyd’s Key Characteristics ► Lloyd’s is a market, not a company ► The Lloyd’s market insures complex and specialist risks and SME business ► London based international business (UK is our second largest market = £3.5bn) ► Regulated by the Prudential Regulatory Authority (PRA) and the Financial Conduct Authority (FCA) ► Products are distributed via Lloyd’s brokers, coverholders and syndicate service companies. © Lloyd’s 2012 Lloyd’s market structure Corporation of Lloyd’s Management Coverholders Policyholders Direct 200 Lloyd’s Brokers 56 Managing Agents 91 Members Corporate Syndicates Reinsurance Service Companies BUSINESS FLOW (£26,106m) Individual Underwriting CAPITAL PROVISION (£60,782m) www.lloyds.com/directories © Lloyd’s A DYNAMIC AND DIVERSE MARKETPLACE At December 31st 2013, the Lloyd’s marketplace was home to 56 “live” managing agents that manage 91 syndicates < Picture to go here > © Lloyd’s 2012 Financial Strength < Picture to go here > © Lloyd’s 2012 Lloyd’s Ratings INDEPENDENTLY ASSESSED < Picture to In the eyes of leading ratings agencies,go here Lloyd’s is viewed as enjoying robust > capital reserves: Standard and Poor’s: ‘A+’ (strong) Fitch Ratings: ‘AA-’ (very strong) A.M. Best: ‘A’ (excellent) ` Lloyd’s Annual Report 2013 © Lloyd’s 2012 OUR CHAIN OF SECURITY • LINK ONE: SYNDICATE ASSETS (£42,342m) • Before writing business, a syndicate must put up funds to cover their own share of claims • These funds are the first port of call when paying policyholder claims Figures correct as at December 2013 OUR CHAIN OF SECURITY • LINK TWO: MEMBERS’ FUNDS AT LLOYD’S (£15,242m) • Every member (corporate or individual) must provide sufficient capital to support their underwriting • These funds are held in trust for the benefit of policyholders and used only if the syndicate assets have been exhausted Figures correct as at December 2013 OUR CHAIN OF SECURITY • LINK THREE: LLOYD’S CENTRAL FUND (£3,198m) • The Central Fund includes members’ annual contributions and funds issued by the Corporation of Lloyd’s • If a syndicate has failed to meet its liabilities and the two previous links proved insufficient, the Central Fund can provide a final reserve to cover those outstanding liabilities Figures correct as at December 2013 Financial Results < Picture to go here > © Lloyd’s 2012 Strong U/W Results Gross written premiums (mns) Combined ratio Investment return Result before tax (mns) Return on capital 2009 2010 2011 2012 2013 35,376 35,469 36,389 40,545 $43,698 £21,973 £22,592 £23,477 £25,000 £26,106 86.1% 93.3% 106.8% 91.1% 86.8% 2,848 1,975 1,528 2,084 $1,406 £1,769 £1,258 £955 £1,311 £839 6,227 3,446 (800) 4,517 $5,734 £3,868 £2,195 (£516) £2,771 £3,205 23.9 12.1 (2.8) 14.8 16.2 (pre-tax) % Source: Lloyd’s Annual Report 2013. All figures as at 31 December 2013 © Lloyd’s 2012 < Picture to go here > 2013 major claims Significantly below long term average < Picture to go here > Source: Lloyd’s 2013 Annual Results (March 2014) Claims in foreign currency translated at the exchange rate prevailing at the date of loss © Lloyd’s 2012 Lloyd’s outperforms peers < Picture to go here > Combined ratio Source: Lloyd’s pro forma financial statements, Dec 2013 Peer group formed of 11 companies operating in the US, European and Bermudan markets 21 © Lloyd’s Global Reach < Picture to go here > © Lloyd’s 2012 2013 Lloyd’s Premiums by region Europe (including UK [18%]) 33% US (including Canada) 13% 2012 43% Central Asia & Asia Pacific 12% Rest of the World US & Canada 41% 2012 44% 2011 43% 2010 45% 2009 Other Americas 8% 4% Other Americas 8% 2012 8% 2011 7% 2010 6% 2009 Europe + UK 15% + 18% = 33% 2012 16% + 18% = 34% 2011 16% + 20% = 36% 2010 16% + 20% = 36% 2009 Sources: Lloyd’s Annual Reports (2008 – 2013): http://www.lloyds.com/Lloyds/Investor-Relations © Lloyd’s 12% 2011 10% 2010 9 % 2009 2014 Lloyd’s Office Network Europe North America Europe 3 2 1 4 1 Type 1 1 3 3 1 1 3 Market Development Scope 3 3 3 1 3 3 3 2 2 2 Territories Local underwriting with co-located syndicates (or via a Lloyd’s regulated entity); Country Manager with Market Development Role China Japan Singapore 3 Country Manager with Market Development Role Benelux, France, Germany, Ireland, Italy, Poland, Spain, Sweden, Switzerland UK Australia, Hong Kong (SAR) Brazil Canada, US Northeast, US Southeast, US Central & US West South Africa, 2 Legal Representative for regulatory requirements Cyprus, Greece, Israel, Malta, 1 Legal Representative for minimum regulatory requirements 4 1 1 3 4 3 3 1 4 www.lloyds.com/AMERICA New Zealand, India Austria, Denmark, Norway, Portugal, Lithuania Argentina, Belize, Chile Namibia, Zimbabwe, US Virgin Islands © Lloyd’s 2 2 Uk insurance market & Lloyd’s < Picture to go here > © Lloyd’s 2012 Uk insurance market Chart: Insurance Market Leaders (2012) (based on ABI Statistics; UK domestic business only, excluding Lloyd’s; in billion GBP) 0.0 2.0 4.0 6.0 4.9 3.4 3.4 3.2 3.1 2.5 2.0 1.7 1.7 1.7 1.4 Almost 75% of the market is dominated by these 11 players © Lloyd’s 2012 Lloyd’s UK Premium income Lloyd’s Premium Income 2008-2013 by Class of Business 4,000 Accident & Health 3,500 Aviation 3,000 Casualty 2,500 Casualty Treaty Energy 2,000 Marine 1,500 Overseas Motor 1,000 Property (D&F) 500 Property Treaty 0 2008 Split % Direct: RI 59:41 2009 55:45 2010 54:46 2011 2012 2013 53:47 51:49 55:45 UK Motor © Lloyd’s Swot analysis STRENGTHS Brand - results of brand survey are encouraging. Distribution model - network of coverholders and service companies. Ratings and Reserves Accreditation of new Lloyd’s brokers and coverholders WEAKNESSES Accessibility for regional brokers and MGAs Competition from the companies market. Perception issues on claims and contract certainty. Absence of Lloyd's regional offices. Lloyd’s in UK OPPORTUNITIES Becoming more active regionally. Some disaffection between regional brokers and MGAs and the companies market. Building new relationships - broker networks/cluster groups (£6.5bn premiums in their control) Extended programme of events/activities. 99% of UK businesses are SME THREATS (Challenges) Volatility of the UK economic recovery. Continuation of prolonged soft market conditions. New regulatory regime in UK (FCA & PRA) Need to stay ahead of the game re: online trading. Growth of aggregators and comparison sites in SME sector. © Lloyd’s Accessing the market < Picture to go here > © Lloyd’s 2012 Access to Lloyd’s for EU Brokers This roadmap is for local Brokers who are seeking access to the Lloyd’s Market for a local client Placement Via Local Service Company Via Local Coverholder Local Broker / MGA with binding authority, Underwriting Agency Via Eu Service Company (crossborder) Via Eu Coverholder (crossborder) local Broker / Agent with binding authority, Underwriting Agency Via Lloyd’s Broker Become a coverholder In countries with established licence – approval via Delegated Authority Approval Process (contact Managing Agent and Lloyd’s Broker) Become a managing agent approved broker Become a non Lloyd’s Registered Broker - approval via individual Managing Agent registration process (direct contact) Become a Lloyd’s registered broker - approval via Lloyd’s Broker Approval Process Lloyd’s Managing Agent Lloyd’s Managing Agent – direct or via a Lloyd’s Broker Lloyd’s Managing Agent Lloyd’s Managing Agent – direct or via a Lloyd’s Broker Lloyd’s Managing Agent Lloyd’s Managing Agent – via a Lloyd’s Broker or direct Lloyd’s Managing Agent Lloyd’s Managing Agent Risk Carrier How to access this channel Contact local Country Manager >www.lloyds.com/offices Syndicate(s) Access Service Company details in the Coverholder Directory > www.lloyds.com/directories/coverholders Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access the Coverholder Directory > www.lloyds.com/directories/coverholders Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access Service Company details in the Coverholder Directory > www.lloyds.com/directories/coverholders Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access the Coverholder Directory > www.lloyds.com/directories/coverholders Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access Directory of Lloyd’s Registered Brokers www.lloyds.com/directories/brokers Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access information for prospective Coverholders > www.lloyds.com/coverholders Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access information on Managing Agents – non Lloyd’s Brokers > www.lloyds.com/nonlloydsbrokers Contact local Country Manager > www.lloyds.com/offices Syndicate(s) Access information on becoming a Lloyd’s Registered Broker © Lloyd’s > www.lloyds.com/brokerregistration coverholders < Picture to go here > © Lloyd’s Improvements to the coverholder model Prior to July 2010 ► No applicant coverholder had been visited by a Lloyd’s representative ► No Lloyd’s networking opportunities for coverholders ► Restricted access to the Lloyd’s brand ► Lack of best practice guidelines ► UK Population: 700 coverholders Today ► Visited all applicants (ex-City of London) since 2010 - 95% have been approved ► Held coverholder conferences ► A number of enhancements have already been made - faster turnaround times, branch approvals, broker sponsored approvals, and more informative welcome packs ► Greater access to the brand, a coverholder toolkit and enhanced guidelines online. ► Monitoring how we compare to the companies market (‘gap’ analysis) and enhancements to the rules on sub-delegation/internet trading ► UK Population: 1600 coverholders (‘grand-fathered’ 600 restricted coverholders this year) © Lloyd’s Coverholders (& Service Companies): Regional Distribution www.lloyds.com/directories Number of Service Companies August 2014: Total 90 Number of Coverholders August 2014: Total 1649 South East: London: East: South West: West Midlands East Midlands North West Yorkshire Wales Scotland North East Jersey Guernsey Isle of Man Northern Ireland Isle of Wight Coverholders 363 295 241 138 137 124 119 75 59 34 28 7 6 4 15 4 Service Co South East: London: East: South West: 7 42 10 0 West Midlands 8 East Midlands North West Yorkshire Wales Scotland North East Jersey Guernsey Isle of Man Northern Ireland Isle of Wight 1 8 5 0 5 1 0 2 0 1 0 © Lloyd’s Source: Market Intelligence based on: Lloyd’s Delegated Authorities Events where can you meet lloyd’s underwriters < Picture to go here > & brokers? © Lloyd’s 2015 events schedule ► Compass Broker Services (Whittlebury Hall) – 25th/26th February 2015 – 4 underwriters ► BIBA (Manchester) – 13th/14th May – 10 underwriters ► AIRMIC (Liverpool) – 15th/16th/17th June – 22 underwriters and brokers ► Broker Expo West (Bristol) – 24th Sept 2015 – 4 underwriters ► Lloyd’s Meet the Market (Birmingham) – October – 100 market practitioners ► Broker Expo North (Coventry) – 12th November – 5 underwriters ► BIBA Scotland – November – 4 underwriters ► Contact me at keith.stern@lloyds.com © Lloyd’s Questions? © Lloyd’s © Lloyd’s