CF Breakfast Group Presentation April 2013

advertisement

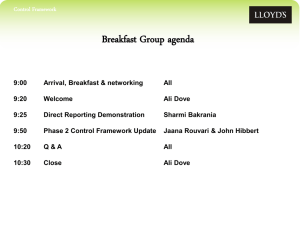

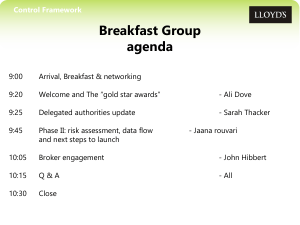

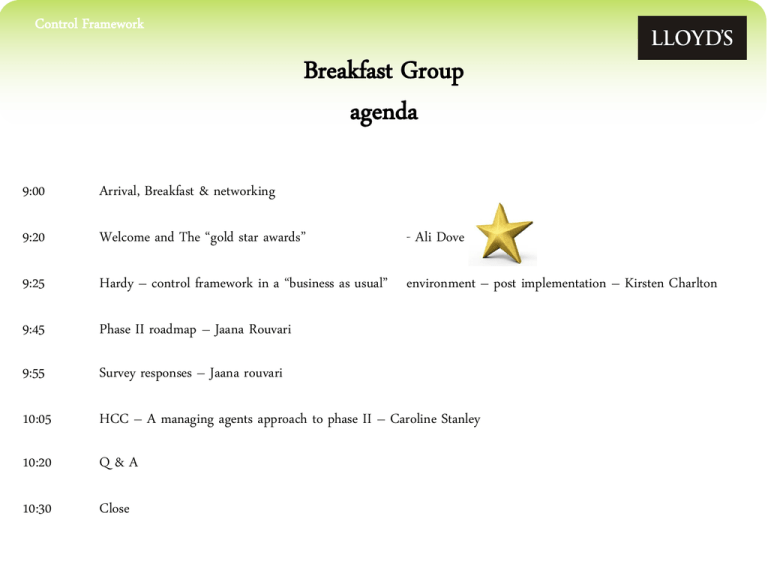

Control Framework Breakfast Group agenda 9:00 Arrival, Breakfast & networking 9:20 Welcome and The “gold star awards” 9:25 Hardy – control framework in a “business as usual” environment – post implementation – Kirsten Charlton 9:45 Phase II roadmap – Jaana Rouvari 9:55 Survey responses – Jaana rouvari 10:05 HCC – A managing agents approach to phase II – Caroline Stanley 10:20 Q&A 10:30 Close - Ali Dove Control Framework Lloyd’s market gold star awards… ALTERRA ASCOT LIBERTY MARKEL SERVICE COMPANY CONTROL FRAMEWORK Kirsten Charlton, April 2013 3 The Challenge Goal: Implement and provide evidence for Service Company Control Framework compliance for Board sign-off by 30 Jun 2013 Guiding Principles • Simple • Repeatable • Embed into business as usual operations Challenges • Limited resources and other critical projects on going • Backlog of premium and claim transactions • No single view of the Service Company world 4 How We Tackled It Underwriting Finance Claims 1. Eliminate premium backlog 2. Redefine premium process 3. Jointly train Underwriting, Finance, and Delegated Underwriting 4. Eliminate claim backlog 5. Redefine claims process 6. Jointly train Claim, Finance, and Delegated Underwriting Delegated Underwriting Cross-functional Steering Group: Claims, Compliance, Delegated Underwriting, Finance, Internal Audit, International Operations, IT, Operations, Risk Management, 5 Aspirational Evidence Diagram 6 Evidence Diagram – Underwriting • Focus on Risk Entry • Developed risk entry indicators on scorecard • Review of scorecard built into process • Connections with Compliance, Risk Management, and Internal Audit 7 Evidence Diagram – Claims • Very similar to Underwriting controls, but in development • Focus on process • Developing claims quality indicators • Same connections with Compliance, Risk Management, and Internal Audit 8 Evidence Diagram – Finance • Focus on separation of duties and enhanced reports • Better understanding of Underwriting and Claims processes • Connections with Compliance, Risk Management, and Internal Audit 9 Critical Success Factors • Hardy management recognised importance of this project and dedicated resource to it • Early decision to capture all data requirements into Subscribe – All data in one spot – Importance of getting the data right from the start at the source – Long-term view: pre-requisite for Direct Reporting • Risk entry refresher training – Small, defined, internal group of underwriters, underwriting assistants, and finance – New measurements of risk entry quality – Provided context for why the changes were being made – Made a case for benefits of the new process and details 10 LONDON 1st Floor Fitzwilliam House 10 St Mary Axe London, EC3A 8BF GUERNSEY BERMUDA SINGAPORE PO Box 155 Mill Court, La Charroterie St Peter Port Guernsey GY1 4ET T: +44 (0)1481 719 292 4th Floor, Park Place 55 Par-la-Ville Road Hamilton, HM11 Bermuda T: +1 441 295 0382 F: +1 441 295 7926 8 Marina View #15-01 Asia Square Tower 1 Singapore 018960 T: +65 6303 6700 F: +65 6535 8274 www.hardygroup.co.uk www.hardygroup.bm www.hardygroup.com.sg T: +44 (0)20 7626 0382 F: +44 (0)20 7283 4677 www.hardygroup.co.uk 11 V6 Oct 12 Control Framework Phase II Managing agent working Group April March Breakfast Group Feedback & Volunteers Challenge & provide alternative solution BIG changes DUM DUC Lloyd’s Control Framework Managing agent working group Managing agent Representative ACE Sue Burn Argenta Stuart Taylor Barbican Steven Green Brit Leena Ekman Alex Smith Catlin Charles Rowley Chaucer Chris Rees HCC Caroline Stanley Hiscox Steve Burns James Chaplin Kiln Charlotte Boardman Markel Martyn Lucas Talbot Richard Faulkner Andrew Howse XL Vicky Draper Control Framework Phase II Roadmap 2013 Q3 Q2 Pre-project consultation Develop Lloyd's project tool kit Phase II kick off Understand Phase II requirements and apply risk matrix to coverholder data Q4 Design and plan implementation Lloyd’s and managing agents joint broker engagement Carry out audits and review findings Control Framework Phase II Roadmap 2014 Q2 Q1 Assess risk, identify controls & gaps Q3 Develop / Implement controls Develop / Implement/ test controls Q4 Review and monitor Sign off Lloyd’s and managing agents joint broker engagement Carry out audits and review findings Control Framework Survey Feedback It was suggested that a conference be held by Lloyd’s and managing agents for brokers. Do you support this suggestion? • • 83% - Yes 17% - No • Lloyd’s are investigating feasibility of a Launch event in July. Control Framework Survey Feedback How can Lloyd’s assist with your broker engagement dialogue? • • • • • • Lloyd’s to drive all Phase 2 communication Centralised/standardised messages Provide materials to managing agents to reinforce message Ali Dove, Andrew Gurney and Mark Edwards to speak at a forum for brokers Representation at various market broker meetings Managing agents to liaise with the brokers, with guidance and steer from Lloyd’s Control Framework Survey Feedback What are the foreseeable issues from brokers relative to managing agents achieving sign-off for Phase 2? • • • • • Too many managing agents providing a different message to each broker Brokers avoiding doing business with managing agents who are out in front with regards to compliance – more work, additional costs As agents of coverholders, no incentive to engage with managing agents to achieve sign-off Lack of understanding of the requirements Smaller brokers will not maintain adequate data records Control Framework Survey Feedback Would you support Lloyds coordinating the audit activity? • 81% - Yes • 19% - No Comments: • • • • Yes: Avoid duplication of effort and cost No: Managing agents should retain control over selection of auditors and timing of audits Should be on an optional basis Delegated Authorities team at Lloyd’s running a pilot with 6 managing agents Control Framework Survey Feedback What are the obstacles for delivering Phase 2? • • • • • • Distortion of “the message” from individual managing agents. Broker engagement. The key is to identify several key people from each broking firm. Resistance to change from coverholders without a clear Lloyd’s mandate. Managing the audit process – responsibilities of lead vs. follow. Coverholders having inadequate systems. Time. Control Framework Survey Feedback Suggested future topics: • • • • • • Managing agent presentations on both process for Phase 1 and approaches to Phase 2 How to create the right message for Phase 2 How to manage/control the audit process Re-development of ATLAS – what can we expect? General view on market progress/readiness Overview of Crystal Control Framework A managing agents approach to phase II Caroline Stanley Control Framework HCC - A managing agent’s approach to Phase II • Clarification on the number of Coverholders • Confirmation of data elements • Collaborative approach with other Managing Agents who have same Coverholders • Communication strategy • Internally • Externally with brokers and coverholders – Mixed messages – Duplication – Loss of reputation – Loss of business Control Framework HCC - A managing agent’s approach to Phase II • Gap analysis – How can we avoid duplication work within Managing Agents – Where should the information be stored to enable Managing Agents to access • Risk Assessment Approach – Is it a one size fits all approach or do we split them into the ‘Good, The Bad and the Ugly’ – Can scope of existing audits be expanded to provide the additional information required? • What are the consequences if the 2014 deadline is not met? Control Framework Q & A session & Close