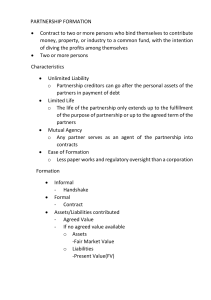

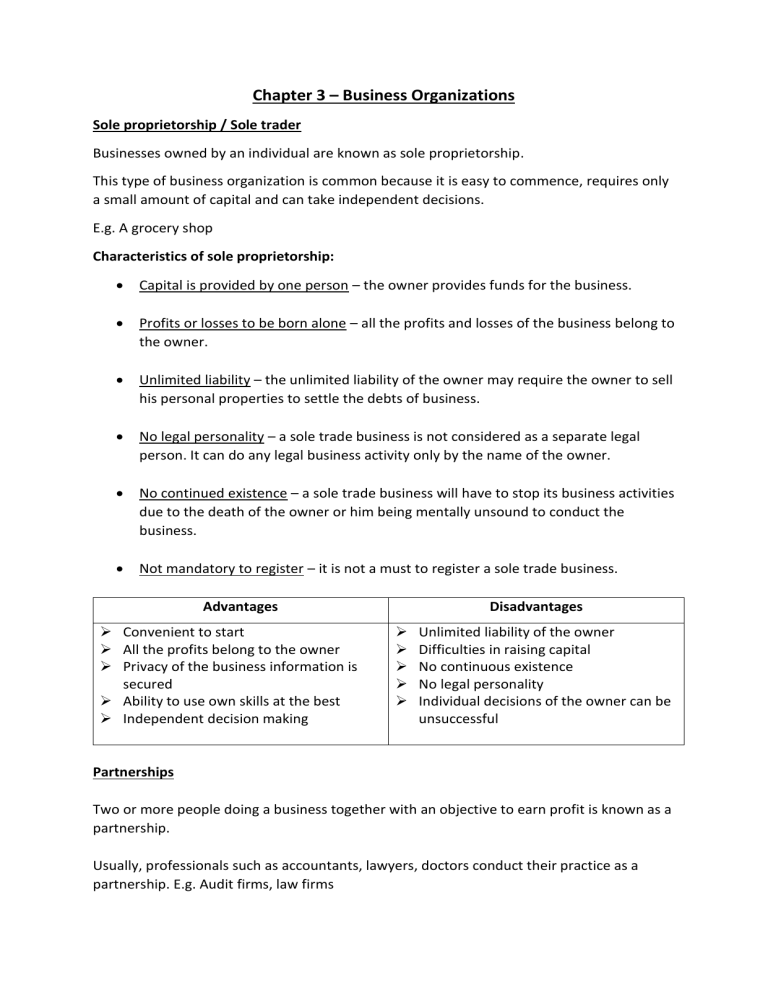

Chapter 3 – Business Organizations Sole proprietorship / Sole trader Businesses owned by an individual are known as sole proprietorship. This type of business organization is common because it is easy to commence, requires only a small amount of capital and can take independent decisions. E.g. A grocery shop Characteristics of sole proprietorship: Capital is provided by one person – the owner provides funds for the business. Profits or losses to be born alone – all the profits and losses of the business belong to the owner. Unlimited liability – the unlimited liability of the owner may require the owner to sell his personal properties to settle the debts of business. No legal personality – a sole trade business is not considered as a separate legal person. It can do any legal business activity only by the name of the owner. No continued existence – a sole trade business will have to stop its business activities due to the death of the owner or him being mentally unsound to conduct the business. Not mandatory to register – it is not a must to register a sole trade business. Advantages Convenient to start All the profits belong to the owner Privacy of the business information is secured Ability to use own skills at the best Independent decision making Disadvantages Unlimited liability of the owner Difficulties in raising capital No continuous existence No legal personality Individual decisions of the owner can be unsuccessful Partnerships Two or more people doing a business together with an objective to earn profit is known as a partnership. Usually, professionals such as accountants, lawyers, doctors conduct their practice as a partnership. E.g. Audit firms, law firms Characteristics of partnerships: Number of members in a partnership – there should be minimum 2 and maximum 20 members to start a partnership. Partnership agreement – this is the agreement among the partners which can be either written, oral or implied. If the initial capital of the partnership is greater than Rs. 1000, a partnership is required to be conducted under a written agreement. This written agreement is known as partnership deed. Unlimited liability of partners Not mandatory to register No separate legal identity No continued existence Advantages Convenient to commence Can raise more capital Can utilize different skills of partner Shared liability among partners Can take collective decisions Disadvantages Unlimited liability Profit shared among partners Conflicts among partners No continued existence No legal personality Incorporated companies A firm which is required to be registered under the Companies Act No. 07 of 2007, with a legal personality, can raise capital by issuing shares and the liability of the shareholders being limited, is an incorporated company. The owners of these companies are the shareholders. Characteristics of incorporated companies: Incorporation under the Companies Act – it is mandatory to register. Continued existence - the death of shareholders or shareholders being bankrupt shall not affect to the continued existence of its business activities. Ability to register with limited liability - The liability of shareholders are limited to the amount of capital they have invested in the company. Can raise capital by issuing shares – can issue shares to the public. Advantages Can raise more capital legal personality Continued existence Limited liability Managed by a Board of Directors Disadvantages More legal provisions Profits and ownership are shared