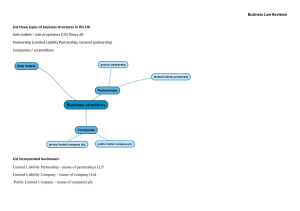

Unit 1 Business Ownership

advertisement

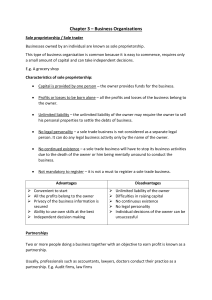

Business ownership Part 1 . 1 2a UK business ownership Most businesses in the UK are privately owned. This means: They are owned by private individuals These individuals risk their own money The owners’ reward is the profit they make. 1.2a Business ownership Part 1 Private ownership options Sole trader – 1 owner Partnership – 2 people or more Private limited companies – often a family-run business with the protection of limited liability Public limited companies – large organisations whose shares are traded on the Stock Exchange Franchises – small business trading with agreement of large firm Cooperatives – collectively owned by workers/customers 1.2a Business ownership Part 1 Key difference Sole traders and partnerships have unlimited liability. Owners are responsible for all debts and may have to sell personal possessions. Companies have limited liability. Owners can only lose their investment even if the company has huge debts. 1.2a Business ownership Part 1 Sole traders Benefits Drawbacks Easy to set up and give a personal service Unlimited liability Owner independent – can make quick decisions Capital may come from savings Minimum of paperwork Needs business skills Knows customers – helps to avoid bad debts Business ends on death Long hours, no cover for holidays/sickness 1.2a Business ownership Part 1 Partnerships Benefits Easier to raise capital Drawbacks Unlimited liability Profits are shared Death of a partner means share needs repaying Problems/ideas can be discussed Greater range of skills/expertise Cover for holidays/sickness May be disagreements Decisions/actions legally binding on all partners 1.2a Business ownership Part 1 Key points about companies Each company has its own identity in law. The company employs staff, not the owner(s). The company owns assets, not the owner(s). The company operates until it is formally wound up or goes into liquidation. The company pays corporation tax on its profits. 1.2a Business ownership Part 1 Private limited companies Benefits Limited liability Minimum of 1 director and 1 shareholder Drawbacks Cannot sell shares to the public Easy to set up/affairs still private More regulations to comply with Easier to raise capital/borrow from bank Accounting procedures may be more costly Death of shareholder has no effect on company Share transfers need agreement of all 1.2a Business ownership Part 1 Public limited companies Benefits Limited liability Increased capital as public can buy shares Minimum of 2 directors and 2 shareholders Shares increase in value if company successful Operating large scale can lower costs per unit Drawbacks Many regulations to comply with Accounts (and problems) are public knowledge Shareholders may sell shares if dividends poor Original owner may lose overall control 1.2a Business ownership Part 1 Review of main types of private ownership Sole traders – suitable for one person running small business with low risk/little investment required Partnership – suitable for professional groups, husband/wife businesses, small business needing different skills Private limited company – suitable for family business, essential if risk considerable, eg through expensive stock Public limited company – suitable for large national/international operations 1.2a Business ownership Part 1