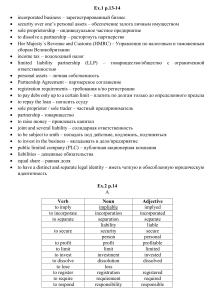

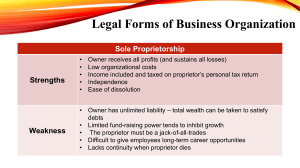

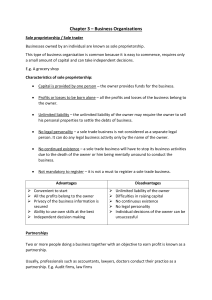

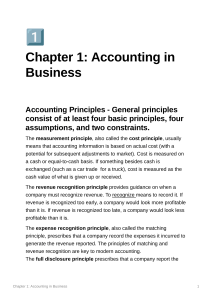

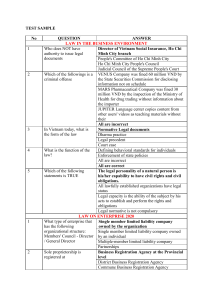

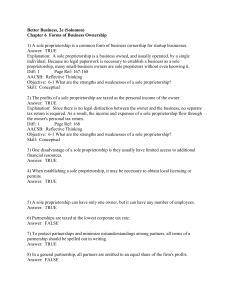

Chapter 1 Highlights What is finance? Finance is the study of the art and the science of money management; it is based on the latin root finis, meaning the end. (The finish line, for example.) In this class, we are concerned with Business Finance, or the art and the science of managing the money of the firm. The financial manager of the firm performs three primary duties: 1. She determines where to invest. (The capital budgeting decision - evaluating the size, timing and risk of a project’s cash flows) 2. She determines where to get the money to invest. (The capital structure - or mixture of debt and equity - decision) 3. She manages the day-to-day cash of the firm. (The working capital decision - balancing the cash accounts and insuring the currency of the firm’s day-to-day activities) We focus on the corporate form of business ownership, but recognize there are two simpler forms of ownership - the sole proprietorship and the partnership. The sole proprietorship is favored as the simplest business form, with advantages of control and easy formation, but disadvantages of termination at founder death or disability, founder direct liability, limited funds for expansion and no ease of ownership transfer. The partnership is also easily formed, but suffers from the same basic defects of the sole proprietorship, with the exception of limited liability (with similarly limited participation in profits) for the limited partners of the limited partnership. The corporation is best for protecting owners from liability, for ease of ownership transfer (i.e., stock sale), for a life not limited by owners and for greater access to funds. Perhaps its greatest disadvantages are double taxation of dividend income and costs of separation of the owners from management. (Agency costs below.) The primary goal of the financial manager of a firm with publicly traded shares is to maximize share price. (Simultaneously maximizing shareholder wealth and firm value) To assure that manager’s actually do pursue the best interests of the shareholders, since an “agency” issue exists between owners and management, shareholders can: 1. Tie compensation directly to share price, with stock options and such. 2. Fire managers who do not pursue/achieve shareholder objectives. 3. Take over a struggling firm and reduce the power/prestige/promotion of management. The financial manager is “graded” by the stock and financial markets. The markets exist first, in the primary markets, to provide initial capital to the firm, and later, in the secondary markets, to provide a vehicle for the purchase and sale of securities after original issue. It is in the framework of these markets and on behalf of these stockholders that we begin our study of Business Finance...(notice the capitalization....) Good Luck!!!