INTRODUCTION TO FINANCE

advertisement

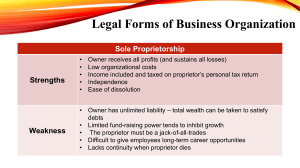

Finance is concerned with resource allocation as well as resource management, acquisition and investment. Simply, finance deals with matters related to money and the markets. Finance can be defined as the art and science of managing money. All the individuals and organization earn or raise money and spend or invest money Finance is concerned with the process, institutions, markets and instruments involved in the transfer of money among and between individuals, businesses and government Financing Decision Investment Decision Dividend Decision Financial Analysis and Planning The primary goal is shareholder wealth maximization, which translates to maximizing stock price. Other Goals include ◦ Profit Maximizing ◦ Preserving Stakeholders wealth The Primary responsibility of financial managers is the acquisition of funds (cash) needed by the firm and directing those funds into projects that will maximize the value of the firm to its owners. Raise funds from investors Invest funds in value-enhancing projects Manage funds generated by operations Return funds to investors - dividends Reinvest funds in new projects Financial Service Managerial Finance Shareholders are the Principals Managers are their Agents An agency conflict arises when the goals of these two parties are not congruent. An agency conflict is generally costly to the firm, I.e., it results in reduced value of the total firm There are ways of mitigating this conflict but it cannot totally eliminated or reduced to zero Shareholders can attempt to control managers in a variety of ways Market-value based compensation such as stock options and bonus plans Threat of firing Threat of takeover Consider the evolution of a firm from a Sole Proprietorship, I.e., a firm owned by a single owner The owner is the manager of the firm’s operation manager, marketing manager, finance manager, and everything else for the firm A sole proprietorship has little conflict, low taxation, but limited financing available, and unlimited liability The firm may eventually add more partners (Partnership)and start to borrow from banks to fuel its growth. At some stage the firm may choose to incorporate and go public, I.e. becomes a Corporation An intangible business entity created by law often called a legal entity Individuals or firms who buy shares of such a firm become equity participants and may be quite active Other individuals lending money on very specific terms such as bondholders may choose to be passive At the Corporation stage, new investment and challenges face a firm, financing is abundant, stockholders have limited liability, but accountability is high as well On or about this stage, the firm is likely to hire finance professionals Strength Sole Proprietorship Partnership Corporation Owners receive all the profits and losses Can raise more funds than sole proprietorship Owners have limited liability Which guarantees that they cannot lose more than they invested Low organizational costs Borrowing power enhanced by more owners Ownership is readily transferred Income taxed as personal income of proprietor Income taxed as personal income of partners Long life of firm Ease of dissolution More available brain power and managerial skills Can expand more easily due to access capital market Weaknesses Sole Proprietorship Partnership Corporation Owner has unlimited liability Owners have unlimited liability Taxes generally higher, since corporate income is taxed & dividends paid to owners are again taxed Limited fund raising power When partner dies, partnership is dissolved More expensive to organize than other business forms Difficult to give Difficult to achieve large employees long run career scale operations opportunities Subject to greater government regulation