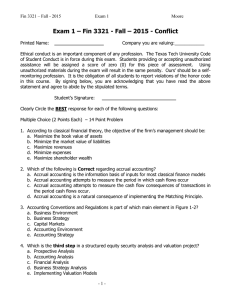

Exam 1 – Fin 3321 - Summer 1 - 2014

advertisement

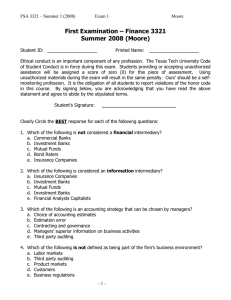

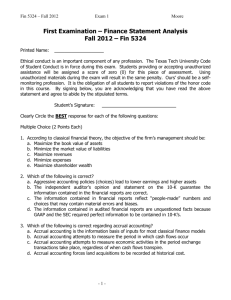

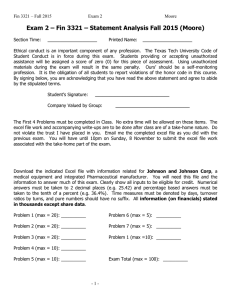

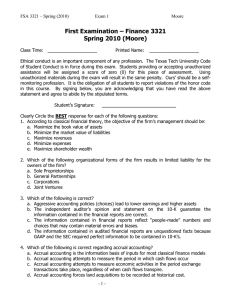

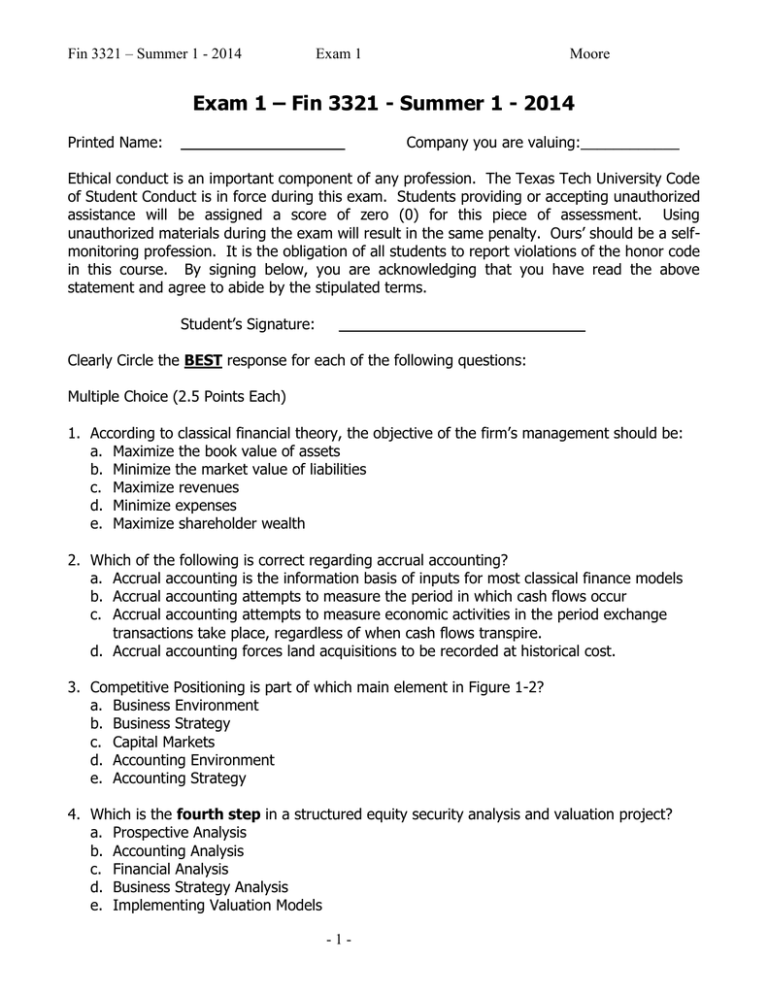

Fin 3321 – Summer 1 - 2014 Exam 1 Moore Exam 1 – Fin 3321 - Summer 1 - 2014 Printed Name: ____________________ Company you are valuing:____________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: Multiple Choice (2.5 Points Each) 1. According to classical financial theory, the objective of the firm’s management should be: a. Maximize the book value of assets b. Minimize the market value of liabilities c. Maximize revenues d. Minimize expenses e. Maximize shareholder wealth 2. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. 3. Competitive Positioning is part of which main element in Figure 1-2? a. Business Environment b. Business Strategy c. Capital Markets d. Accounting Environment e. Accounting Strategy 4. Which is the fourth step in a structured equity security analysis and valuation project? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models -1- Fin 3321 – Summer 1 - 2014 Exam 1 Moore 5. Identify the proper sequence in which following items would be presented on the income statement is: 1. Net Revenue 2. Gross Profit 3. Comprehensive Income 4. Net Income 5. Operating Income a. b. c. d. e. 6. An a. b. c. d. e. 1, 1, 1, 1, 1, 2, 5, 2, 5, 2, 3, 2, 5, 3, 3, 4, 4, 4, 2, 5, 5 3 3 4 4 industry having a high degree of price competition would be characterized by: Low Industry Concentration, Low Legal Barriers to Entry, High Product Differentiation Few Exit Barriers, Low First mover advantage, Low Product Differentiation High Industry Concentration, High Distribution Access, Low Firm Excess Capacity Low Concentration, High Fixed-Variable Cost Ratio, Few Legal Barriers to Entry Supply > Demand, High First Mover Advantage, High Fixed to Variable Cost Ratio 7. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First Mover Advantage, High Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, High Fixed-Variable Cost Ratio, Hi product differentiation e. Supply > Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 8. Which of the following models, theorems or hypotheses, if absolutely true in the real world, would make the activities of information production or financial analysis a socially and economically non-productive activities? a. Capital Asset Pricing Model b. Weak Form Efficient Market Hypothesis c. Strong Form Efficient Market Hypothesis d. Modigliani and Miller Theorem, without taxes e. Residual Income Valuation Model -2- Fin 3321 – Summer 1 - 2014 Exam 1 Moore Short Problem 1 (show all work and briefly comment) (20 Points) Assume PG is the fair insurance price for Good drivers and PB is the fair insurance price for Bad drivers, where PG = 200, PB = 400 and 30% of the drivers are Good drivers. If insurers do not have a mechanism to distinguish good and bad drivers, what price(s) will result in the mandatory insurance market (assume linear risk preferences and insurers cannot, on average, overcharge customers)? Identify which group of drivers dislike the resulting pricing scheme and comment as to why. Discuss how imperfect information (screening applications) could/would improve the outcome. -3- Fin 3321 – Summer 1 - 2014 Exam 1 Moore Short Problem 2 (show all work and briefly comment) (10 Points) You are the CEO of a just formed company that will last exactly 1 year and then be liquidated. The initial capitalization of the company consists of: Debt: Equity: $10,000 $ 4,000 You have the choice of only 2 investment alternatives with the initial capital. Each project will require the investment of the entire initial capital. Project 1 has a 60% chance of paying $9,000 and a 40% chance of paying $7,000. Project 2 has a 10% chance of paying $50,000 and a 90% chance of paying $3,000. Issuers of Debt and Equity are assumed risk neutral. Which project do bondholders want you, the CEO, to choose? Explain and provide supporting computations where appropriate. Which project do shareholders want you, the CEO, to choose? Explain and provide supporting computations where appropriate. -4- Fin 3321 – Summer 1 - 2014 Exam 1 Moore Short Essay Problem 1 (write concisely, with bullet points and sentences, but make your answer clear) (20 Points) Company: ___________________________________ This Essay is directly related to the company your group is analyzing. For each of the 5 forces (Porter’s Model), conclude whether that item (force) leads to price-taking, pricesetting or mixed behavior in the industry (e.g. Existing Competition = hi, low or mixed) and then provide 2 specific business activity examples for the industry that support this conclusion for each “force”. (e.g. low industry concentration). Also, identify the three relevant competitors your group is using for industry benchmarks: 1. ______________________________ 2. ______________________________ 3. ______________________________ -5- Fin 3321 – Summer 1 - 2014 Exam 1 Moore Short Essay Problem 2 (Use bullet points with complete sentences for clarity) (20 Points) This Essay is directly related to the company your group is analyzing (Goodyear or SkyWest). Identify 5 (five) specific value drivers for the industry you analyzed and explain, briefly, how these business activities create value and lead to creating or maintaining competitive advantages. -6- Fin 3321 – Summer 1 - 2014 Exam 1 Moore Short Essay Problem 3 (Use bullet points with complete sentences for clarity) (10 Points) This Essay is directly related to the differences between cash flow and accrual accounting information for the purpose of business valuation and business activity analysis. Your context is performing Porter’s 5-Forces Analysis and the Identification and Assessment of Value added activities as they relate to Key Success Factors (KSF’s). Compare and contrast the benefits and limitations of cash flow measurements (CFFO, CFFI, and CFFF) to accrual earnings and balance sheet measures (including supplemental disclosure) aiding or limiting your abilities as an equity analyst assigned with “Draft 1” responsibilities. Provide 5 (five) specific examples to support your argument. -7-