Exam 2 – Fin 3321 – Statement Analysis Fall 2014...

advertisement

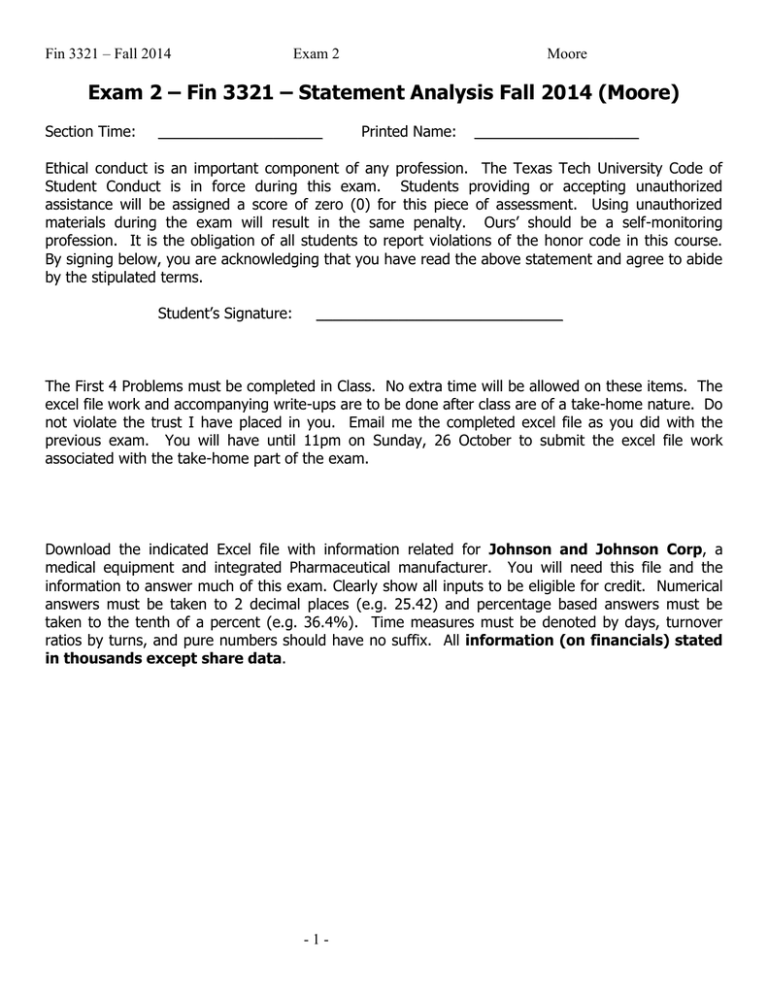

Fin 3321 – Fall 2014 Exam 2 Moore Exam 2 – Fin 3321 – Statement Analysis Fall 2014 (Moore) Section Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ The First 4 Problems must be completed in Class. No extra time will be allowed on these items. The excel file work and accompanying write-ups are to be done after class are of a take-home nature. Do not violate the trust I have placed in you. Email me the completed excel file as you did with the previous exam. You will have until 11pm on Sunday, 26 October to submit the excel file work associated with the take-home part of the exam. Download the indicated Excel file with information related for Johnson and Johnson Corp, a medical equipment and integrated Pharmaceutical manufacturer. You will need this file and the information to answer much of this exam. Clearly show all inputs to be eligible for credit. Numerical answers must be taken to 2 decimal places (e.g. 25.42) and percentage based answers must be taken to the tenth of a percent (e.g. 36.4%). Time measures must be denoted by days, turnover ratios by turns, and pure numbers should have no suffix. All information (on financials) stated in thousands except share data. -1- Fin 3321 – Fall 2014 Exam 2 Moore Problem 1 (10 Points) (multiple choice at 2.5 points each) 1. Within the context of forecasting, which of the following ratios best links the income statement to the balance sheet? a. Net profit margin b. Current Ratio c. Return on Equity d. Asset Turnover e. Day’s Sales outstanding 2. You have just computed the Beta of a stock to be 1.5 and the estimate the expected market return next period is 7.3333%. The estimated cost of equity is 16%. With an estimated long run market risk premium of 8.0%, what risk free rate supports this cost of equity? a. 2.00% b. 3.00% c. 4.00% d. 5.00% e. 6.00% 3. You are trying to value JNJ (financials on the spreadsheet). Today is October 24, 2014. In one week valuation forecasts will be made. Assume JNJ publishes its 10-K’s no earlier than 6 weeks after the fiscal year end and 10-Q’s no earlier than 2 weeks after the period end. How many quarters of activity must you forecast (in one week) when estimating the annual net income that will be reported on the next published 10-K? a. 0 b. 1 c. 2 d. 3 e. 4 f. 5 4. Which statistic is assess the whether the estimate of Beta significantly differs from zero in a statistical sense? a. Beta b. T-Statistic of the intercept c. T-Statistic of the independent variable d. Adjusted R-squared e. Correlation coefficient -2- Fin 3321 – Fall 2014 Exam 2 Moore Problem 2 (10 Points) (Regression Results and CAPM) Provided below is the regression output resulting from using monthly portfolio returns and the excess return on the S&P 500 (Rm – Rf) to estimate the Beta of the portolio. Use this information to answer the following question: SUMMARY OUTPUT Regression Statistics Multiple R 69.70% R Square 48.59% Adjusted R Square 47.70% Standard Error 0.07 Observations 60 ANOVA df Regression Residual Total Intercept X Variable 1 SS 1 58 59 Coefficients 0.02 1.46 0.2626 0.2779 0.5404 Standard Error 0.01 0.20 MS 0.2626 0.0048 F 54.8120 Significance F 6.1496E-10 t Stat 2.60 7.40 P-value 0.01 0.00 Lower 95% 0.01 1.06 Upper 95% 0.04 1.85 1. What is the estimated Beta of the portfolio? 2. Assume a Long-run Market Risk Premium and a risk-free rate of 2.5%. What estimated required rate of return for the portfolio is implied by CAPM? 3. How much of the portfolio’s return is explained by systematic risk? 4. How much of the return is explained by non-systematic risk? -3- Fin 3321 – Fall 2014 Exam 2 Moore Problem 3 (10 Points) (Short Essay) Company Valued:_________ Briefly comment on the Liquidity, Profitability, Operating Efficiency, and Capital Structure risk or performance for the firm your group has been tasked with valuing this semester. Be sure to discuss trends of the firm and the benchmark companies. Also, discuss any identified subindustry (benchmark) segmentation you have observed in the analysis. Liquidity: Operating Efficiency: Profitability and Returns: Capital Structure, Leverage and Debt Service Capacity: -4- Fin 3321 – Fall 2014 Exam 2 Moore Problem 4 (5 Points) (Short Essay) Company Valued:_________ Choose 1 of the 2 following topics: Briefly discuss either the cost of equity estimated for your firm that you will have estimated using regression analysis and assumptions regarding the market risk premium and the risk-free return. Does your firm have a Beta greater or less than the market Beta? How good a job does CAPM do in terms of explaining the volatility of your firm’s returns? How forecastable are the income statement components of the firm you are valuing? Comment on structure, trends and stability. Next, do the same regarding the Balance sheet and the Key elements of the statement of cash flows. -5-