Black and Scholes’s formula

advertisement

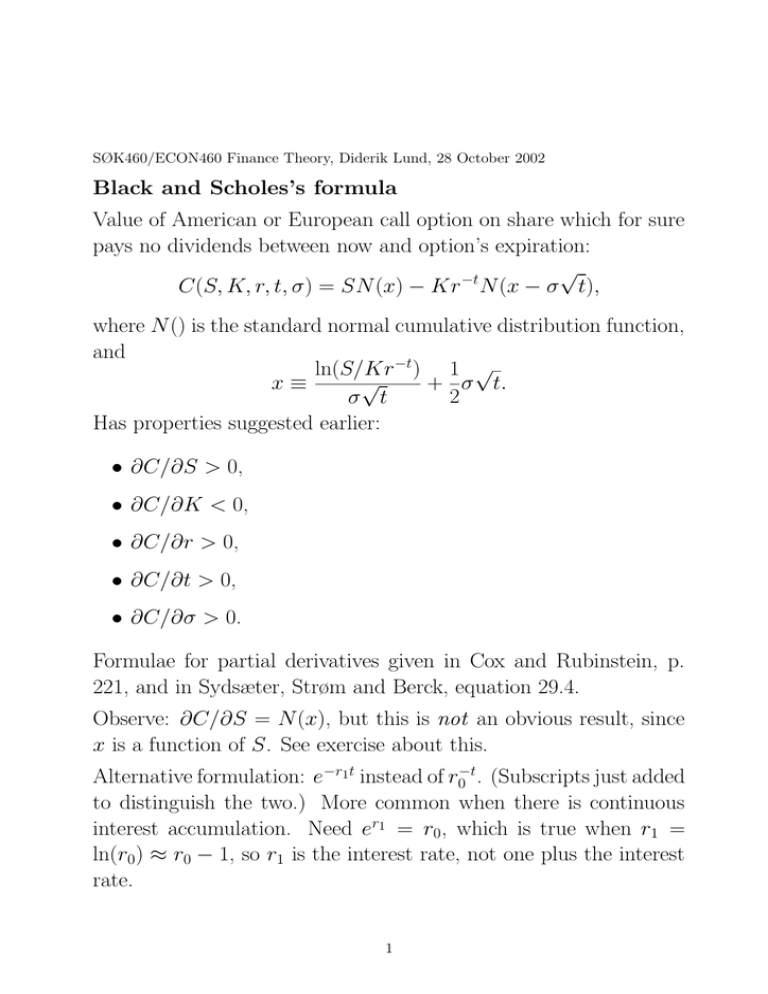

SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Black and Scholes’s formula Value of American or European call option on share which for sure pays no dividends between now and option’s expiration: √ C(S, K, r, t, σ) = SN (x) − Kr −t N (x − σ t), where N () is the standard normal cumulative distribution function, and ln(S/Kr −t ) 1 √ √ x≡ + σ t. 2 σ t Has properties suggested earlier: • ∂C/∂S > 0, • ∂C/∂K < 0, • ∂C/∂r > 0, • ∂C/∂t > 0, • ∂C/∂σ > 0. Formulae for partial derivatives given in Cox and Rubinstein, p. 221, and in Sydsæter, Strøm and Berck, equation 29.4. Observe: ∂C/∂S = N (x), but this is not an obvious result, since x is a function of S. See exercise about this. Alternative formulation: e−r1t instead of r0−t . (Subscripts just added to distinguish the two.) More common when there is continuous interest accumulation. Need er1 = r0, which is true when r1 = ln(r0) ≈ r0 − 1, so r1 is the interest rate, not one plus the interest rate. 1 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Illustrating Black and Scholes’s formula C as function of S when K = 1.1, r = 1.1, t = 1 for three alternative σ values: σ = 0.3, σ = 0.5, σ = 0.7. Have shown before: S − Kr−t ≤ C ≤ S, straight lines in diagram. • σ matters much around S = Kr −t (= 1 in diagram). • Hardly any effect when S much smaller or much larger. • Uncertainty whether in-the-money or out-of-the-money. • If very likely in-the-money: C ≈ S − Kr −t . • If very likely out-of-the-money: C ≈ 0. 2 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Illustrating Black and Scholes, contd. C as function of S when K = 1.1, r = 1.1, σ = 0.3 for three alternative t values: t = 1, t = 1.4, t = 1.8. • Main effect of higher t: More uncertainty. • Thus: Similar effect as σ. • Notice that S − Kr −t increases with increased t. • Diagram only shows S − Kr −t for t = 1. 3 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Share price process Geometric Brownian motion with drift or lognormal diffusion. Formula: dSt = αStdt + σStdzt with α = µ + σ 2/2. • Expected path is exponential curve. • Expectation conditional on today’s price. • Conditional expected path starts at today’s price. 4 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Black and Scholes: C independent of µ • Major break-through with B & S: Formula independent of µ. • Different from, e.g., CAPM. • CAPM: Expected value next period affects today’s value. • B & S: This dependence goes via today’s S0. • Assumes S0 is already priced in market. • This pricing useful for pricing derivative assets. • Derivative assets: Values derive from other assets’ values. • B & S: More easily applied, since S is observable. • People will agree on C even if disagree on µ. • But need to estimate σ. • Conclude: One less parameter to estimate. • Also: σ is more easily estimated than µ. 5 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 σ more easily estimated than µ With h = t/n, consider time-series observations of yi ≡ ln(Sh·i /Sh·(i−1) ) for i = 1, . . . , n. Best estimators for expectation and variance are n 1 X 1 Sh S2h St yi = ln · · ... · , µ̂h = n i=1 n S0 Sh St−h (now using “hat” to denote estimator, not binomial model), and n 1 X σ̂ h = (yi − µ̂h)2. n − 1 i=1 2 For µ̂, no help in observing prices more often. Only first and last ¶ µ observation matter, µ̂ = 1t ln SS0t . More formally: σ2 2σ 4h 2 var(µ̂) = , var(σ̂ ) = , t t−h (the latter being the variance of a χ21). The latter can be reduced by increasing h, while the former cannot. 6 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Testing Black and Scholes’s formula? • The arguments S, K, r, t, σ all observable. • Can compare C(S, K, r, t, σ) with observed value. • Rejection/acceptance based on one observation? • But σ only observable in statistical sense. • Formulate model in statistical terms? • C = C(S, K, r, t, σ) + ε? • (What to test?) No! • Instead: Consider equation C = C(S, K, r, t, σ). • Let C on left-hand side be an observed value. • Let right-hand side be Black-Scholes function. • Plug in observed S, K, r, t, but consider σ unknown. • Solve equation for σ, called the implicit σ. • Non-linear equation, can only solve numerically. • Time-series estimates of σ significantly different from implicit? • Alternative view: Implicit σ is market’s prediction. • But time-varying σ not strictly consistent with model. • Can test prediction power in hindsight. 7 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Option pricing when underlying share pays dividends • So far: Exact option pricing only when no dividends. • More precisely: Share for sure pays no dividends until expiration. • Not satisfactory. Most shares pay some dividends. • In Norway normally once per year. • In some other countries more often. U.S.A.: Each quarter. • Also possible to decide extraordinary dividends at any time. • Dividends are first announced, then paid. • After announcement date: Dividends known. Easily handled. • Known dividends (to be paid before expiration): Adjust S. • In C formula: Use S minus present value of D. • Justification: Option owner interested in share after D payment. • Then irrelevant whether D paid later, or P V (D) paid now. 8 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 European options when share pays unknown dividends • Possible simplification: Dt = D(St, t). • If believe in this: Can use absence-of-arbitrage method. • Slightly more general: D written as function S history. »» »»» » XXX S0 » X XXX »» » XXX u·S ((( (((( ( ( hhh 0 ( hhhh hhh d · S0 (((( (((( ( h( hhh hhhh hh u2 · S 0 − D 1 du · S0 − D2 du · S0 − D3 d2 · S0 − D 4 • Compared to binomial model: Tree extended. • Allow D depends on whole history, not just current S. • If willing to make assumption like this: Can use a-o-arbitrage. • Alternative, simpler: Assume Dt = δSt. • Continuous version of this: See McDonald and Siegel paper. • Discrete version: Known number, ν, of Dt = δSt payments. • In that case, use S(1 − δ)ν in C formula. 9 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 American options when share pays unknown dividends • Prop. 5 (ch. 4) (16 Oct., p. 3): Early exercise may be optimal. • Under some assumptions: Exists theory for this. • More difficult, not for this course. • (If interested: See section IV in Bjerksund and Ekern.) • Theory gives both criterion for exercise, and option’s value. • When possible dividend dates known: Candidates for exercise. • Simplification in that case: “Pseudo-American” option values. • Calculate European option values with each of these dates as expiration. • Maximum of those European values is the pseudo-American value. • Valuation as if best exercise date chosen in advance. • But American option allows waiting for information before choosing. • Thus actual American value must be somewhat higher than pseudo. 10 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Application: Pricing of corporate liabilities Black and Scholes, “The pricing of options and corporate liabilities.” • “Corporate liabilities” can be bonds issued by corporation. • Normal way of borrowing in, e.g., the U.S. • Corporate bonds risky, as opposed to government bonds. • Bond promises some (re)payment in future, with interest. • Suppose promised payment X at t = 1 (and nothing else). • Let At be corporation’s gross assets at time t. • “Gross” means that obligation to pay X is not deducted. • If A1 ≥ X, bondholders receive X. • If A1 < X, bondholders receive A1. Bankruptcy. • Let Bt be market value of outstanding bonds at t. • Bt less than present value of X, reflects risk. • The remaining value, St = At − Bt, belongs to shareholders. • We find B1 = min(A1, X). • We find S1 = A1 − min(A1, X) = max(0, A1 − X). • Shares analogous to call option on A1 with K = X. • Viewed from t = 0, A1 is uncertain, but X is known. • Use option valuation model to find shares’ value at t = 0? • Black and Scholes? 11 SØK460/ECON460 Finance Theory, Diderik Lund, 28 October 2002 Application: Corporate liabilities, contd. • Need assumption: At is geometric Brownian motion. • But then, St = At − Bt is not geom. Brownian motion. • Cannot use Black and Scholes to price options on St. • Anyhow: Will show how this works. • Let 1+ the interest rate be r = 1.1. • Assume some σ for the At process. • If σ = 0, then for sure full repayment, B0 = Xr−1. • Assume Xr−1 = 12 A0. • At t = 0 bondholders have half the value if no uncertainty. • But then assume σ > 0. • Can now find B0/A0 and S0/A0. • Black and Scholes: S0 = C(A0 , X, 1.1, 1, σ). • S0 = A0N (x) − Xr −1 N (x − σ) = A0[N (x) − 12 N (x − σ)]. • x = σ1 ln[A0/(Xr−1 )] + σ2 = ln(2) σ + σ2 . • If σ = 0.4, then S0/A0 ≈ 0.505, B0/A0 ≈ 0.495. • If σ = 0.8, then S0/A0 ≈ 0.558, B0/A0 ≈ 0.442. • Need huge uncertainty for Pr(A1 < X) to be noticeable. 12