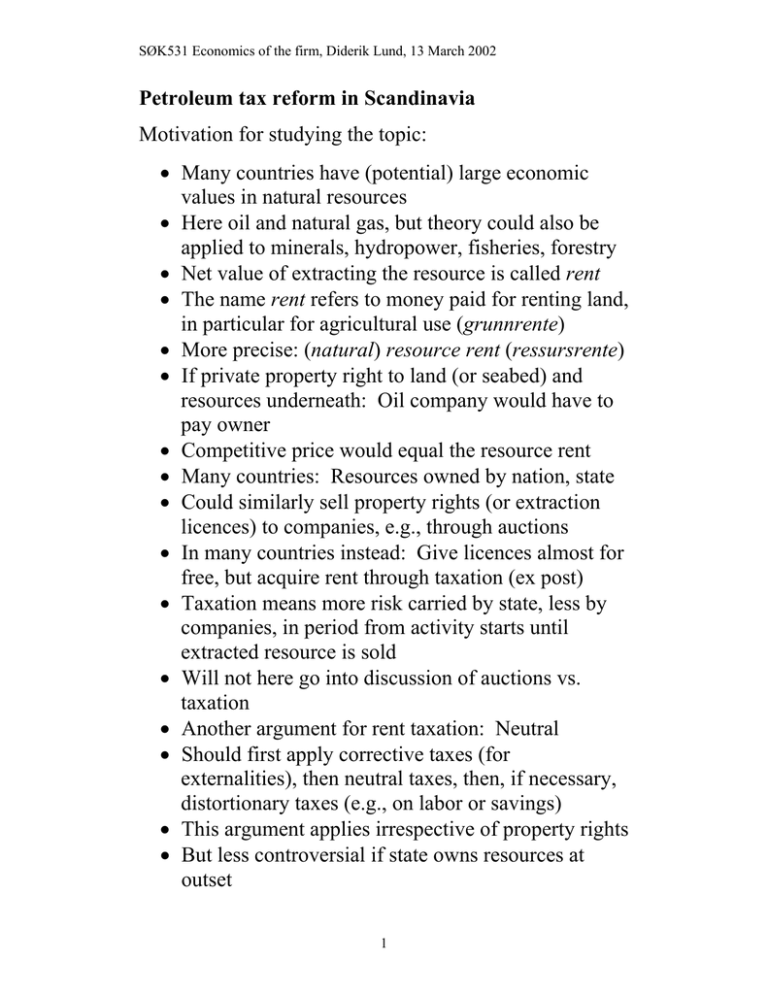

Petroleum tax reform in Scandinavia Motivation for studying the topic:

advertisement

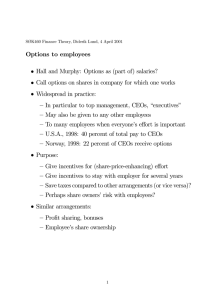

SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Petroleum tax reform in Scandinavia Motivation for studying the topic: • Many countries have (potential) large economic values in natural resources • Here oil and natural gas, but theory could also be applied to minerals, hydropower, fisheries, forestry • Net value of extracting the resource is called rent • The name rent refers to money paid for renting land, in particular for agricultural use (grunnrente) • More precise: (natural) resource rent (ressursrente) • If private property right to land (or seabed) and resources underneath: Oil company would have to pay owner • Competitive price would equal the resource rent • Many countries: Resources owned by nation, state • Could similarly sell property rights (or extraction licences) to companies, e.g., through auctions • In many countries instead: Give licences almost for free, but acquire rent through taxation (ex post) • Taxation means more risk carried by state, less by companies, in period from activity starts until extracted resource is sold • Will not here go into discussion of auctions vs. taxation • Another argument for rent taxation: Neutral • Should first apply corrective taxes (for externalities), then neutral taxes, then, if necessary, distortionary taxes (e.g., on labor or savings) • This argument applies irrespective of property rights • But less controversial if state owns resources at outset 1 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Background, Norway and Denmark • Both countries about the same population • All petroleum (oil, natural gas) found offshore • Discretionary licencing to domestic and foreign private-sector and state oil companies • Earlier: State equity with carried interest, non-neutral • Newer licences: State equity on equal basis, neutral • Different histories 1960’s – today: • Denmark one dominating licencee, DUC • Norway more diversity, more state ownership • Norwegian potential approx. 13 x 109 Sm3 oil equiv. • Danish potential approx. one tenth • Both countries: • Oil companies pay ordinary corporate income tax • Special tax imposed on top of this • Paid on same base minus extra deduction, “uplift” • Intention: Uplift reflects “normal rate of return” (?) • Special tax falls on supra-normal rate of return, rent • Various provisions to avoid transfer pricing • Same companies operate in other sectors, rules to split interest expenses between sectors • Norway until 2000: • Too generous interest deduction in petroleum sector, split on basis of net non-financial income • Borrow in Norwegian subsidiary to finance petroleum activity in other countries, etc. 2 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Overview of reform proposals • • • • Norwegian commission October 1999 – June 2000 Danish commission March 2001 – October 2001 Initiatives taken by ministries Mandates similar: • Reforms towards neutrality • Neutrality to achieve economic efficiency • (Implication: Based on standard theory) • Differences: • Norway: Reform for all licences • Denmark: Reform for future licences only • Norway: Limitation of interest deduction important • Commission reports, proposals: • Both countries: Too generous uplift: Reduce • Denmark extreme: Nominally 250 percent of investment, in present value (@5%) 203 percent • Multiplied by 70 percent tax rate: 142 percent • Ordinary depreciation allowance in addition • Exceeds 100 percent: Gold plating effect • Proposed petroleum tax systems neutral: • Relative to situation with only corp. income tax • Based on standard theory, Boadway and Bruce (1984), Fane (1987) • Destiny: • Norway: Minstry gave priority to limitation on interest deductibility and interest accumulation on loss carry-forwards; passed in Storting; other proposals dropped • Denmark: Discussion on-going 3 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Neutral taxation: Theory ~ In year 0 a company attaches a value V ( X t ) to an ~ uncertain cash flow X t to be received in year t All magnitudes are nominal Two underlying assumptions for neutrality: ~ ~ ~ ~ 1. Value additivity, V (aX t + bYt ) = aV ( X t ) + bV (Yt ) 2. V ( Z t ) = Z t (1 + rs ) −t for a non-stochastic cash flow Z t The discount rate rs , known as the company’s nominal after-tax cost of capital for non-risky cash flows, is assumed to be known • From assumption 1, a proportional tax on the company’s non-financial cash flow with full, immediate loss offset (and payout of negative taxes), is neutral, assuming the tax rate is constant over time, T T T ~ ~ ~ ∑V ( X t ) = 0 ⇔ ∑V ((1 − τ ) X t ) = (1 − τ ) ∑V ( X t ) = 0 t =0 t =0 t =0 ~ • (Here X t could be pre-tax cash flow or cash flow after a corporate income tax; two interpretations of “neutrality”) • From assumption 2, a deviation from a cash flow tax is still neutral if a negative element in the tax base is carried forward, accumulating interest at rate rs , if there is certainty about finally receiving tax value of deduction • Open economy: rs independent of corp. income tax 4 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Schemes for postponed deductions • Garnaut and Clunies Ross (1975): Resource Rent Tax • Cash flow based in each year • But negative cash flows are carried forward with interest, deducted as soon as possible • No clear prescription for interest rate to use • Boadway and Bruce (1984): Any deduction schedule OK, as soon as present value of deductions unchanged relative to cash flow tax • Fane (1987) extends to uncertainty: Use rs as discount rate, need certainty about receiving tax value of deductions • Both commissions suggested, in line with this: • Base tax on income concept, with depreciation allowances instead of immediate expensing • (Reason for this, in part, was treaties against international double taxation) • Went to great length to make tax values of deductions certain; accordingly rs was applied • Loss carry-forward with interest; sale of final loss (Norway) or payout of its tax value (Denmark) • Danish commission: Allowance for Corporate Equity (ACE) as in Institute for Fiscal Studies (1991): Equity-financed part of investment is given a deduction for rate of return on remaining tax value of capital. Debt-financed part gets similar deduction for reported interest expenses • Norwegian commission: No deduction for interest expenses, instead Capital Return Allowance (CRA), like ACE, but for whole investment 5 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Appropriate discount rate: Risk adjustment? • Oil companies dispute neutrality of proposals • Apply same risk adjusted discount rate (globally?) to net after-tax cash flow, irrespective of tax system • Do not recognize need to consider risk in each case • Summers (1987) points out this mistake for tax depreciation allowances; says these are much less risky than operating cash flows • Whether risk-free rate rs is correct, depends on companies’ confidence in authorities • Language misleading: Rent tax on return above “normal,” but what is normal under uncertainty? • “Normal” is to the point only under full certainty Example, project through years 0,1,2: • • • • • • • • • Assume rs is 0.05 X 0 = −100 ~ ~ ~ ~ X 1 and X 2 risky with E ( X 1 ) = E ( X 2 ) = 56 IRR of expected cash flows is 0.08 Assume company regards project as exactly marginal — based on risk adjusted required return Impose rent tax, rate τ , deductions for depreciation allowances and CRA, 55 in year 1, 52.5 in year 2 Company still regards project as exactly marginal according to theory, since PV(deductions) is 100 Assume now: Realized cash flows equal to expected Realized taxes are τ ⋅ 1 in year 1, τ ⋅ 3.5 in year 2, positive tax payments when realized = expected, but still no distortions — counterintuitive? 6 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Appropriate discount rate: Tax adjustment? • Assume effective protection against international double taxation • Only host country (NO, DK) taxes apply at margin • Equity cash flow after tax to host country subsidiary channeled directly to (or from, if negative) parent company, not subject to home country tax • Question is: What is parent's after-tax nominal discount rate (for risk free cash flows) • Typical parent company is mature, with retained earnings as marginal source of financing • Nominal pre-tax cost of capital (Sinn (1991)): 1−τi r , where (1 − τ c )(1 − τ r ) τ i is shareholder's tax rate for interest income τ c is shareholder's effective tax rate for capital gains τ r is company's tax rate for retained earnings • Nominal after-tax cost of capital: 1−τi . r 1−τc • Contrast this with commissions' proposals: • Norway: r (1 − τ i ) (in practice using τ i = 0.28 ) • Denmark: r for ACE • Denmark: r (1 − τ s (1 − τ k )) for loss carry-forward τ s is corporate income tax rate ( = τ r ) τ k is special petroleum tax rate • One justification for applying two rates in Denmark is as a safeguard: Loss carry-forward is unlimited, and a too high interest rate could make its present value explode 7 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Debt as marginal source of finance? • Corporate finance text books typically suggest r (1 − τ r ) as after-tax cost of capital for risk free flows • Justified by ability to completely debt finance risk free flows (e.g., Brealey and Myers (2000)) • Choice of financing source depends on risk, whereas in Sinn (1991) it depends on taxes and availability of retained earnings • In both countries, debt finance in petroleum sector is limited to 80 percent • Debt finance may be best alternative in subsidiary if there is interest deductibility in rent tax • (But Norwegian commission wanted no deductibility) • Then limitation will be binding; mix of debt and equity at margin Who is the marginal equity investor? • Following Sinn, and assuming mature parents, one must identify marginal shareholders of parents • If tax exempt (e.g., pension funds or residents of tax havens), then their alternative investment is tax free • Should be possible to detect empirically: What is required rate of return for risk free equity investment in capital markets, i.e., after corporate taxes, before personal taxes? • Political question: What kind of marginal investor do the two countries want/need to attract? 8 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Neutrality and non-standard theory • In Norwegian discussion after proposals, companies claimed they need some minimum after-tax size of a project, called “materiality” or “financial volume” • Any project could be killed by a high neutral tax • Small project could be killed by a low neutral tax • If problem due to tax system, reason must be that some cost are not deductible, such as headquarter costs • If problem is a general (no-tax) feature, it seems to be at odds with standard theory • Must know details to know whether neutral taxation is justified given this kind of behavior Choice of tax rate in open economy • • • • • Theory of neutral taxation gives no clue for tax rate To minimize other, distortionary taxes: Set to 99 % If companies are owned by foreigners: Set to 99 % Limitation: Transfer possibilities, Lund (2001b) Alternative point of view: Participation constraint • Companies have unique resources which cannot be applied in many countries simultaneously • Each country must limit taxes so that those resources are more highly rewarded than in other countries, even when projects yield rents • Leads to tax competition • But what are the unique resources? Capital is available in markets; technology and knowledge can be reproduced and used in many countries; personnel are not owned by the companies 9 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Conclusions • Cash flow taxes are neutral under value additivity • Generalized cash flow taxes, with interest accumulation on postponed deductions, are only neutral if value to company of postponed deductions are equal to value of immediate deductions • To achieve this: Need to use correct interest rate • Risk adjustment may be necessary if postponed deductions are risky, but there are ways to make them less risky • Problem: Correct risk adjustment will vary between situations • Tax adjustment may be necessary, but relies on identifying marginal source of financing; if this is (at least partly) equity, need to know whether it is retained earnings or new shares, need to know tax rates applying to marginal investor, need to identify that investor (or, perhaps, rely on Miller equilibrium, in which home country corporate income tax rate applies) • Problem: Correct tax adjustment will vary between situations • Various explanations why 99 percent rent taxes will not work • Transfer problems • Minimum after-tax project size • Application of companies' unique resources • Need to know details, and whether justification for neutrality still holds 10 SØK531 Economics of the firm, Diderik Lund, 13 March 2002 Norwegian discussion • Diderik Lund, “Petroleumsskatt — flere uavklarte spørsmål,” Økonomisk forum 55(9), 2001, p. 34–40 • Petter Osmundsen, “Skattedesign og atferdsantagelser,” Økonomisk forum, 56(1), p. 8–13 11