Financial options call option at

advertisement

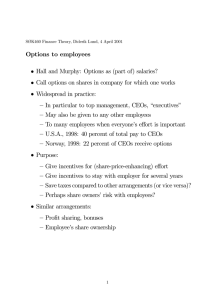

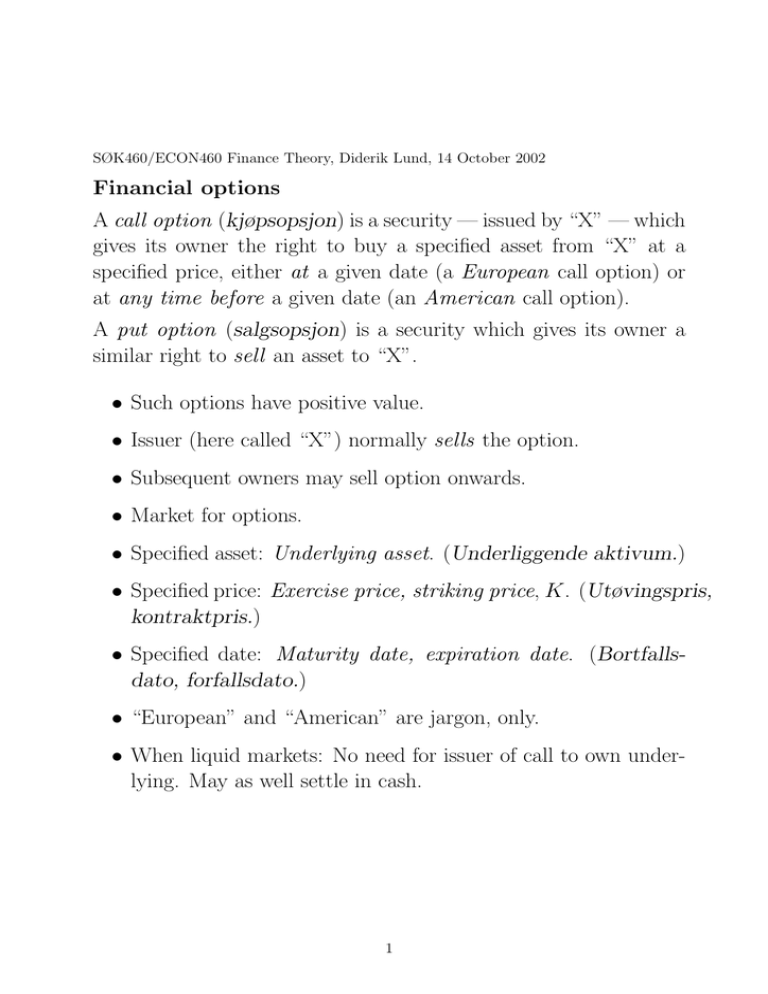

SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Financial options A call option (kjøpsopsjon) is a security — issued by “X” — which gives its owner the right to buy a specified asset from “X” at a specified price, either at a given date (a European call option) or at any time before a given date (an American call option). A put option (salgsopsjon) is a security which gives its owner a similar right to sell an asset to “X”. • Such options have positive value. • Issuer (here called “X”) normally sells the option. • Subsequent owners may sell option onwards. • Market for options. • Specified asset: Underlying asset. (Underliggende aktivum.) • Specified price: Exercise price, striking price, K. (Utøvingspris, kontraktpris.) • Specified date: Maturity date, expiration date. (Bortfallsdato, forfallsdato.) • “European” and “American” are jargon, only. • When liquid markets: No need for issuer of call to own underlying. May as well settle in cash. 1 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Financial options, contd. • Underlying asset could be almost anything: – Shares of stock – Bonds – Units of a stock index – Commodities (standardized quality and delivery) • Original issuer called writer of option. • The right for the option owner is vis-a-vis that writer, irrespective of subsequent trading of the option. • The right (to buy or sell) implies no obligation. (Different from forward or futures contracts.) • To use option called to exercise option. • Define these values: Before At expiration expiration Market value, underlying asset S S∗ Value of call option C C∗ Value of put option P P∗ 2 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Call option at expiration date • Consider first call option at expiration date. • Then European options equal to non-exercised American. • If exercise call: Receive S ∗, pay K. • Exercise if and only if S ∗ > K. Else: Zero. • Value is C ∗ = max(0, S ∗ − K). • Gross value, not subtracting purchase price for option. • Increasing in S ∗, although not strictly. • Owner of option protected against downside risk. 3 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Put option at expiration date • If exercise put: Receive K, give up S ∗. • Exercise if and only if K > S ∗. Else: Zero. • Value is P ∗ = max(0, K − S ∗). • Gross value, not subtracting purchase price for option. • Decreasing in S ∗, although not strictly. 4 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Valuation of options before expiration • Consider European options with time t until expiration. • Value now of receiving C ∗ at expiration? • (Value now of receiving P ∗ at expiration?) • Have candidate model already: Use CAPM? • Problematic: Non-linear functions of S ∗. • Difficult to calculate E(C ∗) and cov(C ∗, RM ). • Instead: Theory especially developed for options. • (But turns out to have other applications as well.) • “Valuation of derivative assets.” • Value of one asset as function of value of another. • Will find C(S) and P (S). • Other observable variables as well. 5 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Net value diagrams (C& R, fig. 1-1–1-24) • Value at expiration minus purchase cost. • S ∗ on horizontal axsis. • Example: C ∗ − C, buying a call option. • Resembles gross value, C ∗, diagram. • But removed vertically by subtracting C. • These diagrams only approximately true: • No present-value correction for time lag between −C and C ∗. • No exact relationship between C and C ∗. • That exact relationship depends on other variables. • Next example: C − C ∗, selling a call option. • Observe: Selling and buying cancel out for each S ∗. • Options redistribute risks (only). Zero-sum. 6 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Net value diagrams, contd. • Buy a share and buy two put options with S = K. • Diagrams show S ∗ − S, 2P ∗ − 2P, S ∗ − S + 2P ∗ − 2P . • Good idea if you believe S ∗ will be different from S (and K), but you do not know direction. 7 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Net value diagrams, contd. • Buy put option with K = S, plus one share. • P ∗ − P + S ∗ − S. • Resembles value of call option. • Will soon show exact relationship to call option. 8 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Determinants of option value (informally) Six candidates for explanatory variables for C and P : • S, today’s share price. Higher S means market expects higher S ∗, implies higher C (because higher C ∗), lower P (lower P ∗). • K, the striking price. Higher K means lower C (because lower C ∗), higher P (higher P ∗). • Uncertainty. Higher uncertainty implies both higher C and higher P , because option owner gains from extreme outcomes in one direction, while being protected in opposite direction. (Remark: This is total risk in S ∗, not β.) • Interest rate. Higher interest rate implies present value of K is reduced, increasing C, decreasing P . • Time until expiration. Two effects (for a fixed uncertainty per unit of time): Longer time implies increased uncertainty about S ∗, and lower present value of K. Both give higher C, while effects on P go in opposite directions. • Dividends. If share pays dividends before expiration, this reduces expected S ∗ (for a given S, since S is claim to both dividend and S ∗). Option only linked to S ∗, thus lower C, higher P . Later: Precise formula for C(S, K, σ, r, t) when D = 0. Missing from the list: E(S ∗). Main achievement! 9 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Put-call parity Exact relationship between call and put values. • Assume underlying share with certainty pays no dividends between now and expiration date of options. • Cox and Rubinstein notation: r = 1+ interest rate (!) • Let t = time until expiration date. • Consider European options with same K, t. • Consider following set of four transactions: Now Sell call option C Buy put option −P Buy share −S Borrow (risk free) Kr−t C − P − S + Kr−t At expiration If S ∗ ≤ K If S ∗ > K 0 K − S∗ K − S∗ 0 S∗ S∗ −K K 0 0 Must have C = P + S − Kr−t, if not, riskless arbitrage. 10 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Put-call parity, contd. Absence-of-arbitrage proof: Assume the contrary: • To exploit arbitrage if, e.g., C > P + S − Kr−t: • “Buy cheaper, sell more expensive.” • Sell (i.e., write) call option. • Buy put option and share. • Borrow Kr−t. • Receive C − P − S + Kr−t > 0 now. • At expiration: Net outlay zero whatever S ∗ is. Put-call parity allows us to concentrate on (e.g.) calls. Thought experiment • Keep S, K, r, t unchanged. • Increased uncertainty must change C and P by same amount. • Alternatively: Increased E(S ∗)? • This should affect C and P in opposite directions. • But put-call parity does not allow that! • Shall see later: No effect of E(S ∗). 11 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Allow for uncertain dividends • Share may pay dividends before expiration of option. • These drain share value, do not accure to call option. • In Norway: Regular dividends paid once a year. • In some countries, like U.S., 4 times per year. • Only short periods without dividends. • Theoretically easily handled if dividends are known. • But in practice: Not known with certainty. Let D+ be maximum present value of dividends. Let D− be minimum present value of dividends. In order to base option value theory on arbitrage in only (the underlying) shares and bonds: Let D+ be the lowest sum needed to buy a portfolio of those shares and bonds such that portfolio can be exchanged for at least the dividends paid by the underlying share between now and expiration. (May be slightly less than ordinary present value (using bonds only) of maximum possible dividends, assuming dividends and share value are correlated.) Define D− similarly: The largest amount one could raise by short selling shares and bonds now, being sure that dividends from one share between now and expiration could at least repay the short sales. 12 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Dividends, short sales, absence-of-arbitrage • S is claim to S ∗ and dividends paid in between. • For short periods: S ≈ E(D + S ∗). • Thus: For given S, a higher D means lower S ∗. • Thus also: Higher D means lower C, higher P . • Intuitive: High D means less left in corporation, thus option to buy share at K is less valuable. • Intuitive: High D means less left in corporation, thus option to sell share at K is more valuable. • Absence-of-arbitrage proofs rely on short sales. • Short sale of shares: Must compensate for dividends. • Short sale starts with borrowing share. Must compensate the lender of the share for the dividends missing. (Cannot just hand back share later, neglecting dividends in meantime.) • When a-o-arbitrage proof involves shares: Must either assume D = 0 with full certainty, or use D+ and D−. • If not D = 0 with certainty, get inequalities instead of equalities. 13 SØK460/ECON460 Finance Theory, Diderik Lund, 14 October 2002 Put-call parity with uncertain dividends P + S − D+ − Kr−t ≤ C ≤ P + S − D− − Kr−t Proof of first inequality: Assume the contrary: At expiration Now At div. date If S ∗ ≤ K If S ∗ > K Buy C −C 0 0 S∗ − K 0 Sell P P 0 S∗ − K −S ∗ Sell S S −D −S ∗ Buy D+ −D+ ≥D 0 0 Lend −Kr−t 0 K K ≥0 ≥0 0 0 A risk free arbitrage, q.e.d. Proof of second inequality: Assume the contrary: At expiration Now At div. date If S ∗ ≤ K If S ∗ > K Sell C C 0 0 K − S∗ Buy P −P 0 K − S∗ 0 S∗ Buy S −S D S∗ Sell D− D− ≥ −D 0 0 0 −K −K Borrow Kr−t ≥0 ≥0 0 0 A risk free arbitrage, q.e.d. 14