ENERGY LABORATORY INFORMATION CENTER

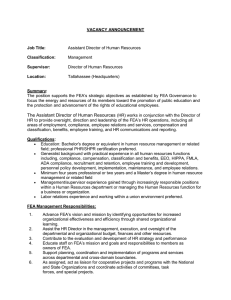

advertisement