Document 11038373

advertisement

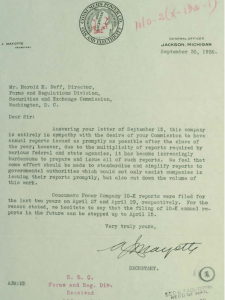

y^^^» HD28 .M414 ALFRED P. WORKING PAPER SLOAN SCHOOL OF MANAGEMENT Extension and Violations of the Statutory SEC Form 10-K Filing Requirements by Andrew W. Alford Jennifer J. Jones Mark E. Zmijewski Working Paper No. 3461-92-EFA MASSACHUSETTS INSTITUTE OF TECHNOLOGY 50 MEMORIAL DRIVE CAMBRIDGE, MASSACHUSETTS 02139 Extension and Violations of the Statutory SEC Form 10-K Filing Requirements by Andrew W. Alford Jennifer J. Jones Mark E. Zmijewski Working Paper No. 3461-92-EFA M.I T. UBP/^'-""'^ OCT 2 8 1992 RECElVtU S SEC Form 10-K Extensions and Violations of the Statutory Filing Requirements Andrew W. Alford Massachusetts Institute of Technology Sloan School of Management 50 Memorial Drive Cambridge, MA 02139 AALFORD@SLOAN.MIT.EDU Jennifer J. Jones University of Chicago Graduate School of Business 1101 East SS"" Street Chicago, IL 60637 and Mark E. Zmijewski University of Chicago Graduate School of Business 1101 East 58'" Street Chicago, IL 60637 August 1992 First draft: December 1991 Abstract In this study SEC we present evidence that as many as 20 percent of the 10-K filings are filed with the 10-K 10-K report are not a random sample of firms; up to 25 percent of the firms that are experiencing unfavorable economic events, and 10 percent of the firms that are experiencing favorable economic events, delay their 10-K filing. On average, firms after the 90-day statutory reports, we document that delay their 10-K due date. In addition to the fact that not all firms file timely that firms that delay filing their filing are small, have negative accounting rates of return, negative earnings changes, low liquidity, and high financial leverage; these firms also experience negative market adjusted stock returns during the fiscal year, the 90-day statutory filing period, and the delay period. These results suggest that verifying the information is an important consideration financial statement information to predict bond rating changes, mergers, and stock public availability of non-earnings financial statement in the experimental design of studies that use non-earnings economic events such as audit opinions, financial distress, returns. We received helpful comments from an anonymous referee. Randy Beatty, Harry Davis, Tom Stober, at CUNY at Baruch, Indiana University, and Southern Methodist thank Eden Stang for her help on this project. and the workshop participants University. We August 28, 1992 Page: 2 Introduction. 1. The 1934 Securities and Exchange Act requires every firm incorporated with publicly traded securities to file a Form 10-K with Commission (SEC) within 90 calendar days of widely known and and Exchange the United States Securities yearend.' This 10-K filing United States requirement is often cited as the foundation for the assumption that the last date a firm's annual financial statement data become the case, however, that not all publicly available The purpose of this is 90 days after firms will be able to procedures for a firm to notify the extension.^ its fiscal in the SEC study is of to its meet its fiscal this filing yearend.' requirement. inability to file a timely document how frequently firms 10-K and It is certainly The SEC has to request an either extend or violate the 10-K filing requirements, and to describe the financial characteristics of these firms. The results of this study have implications for the design of empirical tests that use non-earnings financial statement data to predict economic events such as audit opinions, financial distress, bond rating changes, mergers, and stock returns.* Specifically, we we document the 10-K filing behavior for a sample of 38,775 10-K filings, describe the financial characteristics of this sample, partitioning the observations by the of days between the 90-day statutory due date and the The results ^We use show that 20 percent of the 10-K SEC filings are 10-K receipt date (i.e., and number the filing delay). not filed by the statutory due date, and the term "day" to refer to calendar days unless noted otherwise. "For example, Holthausen and Larcker (1992, p. 5) state, "... we assume that the 68 ratios can be calculated for each firm three months after the fiscal yearend, since 10-K reports are due by that time." -Specifically, the the SEC by SEC requires a firm that does not have the ability to statutory filing file a timely 10-K to notify Form 12b-25, "Notification of Late Filing," within one business day after the 90-day date. The initial Form 12b-25 filing typically provides the firm with an extension of filing the 90-day statutory filing requirement. "See Watts and Zimmerman (1986) for a review of such studies. Augusi 28. 1992 Page: approximately eleven percent of the 10-K (six) surprisingly, in spite of the SEC's requirement that firms inability to file a timely 10-K, filing date file a Form To examine of 182 actual its inability Form filings are delayed by at least six (18) days; SEC notify the fewer than one-half of the firms 10-K filing a (via Form the conditions under which firms delay their 10-K 12b-25 filings from the SEC. 10-K and if after the 90-day statutory We filings, we document the reason stated by the firm 12b-25). Our however, are not experiencing financial for its sample indicates that most analysis of this firms delay their 10-K filing because of reasons related to financial distress/ activities collected a sample the firm expected a significant change in the results of Form operations (required disclosures in filings, 12b-25) of an 12b-25. to file a timely delayed 10-K 3 distress, such as acquisitions or mergers that cause a delay in the 10-K Some firms with but are involved in other filing. Consistent with the majority of the firms experiencing financial distress, 31 percent of the firms stated that earnings for the current fiscal period were expected to be significantly less than earnings in the previous period, while only 10 percent stated that earnings for the current fiscal period were expected to be significantly greater that earnings in the previous period. The sample of Form 12b-25 a random sample of firms. First, we partition the filings indicates that We examine had a delayed 10-K and the one highest return deciles. many To sample of 38,775 10-K filings in two ways. sample on the basis of market adjusted stock returns for the year immediately following the statutory due date, and partitions that this issue for the firms that delay their 10-K filings are not decile, filing. we calculate the proportion of the firms in each of ten The results reveal that the two lowest stock return have a higher proportion of delayed 10-K filings deciles, than the other the extent that extreme stock returns signal economic events, these results indicate that firms that experience unfavorable economic events, and some firms that experience favorable ^Lawrence (1983) documents financial reporting delays for bankrupt firms. August Page: 1992 28. economic events, delay their 10-K and the release of filing » their non-earnings financial statement data. We examine also performance across 10-K measured by accounting document this issue by comparing the accounting characteristics and stock market delay panitions. filing document that the excess stock returns of firms that financial performance of firms that performance of firms that did not New York a a Form Form 12b-25. 12b-25 we examine that firms filing a if file is Form a reliably We observe also filing and the delay 12b-25 reveals that the worse than the financial these results for firms traded on Automated Quotations system (NASDAQ). the possibility that non-earnings financial statement data are released (ARS), press via alternative disclosures (e.g., annual report to shareholders and, We Stock Exchange (NYSE), the American Stock Exchange (ASE), and the National Association of Security Dealers Finally, file filed delay increases. the 90-day statutory filing period, Partitioning the sample into firms that filed/did not period. filing 10-K reports after the 90-day statutory file fiscal year, that the financial performance (as 10-K rates of return) deteriorates as the date are reliably less than zero during the the We 10-K they do, the after the 90-day statutory filing period ARS is typically filed after the 10-K. tend not to We also releases). file an document, We document ARS with the SEC for a sub-sample of the firms, that firms that delay their 10-K filings do not issue a press release containing non-earnings financial statement data; further, by the date of the the SEC. Form 12b-25 we were filing for able to ascertain the financial statements were available many of the 182 Form 12b-25 We document that the financial filings that we collected from statements are not typically available until after the 90-day statutory filing period for this sample of firms. filing if These results suggest that it is unlikely that firms a 10-K after the 90-day statutory filing date provide similar information to the public before the firm files its 10-K with the SEC. Outline of the paper. In section 2 we discuss the SEC's filing requirements for 10-K reports August and 2S, P»««: 1992 (Form notifications of late filing performance of firms that file We a 10-K. present our conclusions and implications for further and industrial firms that have registered securities 1934 Securities and Exchange Act and are required by Section 13 to that have registered securities file The SEC considers principal office in Washington. D. statutory filing date for if SEC If a firm is not able to is a on file its file form as C; Rule 03 of filings until the statutory filing date file a its "filed" on the date is Form 10-Q 90 days received at the SEC's it is a Saturday, Sunday, or holiday. 10-K without "unreasonable effort or expense," 90-day statutory filing date.* if the firm to consider the 15 SEC by filing The SEC considers files a timely Unless the and Form 8-K Form it SEC notifies filing the SEC 12b-25 10-K Form 12b-25 and day extension approved after (quarterly financial reporting) a Rule 12b-25 a delayed ^Rule 12b-25 requires a "Notification of Late Filing" (Form 12b-25) for other for example, SEC within and Exchange Act defers a the 1934 Securities after the original 90-day statutory filing date.' to the contrary, the firm the the business day immediately following the statutory filing to be filed by the statutory filing date (timely) 10-K within 15 days periodic repons, and firms Form 10-K with of the 1934 Securities and Exchange Act requires the firm to notify the within one business day of under Section 12 of the under the 1933 Securities and Exchange Act and are required by periodic reports, are required to after their fiscal yearend. date financial and Stock Exchange Financial Reporting Requirements. Filing All commercial Section 15(d) to and present our 4. SEC 10-K 2. describe the sample 10-K and Form 12b-25 reporting behavior, as well as the descriptive analysis of the research in section we 12b-25). In section 3 5 filing files its the firm initial Form filings as well, (current report of significant events). 'In the early 1970s the filing date. Form 12b-25 provided a 30 day extension of the original 90-day statutory August 28, 1992 Page: beyond the 12b-25; however, firms must consider applications for extensions unless the SEC Figure filing period 1 extension denied issues a specific order granting the additional extension. depicts the sequence of information events for this study. The 90-day statutory 10-K the 90-day period after the fiscal yearend, although adjusting this period for is Saturdays, Sundays, and holidays can extend day of the statutory filing to file a timely 10-K 90-day statutory date and the to notify it filing date; thus, no more than one business day Form The SEC We filing period. 90-day statutory a subsequent initial 6 to 93 days. The statutory define the delay period as the SEC by it 10-K receipt date. The filing a we expect Form 12b-25 that the initial after, a firm's SEC 10-K filing date the last is number of days between requires a firm that is the not able within one business day after the firm's Form 90-day statutory 12b-25 would be filed close filing date. 12b-25 for an additional extension, subsequent Form to, but Although firms can file 12b-25 filings are rare.* takes a strong public position that timely information disclosures are important to the securities markets: The disclosures required in reports filed with the preservation of free, fair and informed Commission are securities markets. It is essential to the of critical importance that such reports be furnished within the time they are required to be filed Commission's rules. under the Only the most compelling and unexpected circumstances justify a delay in the filing of a report and the dissemination to the public of factual information called for therein.' Although the SEC does not have disclosure requirements, the First, the SEC the authority to levy fines for a firm's failure to adhere to statutory SEC can enforce its statutory filing requirements in numerous ways. can prohibit a firm from issuing additional publicly traded securities (of any type) by not approving the firm's registration statement because of the firm's failure to required disclosures on a timely basis. Second, the SEC can institute a civil Form 12b-25 'Securities filings. and Exchange Act of 1934, Release No. 10707, March its injunctive action in the *Our database contains only 67 observations with subsequent Form 12b-25 initial file 29, 1974. filings for the 2,669 August 28, 1992 Page: courts against the firm; a typical example for Permanent Injunction Ener-Mark Corporation in the Notifications of Late Filing it to file its Ener-Mark Corporation. The SEC United States reports, one Form 8-K that it failed to file a (relating to on Form 12b-25. Ener-Mark consented delinquent reports, and enjoining it Complaint filed a Court for the District of Columbia against District Ener-Mark admitted in 1990.'° and 1989, four Form 10-Q is Form 10-K for 1988 an auditor change), and 13 to the Final Judgment ordering from future disclosure violations of the provisions SEC of the 1934 Securities and Exchange Act. If the firm does not comply with this judgment, the can file a Motion for Judgment of Civil Contempt and have the corporation and/or for failure to and its comply with the judgment. The chief executive officer, William firm's stock. Howe and Schlarbaum suspended trading these suspensions was the all Third, the SEC can suspend trading of the They indicate that the reason given by the file SEC for SEC some of required information with the SEC. have financial reporting requirements which provide some also additional incentives for firms to officers fined such a motion against Unioil Corporation filed M. Mulderig." firms' failure to The stock exchanges SEC its (1986) examine stock price changes of firms for which the in the firms' stock. make timely financial disclosures. The NYSE. ASE, and NASDAQ have a general disclosure requirement that a firm must issue a timely press release for significant events that could result in a significant regarding the issuance of financial statements. The change NYSE delay in the issuance of a firm's financial statements.'' SEC '°See, v. 7 Ener-Mark Corporation, Civil in its stock price, and all specific rules even has specific rules pertaining to a The NYSE requires firms to submit an Action No. 90-1550-JHG, D.D.C., July 3, 1990, LR-12532. "See SEC v. Unioil and William M. Mulderig, Civil Action No. 88-2803 TPJ (D.D.C.), SEC Litigation Release No. 12641. '-All three Listed exchanges discuss the financial disclosure requirements Company Manual (1992), Ihe ASE Company in their Guide (1992), and the manuals; see the NASD Manual (1992). NYSE August 28. 1992 Page: annual report to the exchange within three months after the before the annual shareholders meeting. reporting requirements, it shareholders meeting, and is the firm cannot meet these As a result of the delay, the NYSE may delay the annual confident that the audited financial statements will not differ stock exchange enforcement actions result in economic costs to the firm. Firms incur direct costs such as SEC if financial statements currently available. The above SEC and signalling effect of states that requires the firm to issue a press release regarding the financial it statements as soon as the firm from the yearend, but at least 15 days fiscal should notify the NfYSE as soon as the firm becomes aware of its inability to submit a timely annual report. significantly NYSE The litigation costs, an untimely filing are financial reporting requirements.'^ but it may be that indirect costs from the potential an even greater incentive for the firm to comply with the The fact that some firms file a 10-K after the 90-day statutory filing period indicates that these firms cannot avoid (or choose to bear) these costs, and leads us are not a 3. 8 to conjecture that firms that file a random sample of firms. We examine this 10-K economic after the 90-day statutory filing period conjecture in the remainder of this study. Descriptive Analysis. Our sample developed of 10-K and at the University of Form 12b-25 filings is taken from the Chicago. This database contains on the NYSE, the ASE, and the NASDAQ system SEC SEC filing filings for date database most firms traded from the mid 1960s through the first few months some indirect foundation given the document a negative stock price reaction to firms that do not announce earnings by the expected announcement date (see, for example, Kross (1981a, 1981b), Chambers and Penman (1984), Kross and Schroeder (1984), Penman (1984), and Alford and Zmijewski (1992)). "The existence of indirect costs from a signalling effect has results in studies that August Page: 28. 1992 of 1985/" We restrict Form 12b-25 that filings contains the date the document into its our sample to 10-K SEC computer database and 2,669 Form 12b-25 year), except that the database contains fewer which have from one changed fiscal (onfile date). first 10-K to eight 10-K filings in Depending on filings. Form 10-K and Form 12b-25 we present filings; indicate that the 10-K measure the 90-day statutory was when SEC 1985 (1,627 10-K based filings per filings) since the exists in the 42 percent of the firms in the sample filings. number of days period (number in the delay date and the actual filing date); negative/0/positive filing date. We first business day on or after 90 days after the fiscal 90-day statutory date for Saturdays, Sundays, and holidays; thus, the 90-day dates for file it database for every year in numerous SEC forms. It begins information for a subset of firms and ends in filing and whether a firm's fiscal yearend filed before/on/after the filing SEC began collecting this on the SEC Work Load History the filing date as the filing yearend, which adjusts the statutory ^*This database contains entered the Filing Behavior. the distribution of the of days between the 90-day statutory numbers SEC and 5.780 10-K (representing 62 percent of the 10-K filings) have either seven or eight 10-K 1 The database file.^' part of 1985. This sample contains 7.887 unique firms in the sample the sample period can have seven or eight 10-K In Table complete year filings.^* yearend during the sample period, a firm that A. first A total of 38,775 10-K filings are distributed evenly across years (between 4,952 database only covers the the received the document (receipt date) and the date the criteria The 10-K filings is were entered into the SEC's Work Load History publicly accessible meet our selection 1977 because 1978 filings after 9 (September, 1985 version). in the mid 1960s early, 1985; The database is it is available from the Institute of Professional Accounting, University of Chicago, Graduate School of Business. ''It was not until the 19705 that the SEC provided a specific format for although Rule I2b-25 requiring notification of untimely was filings '*We assume that 10-K filings with the following characteristics them fi-om the database: incomplete or apparently incorrect dates the 10-Q or 10-K filing date for a subsequent SEC "onfile" date (the date the SEC fiscal period (if indicates that the filing Form 12b-25 notifications, instituted before the 1970s. are data errors, in and we eliminate the database; a filing date after available); or a filing date after the is publicly available). Page: 28. 1992 August Statutory filing date can be date as the date the SEC between 90 and 93 days indicates that few days before a 10-K typically a The median lag between the filing delay 1 we days, is partition the and the statistics in the table); thus, filing date, 25"" the public in the reading date and the date the filing three days (the is SEC mean is 75"" percentiles are -3 room and days (we do not report these We are on the 90-day statutory due present the six to date, It is interesting to note that and 51 percent are within one 17 day delay partition because the not monitor 10-K filings delayed only a few (five) days;" five percent of the 10-K six and 17 days. The remaining days; 2 percent are delayed SEC will, '* percent of the 10-K 1 Although and Zmijewski (1992) it is NYSE/ASE "The SEC filings are are delayed does delayed more than 17 for a discussion of not the focus of our study, it is NYSE/ASE and NASDAQ has fewer occurrences of delayed 10-K 10-K reporting lags. interesting to note that not very early; only fourteen percent of the 10-K filings are filed 90-day statutory filings also presents these results for the This partitioning indicates that the ''See Easton filed six under between 18 and 30 days, 2 percent between 31 and 60 days, and 2 percent more than 60 days. Table separately. publicly The median 10-K filing delay. most circumstances, grant a 15 day extension automatically, and we conjecture that the between SEC. at the its is while most (80 percent) 10-K filings are filed by the 90-day statutory fillings day of statutory due date. This date 5.1 days).^^ 20 percent of the 10-K reports are filed after that date.'* 38 percent of the 10-K define the filing enters the 10-K into sample by the length of the 10-K and We received the 10-K filing (receipt date). filing is available to accessible database (the onfile date) In Table it after the fiscal yearend. 10 more than many 10-K five filing date. 15 day extension can extend to 17 days if it ends on a reports are days before the weekend or holiday August 28. filings 1992 Page: than NASDAQ The SEC (14 percent Given statutory filing date. first file a Form 25 percent).^" vs. requires a firm to notify the "Notification of Late Filing" SEC (Form 12b-25) with this disclosure of its inability to file a timely SEC the requirement, firms that 12b-25; thus, partitioning the distribution in Table of Table 2 show that, as expected, firms that surprisingly, not all firms that file a delayed 10-K notify the the majority (68 percent) of these firms do not percent) firms that delay a 10-K report fewer than a practical matter, the date as timely SEC may view a file 10-K reports six SEC Form days filing a a delayed 10-K filing should file 1 by firms filing/not first 10-K do not a timely file 10-K by within one business day of the 90-day 12b-25 should partition the firms at approximately zero days delayed. The A by filing a Form a filed within five a percent of the firms with a 10-K Form a file Form 12b-25; 12b-25. In fact, Very few filing days of the 90-day statutory filing between 6 and 17 days, 66 percent file a Form 12b-25. 12b-25, or by filing a granted by the filing file a Form 12b-25; 51 delay between 18 and 30 days. 47 percent of the firms with The results in Table 2 indicate that numerous 10-K by firms that violate the 10-K disclosure requirements by either Form (4 12b-25, possibly because, as a 10-K filing delay between 31 and 60 days, and 33 percent of the firms with a 10-K filing delay a Form three rows in Panel 12b-25 with the SEC. file filing filings. For firms that delay a 10-K than 60 days, H Form 12b-25. Form filing 12b-25 but delaying the 10-K The reason disclosure requirements for this form a firm would not do not appear to be file filing a more filings are filed a delayed 10-K and not filing beyond the extension period Form 12b-25 difficult to satisfy. is It unclear since the may be that firms -°We examined the delay distribution by year, and we compared the delay distribution of December fiscal yearend firms to non-December fiscal yearend firms; the distributions are similar across year and fiscal yearend partitions. This is not the case, however, for the number of days between the date the SEC receives the 10-K filing (receipt date) and the date the 10-K is entered into its computer system (onfile date). There is a longer lag between the receipt and onfile dates for December fiscal yearend filings (see Easton and Zmijewski (1992) for a discussion of the lag between the receipt and onfile dates). August Page: 28. 1992 that delay a 10-K filing well beyond the extension granted by the Form 12b-25 do not 12b-25 because these firms expect to violate the notification of late filing with the SEC. These SEC filing requirements even results are similar for both if file a 12 Form they do file a NYSE/ASE and NASDAQ firms. The results in Panel B complied with the SEC's 10-K file a of Table 2 show the number of firms with delayed 10-K requirements. Recall that a firm delaying filing 12b-25 within one day of Form its 90-day statutory Form within the extension period granted by filing the of the 2,669 Form 12b-25 filings the primary purpose of this study 10-K filing filing date, and then its file 10-K to filing must the delayed 10-K 12b-25 (between 15 and 17 days). Only 1,274 (48 percent) comply with the 10-K filing requirements. is filings that Although examine the characteristics of firms that extend or violate the requirements and not the decision process firms use to decide whether to comply with SEC disclosure requirements, we provide some Form 12b-25 prior to that filed/did not file a empirical evidence on the differences between firms filing a delayed 10-K to gain some insights on this decision process. The implication for practitioners and researchers who develop and non-earnings accounting data to predict economic events is that not all backtest models that use 10-K filings are available within three months of the fiscal yearend; therefore, such models assume data are available for firms that did not release this information within the three fact increases if firms that delay their models are attempting to predict. We 10-K month filing are period. The importance of this stylized experiencing the economic events that such examine the characteristics of firms that delay their 10-K filing next. B. The filing is the Information Disclosed on first Form 12b-25. source of information regarding the characteristics of firms that delay their 10-K Form 12b-25. We collected a sample of 182 Form 12b-25 filings from the SEC, and we August Page: 28, 1992 summarized the information disclosed 12b-25) why it could not in filing date and if the firm anticipates "any significant change in results of operations from the corresponding period for the last will be reflected by the earnings statements to be included anticipates that it will report a significant change Table filings in 3. Many firms provide in the subject report."-^ summarize the information more than one reason within the 90-day statutory filing period; in the two columns of Table first distribution of additional reasons. The last of the firms" disclosures about the results of operations for the in the 182 10-K 3 filings, we must Form 10-K present the and in the third four columns present a fiscal year If the firm for their inability to file a distribution of primary reasons provided by these firms for the delayed column we present the fiscal in the results of its operations, the firm We provide a description of the anticipated change. 12b-25 Form them. Rule 12b-25 requires a firm to disclose (on 10-K by the 90-day statutory file its 13 summary year of the delayed 10-K filing.'^ We their inability to file a group the reasons given by firms for statutory filing date into four major categories: asset acquisitions and dispositions, and other. Form 10-K by financial distress, accounting The The accounting and and auditing issues, financial distress category includes reasons relating to debt negotiations, debt restructuring, bankruptcy, reorganizations, condition. the 90-day and poor financial auditing issues category includes accounting issues or problems, delays in obtaining information from within the firm or from a third party, audit related delays, and investigations of financial statement information. We include any changes in the type or scale of operations such as dispxDsitions or acquisitions of businesses and assets and business combinations and liquidations ^^Securities "To 10-K and Exchange Act of the extent that filing, and dispositions category; in the asset acquisitions filing. may March we include all reasons that 29, 1974. incentives to not reveal the true reasons for the delayed not provide an accurate description of the true reasons for management has the results in this table the delayed 10-K 1934, Release No. 10707, finally, Augusi Page: 28, 1992 are not related to any of the U three categories in the other category. first The most prevalent reason stated for tiling delays The percent of the primary reasons). debt negotiations and restructuring (19 is financial distress category has the largest percentage of primary reasons (31 percent), followed by the accounting and auditing issues category (27 percent). financial distress, however, could be understated The percent of firms experiencing because several of the non-financial distress reasons could be indirectly related to financial distress and, as such, the financial distress category may be understated; for example, the audit related delays category could be due to the increased scope of audit procedures necessary as a result of financial distress.^ Although most of the reasons provided by firms for the delayed 10-K suggest that the firms are experiencing for all firms; for some type of financial difficulty, this example, in 5 percent of the Form 12b-25 fact, may not be 12b-25 the situation filings the firms indicate acquisitions businesses or assets as the reason for the delayed 10-K filing which and, in Form filing in the may of not reflect financial distress, could even indicate the opposite. In the remaining columns. Table 3 presents the expected change in earnings from the prior fiscal period as reported on Form 12b-25. Across all observations, 31 percent report an expected negative change, 36 percent report no expected change, 10 percent report an expected positive change, and 23 percent do not report the expected change (due to an inability to estimate the change or the absence of a response). These results indicate that a small proportion of the sample expect to report improved earnings. categories, most of the filings disclosing Only 12 percent of the issues category report ^Note For both the financial distress an expected change financial distress category an expected increase that 100 percent of the Form in earnings report issues an expected decline. and 10 percent of the accounting and auditing in earnings. 12b-25 and accounting and auditing In summary, the stated reasons for delays filings indicating audit-related delays as the reason for the delayed 10-K filing reported an expected significant negative earnings change. August Page: 28. 1992 10-K reports and the expected changes in filing the in earnings reported on Form 15 12b-25 suggest that there are two types of firms; most firms are performing poorly, but a small percentage of these firms may be performing very well. Proportion of Delayed 10-K Filings of Portfolios Based on Stock Returns. C. In this section of the paper existence of economic events, five we use annual market adjusted stock returns to proxy for the and we compare the proportion of 10-K delayed by more than days across portfolios based on the magnitude of the annual market adjusted stock return. The intuition underlying this analysis develop models result statement is in in is that the changes exactly true for For each firm in the economic events as the difference models that attempt year, (CRSP) we rank between the annual return (portfolio 1 at the University firms is on the of Chicago filings that are filings in the The is we measure file 2. This the annual market adjusted return and the annual return on the equally developed by the Center for Research in Security our data source of stock returns. For each calendar market adjusted return and form ten portfolios delayed by more than Form 12b-25 five We calculate the days for each portfolio. filings, we Given the expect a higher proportion of extreme portfolios, especially the poorly performing portfolios. present the proportion of 10-K portfolio in Figure expected. equity of the firm. to predict stock returns. for the firm basis of their annual reasons for the delayed 10-K stated in the We common equal to the firms with the lowest market adjusted return). proportion of 10-K delayed 10-K which practitioners and researchers our sample we calculate the annual market adjusted stock return for the weighted market index. The daily stock return Prices for market value of the period beginning the day after the statutory due date; 1 filings The shape of filings that are delayed by more than the graph in Figure 2 is days for each the mirror image of the letter portfolio with the highest proportion (26 percent) of delayed (firms with the lowest annual market adjusted return), five and the 10-K J, as filings is portfolio portfolio with the second highest August 28, 1992 Page: proportion (12 percent) and reaches its is portfolio 2. This proportion declines for each of the next lowest value (5 percent) for portfolio 7. It 16 five portfolios, then increases for each of the three remaining portfolios, with the proportion increasing to 10 percent for portfolio 10 (highest annual market adjusted return NASDAQ (see is higher if Figure the firm returns, especially if 2). is We portfolio). These observe similar results for both the results suggest that the likelihood of a firm delaying is we examine the various financial characteristics of firms in the sample, our data source for calculating firms all The Compustat. on all to total assets, financial characteristics filing."^ and current We common we mean calculate the present the results for all (Panel B), and delayed 10-K The results in we examine equity, we by first change files with a constructed by all measured mean of Form 12b-25 this file for their entire history in earnings per share scaled common by price, median equity, total debt financial characteristic in each the eight time series medians.-^ filings without a In Table Form 12b-25 (Panel C). Table 4 indicate that firms that delay their 10-K filing tend to be small, have '"An examination of the accounting rate of return on assets and rate of return on sales provide qualitatively equivalent results to the rate of return on common equity results we present in the paper. ^We return. delete observations with negative denominators on for the fiscal year of the delayed observations (Panel A), delayed 10-K filings file, are the market value of calculating the present the history accounting based financial characteristics; assets to current liabilities, calendar year (1978-1985). and 4 all The Compustat annual of Compustat's current and research accounting rate of return on 10-K filing experiencing unfavorable economic events. partitioning the firms by their 10-K filing delay. contains 10-K experiencing economic events that are reflected by market adjusted stock the firm In this section is its Financial Characteristics of Firms with Delayed 10-K Filings. D. CRSP, NYSE/ASE and when calculating the accounting rates of August 28. 1992 Page: 17 negative rates of return on equity, negative changes in earnings, higher financial leverage, and lower Firm liquidity. Table The rank 4. change size in and rate of return on equity monotonically decrease across the correlations between the 10-K filing delay size, rate earnings (scaled by price), and liquidity (current assets to current than zero, and the rank correlation between the 10-K less and firm filing partitions in of return on equity, liabilities) are reliably delay and financial leverage is reliably greater than zero. Although file Form a this study does not focus on the decision process that firms use to decide to file/not 12b-25 for delayed 10-K present such results in Panels a Form Panels 12b-25 and Panel B and C C filings, interesting to partition the sample it is B and C of Table 4; Panel B presents presents results for firms that did on this basis. We results for firms that did not file file Form a 12b-25. The results in are similar in that they both indicate a negative relation between the 10-K filing delay and firm size, return on equity, change in earnings, and liquidity, and a positive relation between the 10-K that a file do not filing delay and financial leverage. Panels Form 12b-25 tend file Form a to be larger B and C and have worse accounting performance than firms we examine filing, holding periods. The and the second period Filings. is first return holding period filing is delay as in Table the 90-day statutory filing period. often "predicted" in stock return prediction models.'* -^See, for example, Zmijewski (1983), and Lev and Thiagarajan (1991) Ou 4. We the fiscal year of the delayed The third period annual period beginning the day after the 90-day statutory due date. The stock return is that the market adjusted stock returns of firms in the sample over various return holding periods, partitioning the firms by their 10-K five return in that firms 12b-25. In this section 10-K however, Market Adjusted Stock Returns of Firms with Delayed 10-K E. examine differ, The fourth and fifth in this is the period periods partition the and Penman (1989), Holthausen and Larcker (1992), August Page: 28. 1992 third period into the 10-K filing delay period and the remainder of the third period (i.e.. 18 the period beginning the day after the 10-K receipt date to the 90-day statutory due date for the next fiscal year). We measure a between the mean firm's mean market adjusted return for a period as the difference daily daily return for the firm during that period less the We equally weighted market index during that period. adjusted return by we year (1978-1985), and t-statistics calculating the first present the mean mean daily 12b-25 (Panel C), and filings Form without a 12b-25 calculate a portfolio's market adjusted return for all daily return mean daily we present the results for Form 12b-25 (Panel filings that B), delayed 10-K on the market firms in a calendar of the eight time series means in the table; using the eight time series means.'^ In Table 5 (Panel A), delayed 10-K mean we calculate observations all filings with a Form did not have 10-K filings for that fiscal year (Panel D). The results in Table 5 indicate that firms that delay a 10-K market adjusted returns during the fiscal adjusted stock return during these holding periods. more than 60 percent during the The more fiscal days. The The results in number of days mean market market adjusted return of -0.27 it in the return financial adjusted returns during the delay Table 5 indicate that firms that delay their 10-K observation by the the filing period. mean market the return holding period varies cross-sectionally (as we weight an is period; further, and researchers who use non-earnings experience negative market returns during the delay period; the -^If more negative daily year and during the 90-day statutory interesting results to practitioners filing results are quite striking for firms that delay These firms have a mean statement data to predict economic events are the period. delayed, the is on average, negative have, year and during the 90-day statutory the results indicate that the longer a 10-K filing a 10-K filing filing mean filings daily more than 17 days market adjusted returns does, for example, in the delay period), holding period. August Page: 28, 19<>2 10-K for firms with a delay between 18 and 30 days filing -0.20 percent, and more than 60 delayed 10-K filings into firms that file/do days. -0.91 percent.^ not a file is We Form -0.23 percent, between 31 and 60 also partition the 12b-25, see Panels B and C (Panel C). Firms that file in Table 5 are a Form B and C 12b-25 but did not more file a negative for firms that 10-K report subsequent to the statutory 10-K of Table results in the fourth filing column of Table more than 5 days. and 12b-25 in the year These 10-K 5 indicate that firms that delay their the 90-day statutory due date for the delayed 10-K filing filing Form the period (see Panel D). return for the period beginning the day after the 10-K receipt date 10-K a 4, 5. for that year experience even experience negative market excess returns even after the 10-K receipt date. The their file returns during the fiscal year, the statutory 10-K filing period, more negative The similar, but days, sample of firms with Consistent with our observations from the analysis of the financial characteristics in Table results in Panels 19 is mean filing daily excess and ending twelve months after reliable less than zero for firms that delay results suggest that studies that develop models to predict stock returns should consider the timing of the 10-K filing as a potential predictor variable. Taken together, the results in this section of the paper provide strong evidence that firms that extend or violate the 90-day statutory 10-K events, although some filing period on average experience unfavorable economic firms are also experiencing favorable economic events (see Figure 2). On average, however, these firms exhibit negative accounting rates of return for the fiscal year of the delayed filing and negative market adjusted stock returns during the delay period. These have implications for practitioners and researchers who develop and economic events. Not only do some firms release non-earnings 90-day statutory ^The zero. filing date, backtest models that predict financial statement data after the but these firms tend to delay the release of such information t-statistics indicate that all of these mean market results when adjusted returns are reliably less than they August Page: 28. 1992 are experiencing significant economic events, we provide evidence In this section of the study release similar information via 10-K to unless the firm satisfies one or Approximately 70 percent of the 10-K; thus, we can ARS however, firms, In the ARS filed the 10-K also the date the information with the SEC An ARS statement information is same for the that is file less likely to file ARS is the SEC with the SEC, firms that delay 10-K filing date. filing a ARS The date citing the ARS. in addition to the Form becomes filing indicates that The filing. ARS with SEC; the 10-K are more results in financial statement information disclose the ARS is publicly before ^Although not reported NASDAQ ARS with the SEC may further, conditional filing, not be the files the ARS with the SEC. in the tables, the results for firms are not as negative as the results for the NASDAQ and firms. 5; The before ARS on on or filing first an after the 32 percent have an more than 60 ARS filings; days. date that non-earnings First, a firm may Second, a firm may release separate analyses of firms are consistent with the results in Tables 4 have Table 6 indicate that firms available publicly for at least two reasons. it SEC non-earnings financial likely to file the ARS filings that also filings that arrive only 13 percent for firms delaying a 10-K by a firm files an a with the before the 10-K fihng. This percentage, however, decreases for firms with delayed 10-K is is disclosed publicly. the timely 10-K filings that also have an for example, this percentage do not with the SEC, assuming the date the year and the percent of ARS an an financial statement information first before the 10-K filed ARS Of fiscal released before the 10-K 10-K are that delay filing a filed an ARS with an filing (annual report to shareholders) two columns of Table 6 we present the distribution of 10-K first filing. file when file 10-K 10-K disclosure requirements by its provide some evidence on is ARS Firms are not required to filings. more of publicly available by examining firms that receives the that firms that delay their some other means. The competing source of information an events.^' Alternative Sources of Non-Earnings Financial Statement Information. F. SEC economic especially unfavorable 20 NYSE/ASE and NYSE/ASE results for the August 28. 1992 Page. preliminary non-earnings information before the 10-K receipt date. Althougii there empirical evidence supporting these reasons in the literature for firms that, on average, 10-K reports, there To if is no evidence address this issue, we for firms filing delayed also 10-K examined press releases some is file 21 timely reports.'" for a sub-sample of firms to ascertain the firms released non-earnings financial statement data in a press release before the 10-K receipt date. 10-K We searched the filings LEXIS/NEXIS company more than press release for file all firms that delayed their Although some of the firms 17 days for fiscal yearends after 1982.^' released income statement data in press releases before the 10-K receipt date, none of the firms released non-earnings financial statement data. This analysis provides further evidence that firms that delay their 10-K filing do not release non-earnings financial statement data before the 10-K receipt date. An even stronger test of the potential the 10-K receipt date is to their preliminary earnings earnings announcements release of non-earnings financial statement data before examine the frequency with which firms with delayed 10-K announcement. To provide some we conducted the following test. announcements from the Compustat quarterly history Compustat quarterly history CRSP, current and research files file, constructed by for their entire history insights First, file we for a contains filings omit on the omission of preliminary collected all available earnings sample of 10-K all firms on on Compustat. For a 10-K all filings. The of Compustat's filing for which there '°Dodd et al. (1984) consider the postmark date of an ARS sent to the NYSE in addition to the 10-K receipt date as the first date that non-earnings financial statement information is publicly available. We compared their sample of NYSE postmark dates to the earlier of the SEC's 10-K and ARS dates and find that the NYSE postmark date is, on average, 6.0 days before the earlier of the SECs 10-K and ARS dates. Wilson (1985) presents results from a questionnaire to firms in his sample to ascertain when firms release accounting accrual information; 13 percent of the firms responding to his questionnaire released preliminary balance sheets and six percent released fourth quarter financial statements before the release of the annual report to shareholders or the the 10-K report. Neither of these samples, however, examine firms that delay their 10-K ^'This database begins in 1983. filing filings. of August Page: :8. 1992 was no earnings announcement, we examined the earnings announcements on Compustat previous quarters for that firm to ascertain an earnings announcement on Compustat quarter of the delayed 10-K the firm;^^ then filing, it the earnings announcement was omitted. If there 22 for was in either the quarter before, or four quarters before, the we designated the missing earnings announcement as omitted by calculated the percentage of the earnings announcements that were omitted for we each of the partitions of the sample. These results (see the last two columns of Table 6) indicate that firms that delay filing a 10-K are less likely to issue a preliminary earnings announcement; further, firms that delay filing a 10-K are more 10-K likely to filings, omit the preliminary earnings announcement for the fiscal year. Of the timely only 11 percent omit the earnings announcement. This percentage, however, increases for firms with delayed 10-K filings; for example, 72 percent of the firms delaying a 10-K by more than 60 days omit the preliminary earnings announcement. Finally, of the Form we were 12b-25 able to filing for document if a firm's financial statements many of the 182 Form 12b-25 filings we were available by the date collected from the SEC. Table 7 provides information regarding the availability of non-earnings information at the date of the 12b-25 filing. We classified the information financial statements were available in from each Form 12b-25 some form by in Form one of three ways: the the 90-day statutory filing date, the financial statements were not available by that date, or the availability of the financial statements by that date could not be ascertained. financial statements that The were results in Table 7 show that only 3 percent of the sample had available by the Form 12b-25 filing date, whereas 45 percent of the sample indicated that the financial statements were not available." -'-We verified that these earnings announcements were not available in the Wall Street Journal Index for a sub-sample of observations. ^'We could not ascertain if the financial statements were available for 52 percent of the sample. August 28, 1992 Page: Conclusions and Implications. 4. In this study we present evidence statutory filing period; in fact, as statutory fiUng date. many that not all firms as 20 percent of the file 10-K 10-K reports within the 90-day filings are filed after the month period following information via other disclosures. we document In addition to the fact that not that firms that delay their 10-K filing firms all economic events, delay not is investigation of do not release timely 10-K file 10-K report are not a random sample of to 25 percent of the firms that are experiencing unfavorable firms that are experiencing favorable Our the fiscal yearend. alternative sources of this information suggests that firms that delay their reports, 90-day This result suggests that non-earnings financial statement information always available within the three this 23 firms; up economic events, and 10 percent of the their 10-K filing. On average, firms that delay their 10-K filing are small, have negative accounting rates of return, negative earnings changes, low liquidity, and high financial leverage; these firms also experience negative returns during the fiscal year, the 90-day statutory filing period, The results in this study market adjusted stock and the delay period. have implications for studies that examine the ability financial statement information to predict economic events such as audit opinions, bond returns. rating changes, mergers, typically a firm's financial distress, For example, studies that predict stock returns months after yearend, and measure future stock returns as beginning three months after the fiscal assume fiscal and stock of non-earnings that such information is available to stock market participants three yearend." The negative financial performance of firms that delay a 10-K likely that trading strategies these firms as firms to sell filing suggests that based on non-earnings financial statement information would short on the basis of information that is it is classify not available to market ^"Examples of such studies are Zmijewski (1983), Ou and Penman (1989), Holthausen and Larcker (1992), and Lev and Thiagarajan (1991); notable exceptions are Fama and French (1991) who assume that non-earnings financial statement information is not available until six months after a firm's fiscal yearend, and Sloan (1992) who conducts robustness checks by examining alternative assumptions for the public availability date of non-earnings financial statement data. August 28. 1992 Page: participants. Our results suggest that verifying the public availability of non-earnings financial statement information We also is an important consideration document that firms in the do not always follow experimental design of such studies. SEC disclosure regulations. Fewer than one-half of the firms that filed a delayed 10-K also filed the appropriate notification of late on Form 12b-25 with the SEC; interestingly, the sample of firms that filed a interesting direction for future research whether to comply with SEC is filing Form 12b-25 tend be larger and have more negative financial performance than firms that did not An 24 file a Form to 12b-25. to study the decision process firms use to decide disclosure regulations. August Page: 28, 1992 25 References M. E. Zmijewski, 1992, "Analyst following and the anomalous stock market reaction earnings announcements," Unpublished Working Paper, University of Chicago, delayed to Chicago, IL. Alford, A. and American Stock EKchangt, American Stock Exchange Company Guide, American Stock Exchange, New York, NY, 1992. E.. and S. H. Penman, 1984, "Timeliness of reporting and the stock price reaction to earnings announcements," Journal of Accounting Research 22 (Spring), 21-47. Chambers, A. Dodd, N. Dopuch, R. Holthausen. and R. Leftwich, 1984, "Qualified audit opinions and stock prices," Journal of Accounting and Economics 6, 3-38. P., Easton, P. D. and M. E. Zmijewski, 1992, "SEC Form lOK/lOQ reports and annual reports to errors," Unpublished and squared market model prediction shareholders: Reporting lags working paper. University of Chicago, Chicago, II. Fama, E. and K. French, 1991, "On the cross-section of expected stock Working Paper, University of Chicago, Chicago, IL. returns". Unpublished Holthausen, B. and D. Larcker, 1992, "The prediction of stock returns using financial statement information," Unpublished working paper. University of Pennsylvania, Philadelphia, PA. Howe, J. S. and G. G. Schlarbaum, 1986, "SEC trading suspensions: Empirical evidence," Journal of Financial and Quantitative Analysis, (21, 3), 323-333. Kross, W., 1981a. "Profitability, earnings announcement time lags, and stock prices," Journal of Business Finance and Accounting 9, 313-328. Kross, W., 1981b. "Earnings and Announcement Time Kross, W., and D. A. Schroeder, 1984, announcement timing on stock "An empirical Lags," Journal of Business Research 9, 267-281. investigation of the effect of quarterly earnings returns," Journal ofAccounting Research 22 (Spring), 153-176. Lawrence, E. C, 1983, "Reporting delays (Autumn), 606-610. for failed firms," Journal of Accounting Research 22 R. Thiagarajan, 1991, "Fundamental information analysis," Unpublished working paper. University of California at Berkeley. Lev, B. and S. National Association of Securities Dealers, Inc., National Association of Securities Dealers Manual, Commerce Clearing House, Chicago, IL, 1992. Stock Exchange, New York Stock Exchange Listed Company Manual, Exchange, New York, NY. 1992. New York New York Stock August 28. 1992 Page: Ou, J. A. and S. H. Penman, 1989, "Financial statement analysis and the prediction of stock 26 returns," Journal of Accounting and Economics, (4) 295-329. Penman, S. H., 1984, repxDrts," "Abnormal returns to investment strategies Journal of Accounting and Economics SEC V. Ener-Mark Corporation, SEC V. Unioil and William M. Mulderig, Release No. 12641. Civil 6, based on the timing of earnings 165-183. Action No. 90-1550-JHG, D.D.C., July Civil Wharton School, University of Pennsylvania, Watts, R. and J. Zimmerman, SEC Litigation Working paper. The Philadelphia, PA. United States Securities and Exchange Commission, 1974, March 1990, LR-12532. Action No. 88-2803 TPJ (D.D.C.), Sloan, R. G., 1992, "Is the market fixated on reported annual earnings," Release No. 10707, 3, Securities and Exchange Act of 1934, 29, 1974. 1986, Positive Accounting Theory, (Prentice-Hall, New York, NY). Wilson, P. 1985, "The incremental information content of accruals and cash flows after controlling for earnings. Unpublished Ph. D. Zmijewski, M. E., 1983. "A test dissertation, Carnegie-Mellon University, Pittsburgh, PA. of the incremental information content of financial statements beyond that contained in earnings numbers," in "Essays on Corporate Bankruptcy," Unpublished Ph.D. dissertation. State University of New York at Buffalo, Buffalo, NY. August Page: 28, 1992 Figure Time-Line Fiscal Yearend (t) — >|<- for the SEC Form 90 Day Filing Period -> < •• |c |<- Initial -> 12b-25 Filing Delay Period — — >|< — >| Fiscal Yearend (t-H) (t) > — 10-K Statutory Filing Date 10-K Filing | |< 1 Actual Statutory 10-K Filing Date (t) 27 > •• — > | Statutory 10-K Filing Date (t+1) <- 90 Day Filing Period -> Actual Filing to Next Due Date Due Date to Next Due Date — | >| >| — August 28. 1992 Page: Figure 2 Percentage of Delayed 10-K Filings for Portfolios Based on Annual Market Adjusted Returns 30% 28% 26% 24% 22% 20% 18% 16% 14% V I D r 12% 8% - 6% - 4% - 2% 2 3 5 6 10 7 Portfolio C1-Lowest Return) D Total Sarrple + NYSE/ASE NASDAQ 28 August 28. Page: 1992 Table 1 Distribution of 10-K Filings by 10-K Filing Delay Firms Partitioned by Stock Exchange 29 August Page: 28. 1992 Table 2 Form 12b-25 Filings by 10-K Filing Delay Firms Partitioned by Stock Exchange Distribution of Total Sample Number of 10-K Filing' Delay (DD) Panel A: 12b-25 Filings Percent of 10-K Filings'^ NYSE/ASE^ Number of 12b-25 Filings Percent of 10-K Filings NASDAQ^* Number 12b-25 Filings Distribution of 10-K Filing Delays for Firms that Filed Form 12b-25 DD <= -5 Percent of of 10-K Filings a 30 August 28. Page: 1992 Notes to Table 1 2 3 31 2. 10-K Filing Delay (DD) is the number of days between the actual 10-K the 90 day statutory filing date. filing date and The percent of 10-K filings is equal to the number of 12b-25 filings divided by number of 10-K filings for that partition in Table 1, multiplied by 100 percent. NYSE/ASE indicates firms in sample listed the on the New York Stock Exchange or American Stock Exchange. 4 NASDAQ indicates firms in sample that trade on the National Association of Security Dealers Automated Quotations System. 5 Total 12b-25 Filings w/ 10-K 10-K 6 filed by the firm for the is the same number of 12b-25 filings for which there was also a fiscal year. 12b-25 Filings w/o 10-K is the number of 12b-25 by the firm for the same fiscal year. filings for which there was no 10-K filed August 28. 1992 Page: Table 3 Description of Information in SEC Form 12b-25 Filings Significant Earnings Change for Current Year Indicated in Form 12b-25 Primary Reason Provided by Firm stated Reason for the Untimely Filing Panel A: # of Obs^ Financial Distress Debt negotiations/restructuring Bankruptcy /reorganization Poor financial condition Total Financial Distress 34 % of Obs^ Additional" Reasons Provided Neg# of Obs Row % None Pos + Row % Row % N/R Row % 32 August 4 28. 1992 Page: Neg-, None, Pos + N/R, respectively, indicate that the firm stated in the , that the firm's earnings would Form 12b-25 significantly decrease, not significantly change, significantly increase, or did not report any information relative to the previous year's earnings; present the row percent 5 # of Obs 6 % of Obs is is the (Row %) for each primary reason. number of observations providing each the percentage of 33 all reason. observations providing each reason. we August Page: 28. 1992 Table 4 Means of Firms 10-K Reports Sample Partitioned by 10-K Filing Delay Financial Characteristic Market^ 10-K Filing'' Delay (DD) Filing 34 August Notes 1 Page: 28. 1992 to Table 35 4. 10-K Filing Delay (DD) is the number of days between the actual 10-K filing date and the 90 day statutory filing date. 2 Equity is presented in millions of dollars. We measure the market value of common equity as of the end of the fiscal year. For all of the means we present in this table, we first calculate the median for a partition across observations within a calendar year (which results in eight time series medians), and then we present Mean Market Value the 3 mean 4 Change Common of the eight time series means. Return on common of common equity is net income divided by in EPS by price is Debt 6 Mean equity; firms with negative the change in earnings per share after extraordinary items divided by the stock price at the beginning of the 5 common equity were deleted from the sample. to total assets is total debt divided fiscal year. by total assets. correlation between delay and characteristic is calculated by first calculating the rank order correlation between the 10-K filing delay and the financial characteristic in each of the eight calendar years, and then we present the mean of the eight time series means. We use the time series of eight correlations to calculate a t-statistic to test the null hypothesis that the mean correlation is equal to zero; "*" indicates that the null hypothesis can be rejected at five percent level of confidence. August 28, 1992 Page: Table 5 Mean Daily Market Adjusted Stock Returns of Firms Filing 10-K Reports Sample Partitioned by 10-K Filing Delay 10-K Filing'' Delay (DO) 36 August 28. 1992 Notes 1 to Page: Table 37 5. 10-K Filing Delay (DD) is number of days between the the actual 10-K filing date and the 90 day statutory filing date. 2 Fiscal year of delayed fiscal year. For all mean daily market adjusted stock return means we present in this table, we first calculate 10-K of the is the during the the mean for a partition across observations within a calendar year (which results in eight time series means), and then we present the mean of the eight time series means. We use the time series of eight means to calculate a t-statistic to test the null hypothesis that the mean is equal to zero; "*" indicates that the null hypothesis can be rejected at five percent level of confidence. 3 90 day statutory filing period begins on the day after the fiscal yearend and ends at the 90 day statutory due date. 4 Delay period begins on the day after the 90 day statutory filing period and ends on the actual 10-K filing date. This return holding period varies across 10-K filings and does not exist for timely 10-K filings. 5 Actual filing to next due date period begins on the day after the actual filing date and ends on the 90 day statutory filing date for the next fiscal year. This return holding period is equal to one year (beginning three months after the fiscal yearend) less the delay period, which is equal to one year for timely 10-K filings. 6 Due date to next due date period begins on the day after the 90 day statutory filing date year. and ends on the 90 day statutory filing date for the next fiscal This return holding period is equal to one year (beginning three months after the fiscal yearend), which for the current fiscal year is equal to the sum of the return holding periods of the previous two columns. 7 There were 151 Form 12b-25 filings without 10-K indicates that a the return holding period is filings for that fiscal year. N/R not relevant for a particular partition. August Page: 28, 1992 Table 6 Frequency and Timing of Annual Reports to Shareholders Preliminary Earnings Announcements 10-K Filing'' Delay (DD) and 38 August Page: 28. 1992 Table 7 Financial Statement Availability Indicated in Form 12b-25 Filings Financial Statements^ Available by Statutory Filing Date Not Stated Reason for the' Untimely Filing Financial Distress Panel A: Debt negotiations/restructuring Bankruptcy/ reorganization Poor financial condition Total Financial Distress Accounting/Auditing Issues Panel B: Accounting issue/problems Delay in obtaining information Information needed from 3rd party Audit related delay Investigating numbers Total Accounting/Auditing Issues Total Asset Acquisitions/Dispositions Other Panel D: Changes in top executives Printing delays Litigation/regulation related Review/signature of officers/directors Need registration statement approval Labor/employee related Miscellaneous Total Other All Observations Notes 1 to Table 7 Avail Avail N/R Row % Row % Row % 3 39 Date Due Lib-26-67 MM l'PR'^'^a,,?|||li« c^OaO 00721216 3