For the purposes of this tutorial, we will focus on researching Coca

advertisement

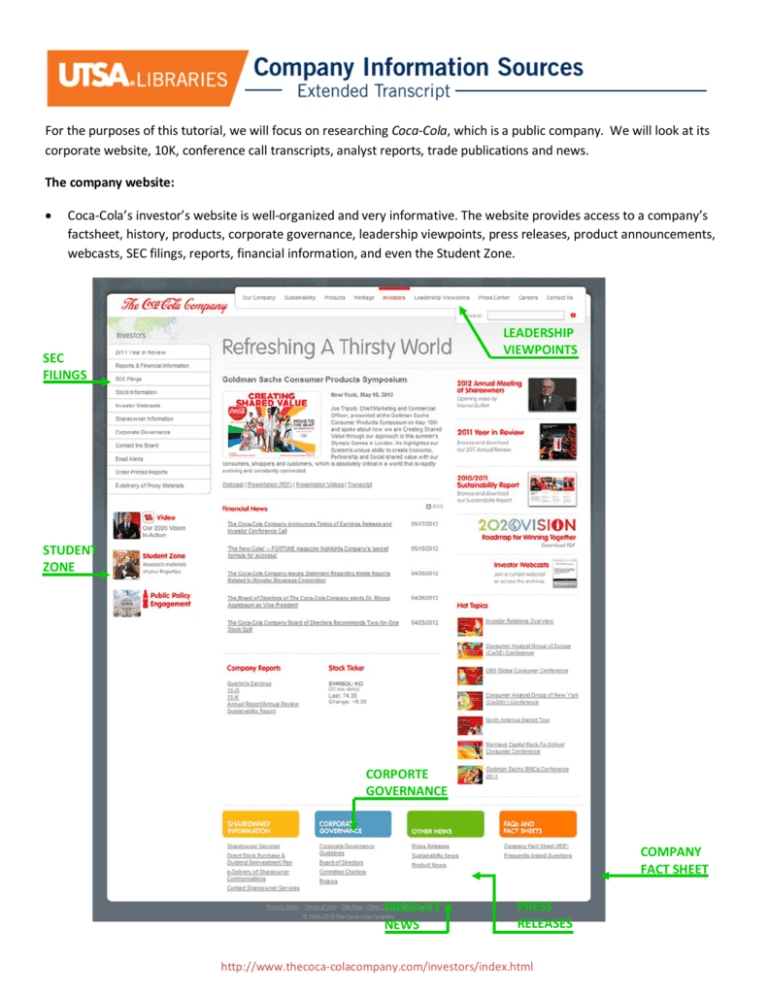

For the purposes of this tutorial, we will focus on researching Coca-Cola, which is a public company. We will look at its corporate website, 10K, conference call transcripts, analyst reports, trade publications and news. The company website: • Coca-Cola’s investor’s website is well-organized and very informative. The website provides access to a company’s factsheet, history, products, corporate governance, leadership viewpoints, press releases, product announcements, webcasts, SEC filings, reports, financial information, and even the Student Zone. LEADERSHIP VIEWPOINTS SEC FILINGS STUDENT ZONE CORPORTE GOVERNANCE COMPANY FACT SHEET PRODUCT NEWS PRESS RELEASES http://www.thecoca-colacompany.com/investors/index.html • As a public company, Coca-Cola has to comply with the Securities and Exchange Commission’s requirements and file a number of financial statements. The two most frequently used financial statements are the 10-K and 10-Q. The 10K is an annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. All 10-Ks have a standard structure. CLICK CLICK TO DOWNLOAD PDF • From the PDF copy, review the Table of Contents for this 10-K, specifically items 1A Risk Factors, 1B Unresolved Staff Comments, 7 Management Discussion and Analysis, 7A Quantitative and Qualitative Disclosures about Market Risk, 15 Financial Statement Schedules. An easy way to scan a 10-K document is to use CTRL+F to find relevant words in a context. • The 10-Q is a quarterly report and can also be found on the investors website. Find a company’s 10-K: On the company’s investor relations website, in SEC’s Edgar database http://www.sec.gov/edgar/searchedgar/companysearch.html or in UTSA subscription databases http://webapp.lib.utsa.edu/Databases/ Conference Calls Earnings or Conference Calls are lengthy conversations over the phone or the Internet between a company's top management, financial analysts tracking this company and institutional investors. Most conference calls are conducted immediately following a financial results news release. Management details a company's financial performance, lists the factors influencing those results and offers some comments on industry trends and long-term strategies. This initial briefing is followed by a questionand-answer session that allows analysts to gain additional information. The SEC encourages companies to extend conference call availability to individual shareholders and the media alike. More than 80 percent of public companies conduct quarterly conference calls. Find webcasts to listen: on a company investor relations website, or Yahoo Finance yahoo.com/finance Find transcripts to read: At Seeking Alpha http://seekingalpha.com In Thomson One Investment Banking, UTSA subscription database http://webapp.lib.utsa.edu/cgibin/db.cgi?DB=TOInv (Internet Explorer only). 1. On the left bottom menu click on Screening and Analysis 2. Click Research, then + symbol, and now Research Search 3. Enter the company name under Search Options and click the Search button. On the result list look for contributor Thomson Reuters Streetevents. COMPANY NAME THOMSON REUTERS STREETEVENTS CONTRIBUTOR Explore the Company Research Guide for more information: http://libguides.utsa.edu/company_research