• If an item is priced at £100 before VAT,... cost £117.50, including VAT at 17.5%. This is

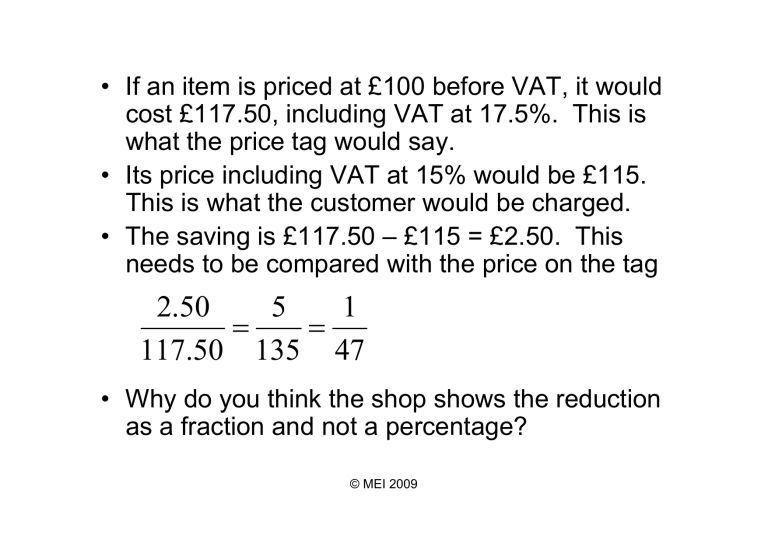

• If an item is priced at £100 before VAT, it would cost £117.50, including VAT at 17.5%. This is what the price tag would say.

• Its price including VAT at 15% would be £115.

This is what the customer would be charged.

• The saving is £117.50 – £115 = £2.50. This needs to be compared with the price on the tag

2.50

=

5

=

1

117.50

135 47

• Why do you think the shop shows the reduction as a fraction and not a percentage?

© MEI 2009

Teachers’ notes

Links

Students need to have met the idea of VAT and working with percentages before doing this. It could be used at the end of a lesson on VAT, at the start of a lesson on using multipliers for percentages or in a revision lesson.

• Another way to show that it is 1/47 is to start with price P ; the saving is

1.175P – 1.15P = 0.025P.

• As a fraction, the saving is

0.025

P

=

25

=

1

1.175

P 1175 47

• This does not work out nicely as a percentage and it is not 2.5%

(as some people thought it should be when the VAT rate changed).

© MEI 2009