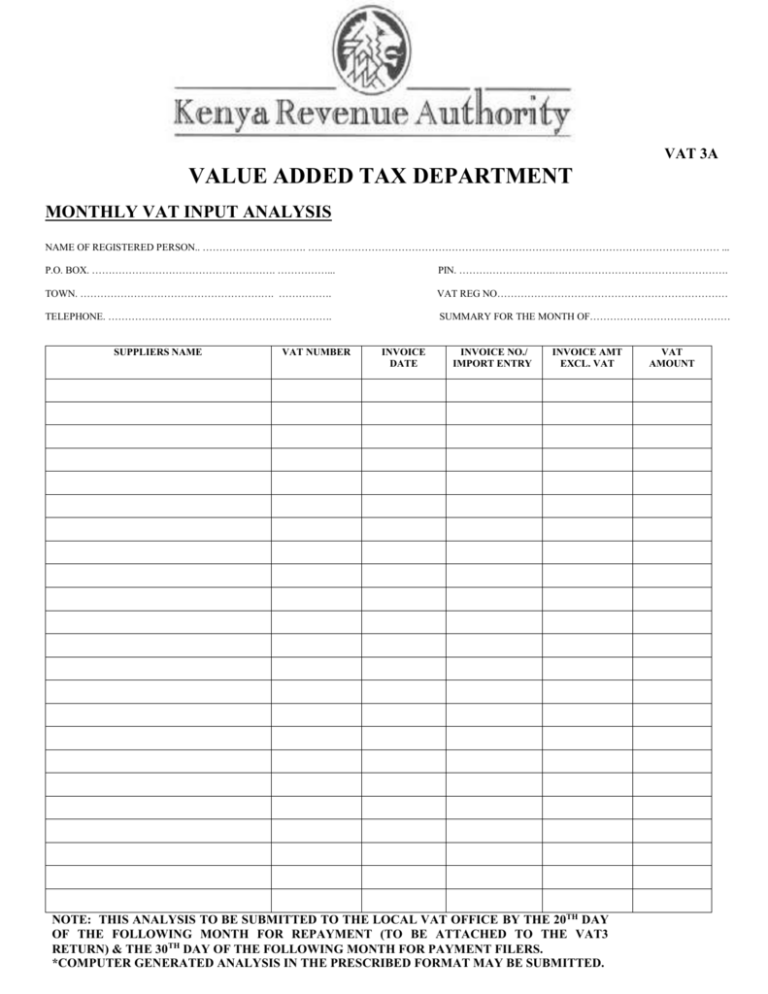

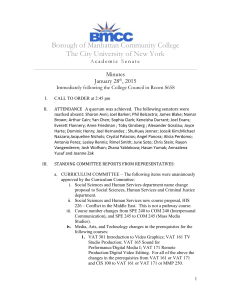

V.A.T. 3A

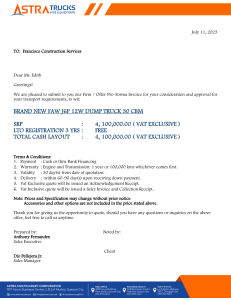

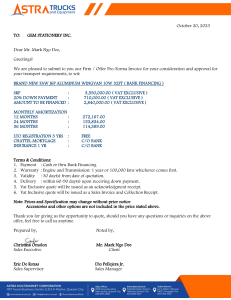

advertisement

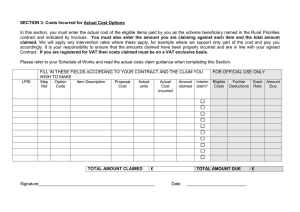

VAT 3A VALUE ADDED TAX DEPARTMENT MONTHLY VAT INPUT ANALYSIS NAME OF REGISTERED PERSON.. …………………………. …………………………………………………………………………………………………………… ... P.O. BOX. ………………………………………………. ……………... PIN. ……………………….….…………………………………………. TOWN. …………………………………………………. ……………. VAT REG NO…………………………………………………………… TELEPHONE. …………………………………………………………. SUMMARY FOR THE MONTH OF…………………………………… SUPPLIERS NAME VAT NUMBER INVOICE DATE INVOICE NO./ IMPORT ENTRY INVOICE AMT EXCL. VAT NOTE: THIS ANALYSIS TO BE SUBMITTED TO THE LOCAL VAT OFFICE BY THE 20TH DAY OF THE FOLLOWING MONTH FOR REPAYMENT (TO BE ATTACHED TO THE VAT3 RETURN) & THE 30TH DAY OF THE FOLLOWING MONTH FOR PAYMENT FILERS. *COMPUTER GENERATED ANALYSIS IN THE PRESCRIBED FORMAT MAY BE SUBMITTED. VAT AMOUNT Continued overleaf TOTAL (SHOULD AGREE WITH RETURN TOTALS) PREPARED BY ………………………………… DESIGNATION……………………………………….. SIGNED. ………………………………………… DATE. ………………………………………………….

![Facilities Claim Form [docx / 210KB]](http://s3.studylib.net/store/data/009702131_1-a76a963067a4586a4f8f1bca351ecaf7-300x300.png)