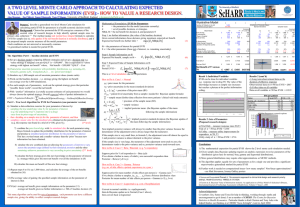

Expected Value of Sample Information

advertisement

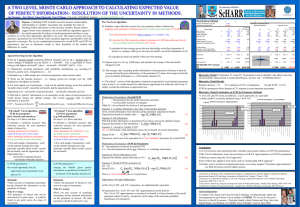

A Two Level Monte Carlo Approach

To Calculating

Expected Value of Sample Information:How to Value a Research Design.

Alan Brennan

and

Jim Chilcott, Samer Kharroubi, Tony O’Hagan

University of Sheffield

IHEA June 2003

What are EVPI and EVSI?

Adoption Decision

Choose policy with greatest expected ‘payoff’

Uncertainty

Confidence interval e.g.

|--------[]---------|

implies Adoption Decision could be wrong

Perfect Information

perfect knowledge about parameter e.g.

Value of

Information

Expected Value of

Information

[]

quantify additional payoff obtained by switching

adoption decision after obtaining additional data

quantify average additional payoff obtained for

range of possible collected data

EVPI

Expected value of obtaining perfect knowledge

EVSI

Expected value of obtaining a specific sample size

Typical Process

Net benefit of alternative policies

Illustrative Model

a

Mean Model

Cost of drug

% admissions

Days in Hospital

Cost per Day

£

£

% Side effects

Change in utility if side effect

Duration of side effect (years)

£

Total QALY

Probabilistic

Sensitivity Analysis

d

e

Uncertainty in Parameter Means

Standard Deviations

Increment

Mean Model

T0

T1 (T1 over T0)

Cost of£drug 1,500 £

1,000

500

%

admissions

10%

8%

-2%

Days in Hospital6.10

5.20

0.90

Cost

400 per

£ Day

400 £

-

%

Responding 80%

70%

Utility change0.3000

if respond

0.3000

Duration

of response

3.0

3.0 (years)

% Responding

Utility change if respond

Duration of response (years)

Total Cost

Illustrative

Model

b

c

Number of Patients in the UK

1,000

Threshold cost per QALY

£10,000

Number of Patients in the UK

Threshold cost per QALY

T0

1

2%

1.00

200

Sampled Values

T1

1 £

2%

1.00

200 £

T0

1,000 £

10%

5.01

589 £

Increment

T1 (T1 over T0)

1,499 £

499

11%

0%

7.05

2.05

589 £

-

10%

-

10%

0.1000

0.5

10%

0.0500

1.0

88%

0.3119

3.1

70%

0.2120 4.1

%

Side effects 20%

25%

-5%

Change in utility -0.10

if side effect

-0.10

0.00

Duration of side 0.50

effect (years) 0.50

10%

0.02

0.20

5%

0.02

0.20

31%

-0.06

0.70

24%

-0.14

0.65 -

Total Cost

1,208

£

1,695

Total QALY

0.6175

0.7100

0.0925

Cost per

1,956

£ QALY 2,388

£5,267

£

£

487

Cost per QALY

£

Net Benefit of T1 versus

T0

Net Benefit of T1 versus

T0 £ 5,405 £437.80

£ 4,967

1,308

£

0.8394

£

1,558

£

£7,086

1,937

-18%

0.0998

1.0

-7%

-0.08

0.05

£

629

0.5948

-0.2446

3,256

-£2,570

£4,011

-£3,075

e.g. 1,000 samples …

C-E plane

Cost Effectiveness Acceptability of T1 versus T0

£2,000

100%

CEACs

£1,500

£1,000

90%

80%

70%

Probability Cost Effective

Model

Inc Cost

£500

£0

-1.4

-1.2

-1

-0.8

-0.6

-0.4

-0.2

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

-£500

60%

T1

50%

T0

40%

30%

-£1,000

20%

10%

-£1,500

0%

-£2,000

£-

£20,000

£40,000

Inc QALY

identify single or

groups of parameters

£80,000

£100,000

£120,000

Threshold (MAICER)

EVPI

£1,400

Value of Information

Partial EVPIs

£60,000

£1,200

£1,000

£800

£600

£400

£200

£-

All Six

Trial +

Utility

Utility

Study

Trial on %

Response

propose specific data collections (n)

calculate expected value

of different samples

EVI for % Responders to T0

Value of Information

Partial EVSIs

Durations

250

200

150

EVSI (n)

EVPI

100

50

0

0

50

100

Sample Size (n)

150

200

£140,000

d

NB(d, )

i

-i

= uncertain model parameters

= set of possible decisions

= net benefit (λ*QALY – Cost) for decision d, parameters

= parameters of interest – possible data collection

= other parameters (not of interest, remaining uncertainty)

Expected net benefit

(1) Baseline decision

=

max E NB(d, )

d

(2) Perfect Information on i

=

Partial EVSI = (3) – (1)

d

two expectations

Partial EVPI = (2) – (1)

(3) Sample Information on i

E i max E i NB(d, ) | i

=

E X max E i NB(d, ) | i

d

Expected Value of Sample Information

0)Decision model, threshold, priors for uncertain parameters

1) Simulate data collection:

• sample parameter(s) of interest once ~ prior

• decide on sample size (ni)

(1st level)

• sample the simulated data | parameter of interest

2) combine prior + simulated data --> simulated posterior

3) now simulate 1000 times

parameters of interest ~ simulated posterior

unknown parameters ~ prior uncertainty (2nd level)

4) calculate best strategy = highest mean net benefit

5) Loop 1 to 4 say 1,000 times Calculate average net benefits

6) EVSI parameter set = (5) - (mean net benefit | current information)

e.g. 1000 * 1000 simulations

Bayesian Updating: Normal

Prior

0= mean, 0= uncertainty in mean (standard deviation)

I 0 1 / 02 = precision of the prior mean

2pop = patient level uncertainty ( needed for update formula)

Simulated Data

X

= sample mean (further data collection e.g. clinical trial ).

2 2pop / n = sample variance

I s 1 / 2

= precision of the sample mean .

Simulated Posterior

N(1, 1 )

2

/n 2

0 0 s

pop

2

0

1 2

1

2

/

n

0 s

0

pop

Normal Posterior Variance – Implications

2

/n 2

pop

2

0

1 2

2 / n

pop

0

.

• 1 always < 0

• If n is very small, 1 = almost 0

• If n is very large, 1 = almost 0

Normal Bayesian Update (n=50)

Prior

Frequency (1000 samples)

300

250

Posterior after

sample 1

200

150

Posterior after

sample 2

100

Posterior after

sample 7

50

0

0%

20%

40%

60%

Response Rate (T0)

80%

100%

Bayesian Updating: Beta / Binomial

• e.g. % responders to a treatment

Prior

• % responders ~ Beta (a,b)

Simulated Data

• n cases,

• y successful responders

Simulated Posterior

• % responders ~ Beta (a+y,b+n-y)

Bayesian Updating: Gamma / Poisson

e.g. no. of side effects a patient experiences in a year

Prior

side effects per person

~ Gamma (a,b)

Simulated Data

• n samples, (y1, y2, … yn)

• from a Poisson distribution

Simulated Posterior

• mean side effects per person ~ Gamma (a+ yi , b+n)

Bayesian Updating without a Formula

• WinBUGS

• Put in prior distribution

Conjugate Distributions

Beta

Inverted Beta

• Put in data

Cauchy 1

Cauchy 2

• MCMC gives posterior

Chi

(‘000s of iterations)

Chi² 1

• Use posterior in model

Chi² 2

• Loop to next data sample Erlang

Expon.

Fisher

Gamma

• Other approximation methods

Inverted Gamma

Gumbel

Laplace

Logistic

Lognormal

Normal

Pareto

Power

Rayleigh

r-Distr.

Uniform

Student

Triangular

Weibull

EVSI Results for Illustrative Model

Value of Information

EVI for % Responders to T0

250

200

150

EVSI (n)

EVPI

100

50

0

0

50

100

Sample Size (n)

150

200

Common Properties of EVSI curve

• Fixed at zero if no sample is collected

• Bounded above by EVPI, monotonic, diminishing returns

? EVSI (n) = EVPI * [1 – exp -a*sqrt(n) ]

EVI for % Responders to T0

Value of Information

EVSI = EVPI * [1-

EXP( -0.3813 * sqrt(n) ]

250

200

EVSI (n)

150

EVPI

100

50

Exponential fit

0

0

50

100

150

Sample Size (n)

200

Correct 2 level EVPI Algorithm

0)Decision model, threshold, priors for uncertain parameters

1) Simulate data collection:

• sample parameter(s) of interest once ~ prior

• decide on sample size (ni)

(1st level)

• sample the simulated data | parameter of interest

2) combine prior + simulated data --> simulated posterior

3) now simulate 1000 times

fixed at sampled value

parameters of interest ~ simulated posterior

unknown parameters ~ prior uncertainty (2nd level)

4) calculate best strategy = highest mean net benefit

5) Loop 1 to 4 say 1,000 times Calculate average net benefits

6) EVPI parameter set = (5) - (mean net benefit | current information)

e.g. 1000 * 1000 simulations

Shortcut 1 level EVPI Algorithm

1) Simulate data collection:

• sample parameter(s) of interest once ~ prior

• decide on sample size (ni)

(1st level)

• sample the simulated data | parameter of interest

2) fix remaining unknown parameters

2) combine prior + simulated data --> simulated posterior

constant at prior mean value

3) now simulate 1000 times

E i maxofNB(d,

i~| simulated

parameters

interest

i i )posterior

d

unknown parameters ~ prior uncertainty (2nd level)

4) calculate best strategy = highest mean net benefit

5) Loop 1 to 4 say 1,000 times Calculate average net benefits

6) EVPI parameter set = (5) - (mean net benefit | current information)

Accurate

if .. (a) net benefit functions are linear functions of the -i for all d,i,

and (b) i and -i are independent.

How many samples for convergence ?

E V P I e s tim a te s - Im p a c t o f M o re S a m p le s

600

550

5 5 0 -6 0 0

500

5 0 0 -5 5 0

450

400

4 5 0 -5 0 0

350

4 0 0 -4 5 0

300

3 5 0 -4 0 0

250

3 0 0 -3 5 0

£334

200

2 5 0 -3 0 0

150

2 0 0 -2 5 0

100

•

•

500

750

1000

2000

5000

1000

10000

750

500

100

10

K - o u te r le ve l

10

100

1 5 0 -2 0 0

50

0

1 0 0 -1 5 0

5 0 -1 0 0

0 -5 0

J - in n e r le ve l

outer level - over 500 samples, converges to within 1%

inner level - required 10,000 samples, to converge to within 2%.

How wrong is US 1 level EVPI approach

for a non-linear model?

• E.g – squared every model parameter

• Adjusted R2 for simple linear regression = 0.86

Part b: Comparison of 1 Level US versus 2 Level US in the Two Models

150

100

Linear Model

Non-linear Model

50

T r ia l

U tility O n ly

Difference

0

T r ia l + U tility

-5 0

D u r a tio n s

-1 0 0

Main Illustrative Model

-1 5 0

-2 0 0

-2 5 0

2nd Model (non-linear)

Maximum of Monte Carlo Expectations:Upward Bias

• simple Monte Carlo estimates are unbiased

• But, bias occurs when use maximum of Monte Carlo estimates.

E{max(X,Y)} > max{E(X),E(Y)}.

E.g. X ~ N(0,1), Y ~ N(0,1)

• E{max(X,Y)} = 1.2 ,

max{E(X),E(Y)} = 1.0

• If variances of X and Y reduces to 0.5, E{max(X,Y)} = 1.08

• E{max(X,Y)} continues to fall variance reduces, but stays > 1.0

1

Partial EVPI =

K

1

max

d 1toD J

k 1

K

NBd ,

J

j 1

i

j

i

i

k

1 L

NB(d, l )

- dmax

1toD L

l 1

• Illustrative model:- 1000*1000 not enough to eliminate bias.

• Increasing no. of samples reduces bias, since it reduces the

variances of the Monte Carlo estimates.

Computation Issues: Emulators

•

Gaussian Processes (Jeremy Oakley, CHEBS)

•

•

•

F() ~ NB(d, )

Bayesian non-linear regression (complicated maths)

Assumes only a smooth functional form to NB(d, )

Benefits

1. Can emulate complex time consuming models with formula

i.e. speed up each sample

2. Can produce a quick approximation to inner expectation for

partial EVPI

3. Similar quick approximation for partial EVSI

but only for one parameter

Summary

1. 2 level algorithm for EVPI and EVSI is correct approach

2. Bayesian Updating for Normal, Beta, Gamma OK

Others – WinBUGS / approximations

3. There are issues of computation

4. Shortcut 1 level EVPI algorithm is accurate if …

(a) net benefit functions are linear and

(b) the parameters are independent.

5. Emulators (e.g. Gaussian Processes) can be helpful