Case study slides

advertisement

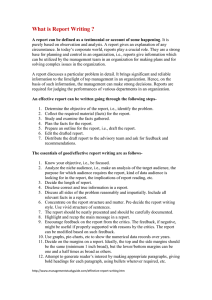

Capital One: Leveraging Information-Based Marketing Case Study MIS 3090: Spring 2008 Capital One - Background • 2004 case • CO founded in 1988 by Richard Fairbank and Nigel Morris as a spinoff from Signet Bank • Located in Mclean, VA • Focused on consumer credit lending – Pioneered mass customization, innovative products – Huge growth throughout the 90s Case Questions - 1 • How do credit card companies (e.g., Citi, Capital One, MBNA, First USA, etc.) make money? If I pay my balance in full at the end of each month, say it’s $3,000 on average each month for an entire year (meaning I chalk up $36,000 in transactions annually), how can the credit card company profit from my business? Case Questions - 2 • Credit card companies are exposed to type I and type II errors (these are terms from statistics) in their dealings with customers. Interpret these two error types; what do they mean, and how has technology allowed firms like Capital One to minimize the risk of committing both types of errors. Can errors of either type be completely eliminated – what technology would you need for this to occur? In terms of Capital One’s global market operations (including countries or regions that they may have earmarked for launch and expansion), would the same technology solutions work across all markets? Why or why not? Case Questions - 3 “Credit cards seemed like the perfect place to start riding the macro-trends of direct marketing and of technology – the increase in computer speed, power, and memory that offered companies the ability to record, organize, and analyze data on the characteristics and behavior of their customers.” What opportunities / threats has the Internet created for credit card companies? How have these companies reacted? How have smart cards been received by the public – for examples, see Blue or the Visa Smart Card. What is the current status of stored-value cards like your Villanova student card (for meals) or the Starbucks card? Case Questions - 4 According to the case, merchants pay as much as 2.2% of the transaction value in fees – sometimes it may be even higher for Discover, Diners and other cards. In firms with tight margins, this could be a very high cost of doing business – you could have a problem, for example, if your margin is less than 2.2%. Without having to insist that customers use checks or cash, or impose a minimum charge for all credit card transactions, are there any B2C or B2B solutions that would help merchants to continue to accept credit cards even in the face of very tight margins? Capital One – Current Update • • • • • Auto Loans? Credit crunch? Other products? Global growth? Overall prospects?