Capital Structure and Valuation

advertisement

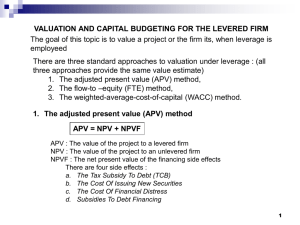

8-1 Capital Structure and Valuation 8-2 Example Current Proposed $8,000 $8,000 $0 $4,000 $8,000 $4,000 10% 10% Share Price $20 $20 Outstanding 400 200 Assets Debt Equity Interest Capital Structure Current 8-3 ROA Earnings ROE EPS Recession 5% $400 5% $1.00 Expected 15% $1,200 15% $3.00 Expansion 25% $2,000 25% $5.00 ROA EBI Interest Earnings ROE EPS 5% $400 400 $0 0% $0 15% $1,200 400 $800 20% $4.00 25% $2,500 400 $1,600 40% $8.00 Proposed Miller and Modigliani: Proposition I 8-4 Strategy A: Buy 100 shares of levered equity Recession Expected Earnings $0 $400 Initial Cost: 100 x $20 = $2,000 Expansion $800 Strategy B: Buy 200 shares of unlevered equity using $2,000 in borrowing (Homemade Leverage) Earnings $200 $600 Interest $200 $200 Net Earnings $0 $400 Initial Cost: 200 x $20 -$2,000 = $2,000 $1,000 $200 $800 Proposition I (no taxes): Value of the unlevered firm is equal to the value of the levered firm Miller and Modigliani: Proposition II (no taxes) 8-5 Remember: rWACC = D/A × rD + E/A × rE MM(I) implies rWACC is independent of leverage Define r0 is cost of capital for all-equity firm r0 = unlevered earnings / unlevered equity =15% Result: r0=rWACC if there are no taxes Result: MM(II) (no taxes): rE = r0 + D/E × (r0 – rD) Cost of Capital and MM(2) Cost of Capital (%) rE r 0 rWACC rD D/E 8-6 Taxes Present value of the tax shield Interest = rD × D Tax reduction = Tc × rD × D Under normal circumstances we can assume: cash flow from tax reduction has same risk as debt cash flows are perpetual PV(Tax Shield) = (Tc × rD × D) / rD = Tc × D MM(I): VL = VU + Tc × D VU = (EBIT × (1 – Tc)) / r0 8-7 MM(2): rE = r0 + D/E × (1-Tc) (r0 – rD) Cost of Capital (%) r 0 8-8 rE A declining rWACC is a direct result from MM(I), i.e, the value of the firm rises in leverage rWACC rD D/E Example 8-9 Blue Inc. has no debt and is expected to generate $4 million in EBIT in perpetuity. Tc=30%. All after-tax earnings are paid as dividends.The firm is considering a restructuring, allowing $10 million in debt at an interest rate of 8%. The unlevered cost of equity, r0, is 18%. What is the current value of Blue? VU=EBIT × (1–Tc) / r0 = ($4 million × 0.7) / 0.18 = $15.56 million What will the new value be after the restructuring? VL = VU + Tc × D = $15.56 + 0.3 × $10 = $18.56 million What will the new required return on equity be? rE = 0.18 + (10/8.56) × 0.7 × (0.18 – 0.08) = 26.18% Check with: Elevered = ((4 – 0.8) × 0.7) / 0.2618 = $8.56 million How about using rWACC? 8-10 rWACC = (10/18.56) × 0.7 × 0.08 + (8.56/18.56) × 0.2618 = 15.08% Hence, Blue has decreased its WACC from 18% to 15.08% VL = (4 × 0.7) / 0.1508 = $18.56 million Downside of Debt Financial Distress and Agency Costs 8-11 Financial Distress costs decrease the size of the firm and hence decrease the distribution to shareholders and bondholders. Costs Direct costs of financial distress Indirect costs of financial distress Agency costs (of debt) Asset substitution and risk shifting Underinvestment Milking the company 8-12 Static trade-off theory of debt Firm Value Maximum Firm Value Actual Firm Value Debt Optimal amount of Debt More on Agency Costs Benefits of debt 8-13 Agency cost of Equity (motive) Shirking is less likely when issuing debt Perquisites are less likely with debt Over-investment is less likely with debt Agency cost of Free Cash Flow (opportunity) Retained earnings versus dividends? Growth and investment opportunities Debt serves as a monitoring device, decreasing managerial discretion The Pecking-Order Theory Internal Financing External Financing Debt Financing Equity Financing (last resort) Asymmetric information and Signaling Dynamic decision, rather than static 8-14 Valuation Weighted Average Cost of Capital All Cash Flows discounted by discount rate that takes into account leverage Adjusted Present Value Separate cash flows from project and cash flows from financing Flow-to-Equity Approach Cash flows to equity holders discounted by the cost of equity 8-15 Example 8-16 You are considering a project with the following characteristics: Perpetual cash inflows starting in year 1 of $25,000 per year Yearly operating expenses of 12% of revenues Initial investment outlay of $125,000 Tc=34% and r0=14%, rD=8% Calculate the NPV for an all-equity firm Calculate the NPV for a firm with a target capital structure of 65% debt and 35% equity Use WACC method Use APV method Use FTE method Answers Unlevered firm valuation To the shareholders Cash Inflows $25,000 Operating Expenses $ 3,000 Operating Income $22,000 Tax $ 7,480 Unlevered Cash Flow (UCF) $14,520 NPV = –$125,000 + ($14,520 / 0.14) = –$21,286 8-17 Answer WACC rWACC = (D/V) × (1–Tc) × rD + (E/V) × rE rWACC = (0.65) × (1– 0.34) × 0.08 + (0.35) × rE rE = r0 + (D/E) × (1 – Tc) × (r0 – rD) rE = 0.14 + (65/35) × (1 – 0.34) × (0.06) = 0.2135 = 21.35% rWACC = (0.65) × (1– 0.34) × 0.08 + (0.35) × 0.2135 = 10.906% NPV = –$125,000 + ($14,520 / 0.10906) = $8,138 8-18 Answer APV 8-19 NPV of Financing Side Effects APV = NPV + NPVF NPVF = Tc × D APV = –$21,286 + (0.34 × 0.65 × (APV + $125,000)) 0.779 × APV = $6,339 APV = $8,138 Verify the target capital structure: Firm borrows 0.65 × ($125,000 + $8,138) Firm borrows 0.65 × $133,137 = $86,539.52 Firm uses $125,000 – $86,539.52 = $38,460.48 in equity Answer 8-20 VL = VU + Tc × D VL = 125,000 – 21,286 + 0.34 × 0.65 × VL VL = 133,138 D = 0.65 × 133,138 FTE method To the shareholders Cash Inflows Operating Expenses Operating Income Interest (8% of $86,539.52) Income after interest Tax Levered Cash Flow (LCF) $25,000 $ 3,000 $22,000 $ 6,923 $15,077 $ 5,126 $ 9,951 From before, rE = 21.35% and PV = $9,951 / 0.2135 = $46,609 NPV = – $38,460 + $46,598 = $8,138 Evaluation 8-21 Valuation for all-equity firm is easy Valuation for levered firm is complex tax shields bankruptcy, agency, and other costs WACC, APV, and FTE method constant risk over life of project (constant r0) constant debt/value ratio over life of project (constant rE and rWACC) FTE and WACC work well under this scenario if debt/value ratio is changing use APV (based on the level of debt) APV works well for LBO’s and cases with interest subsidies and flotation costs (see example in Appendix 17A). Beta revisited Remember the following: Levered Equity = L = Unlevered Assets × (1 + (D/E)) Assumes Debt = 0 and no corporate taxes With corporate taxes (assume Debt = 0): L = U × [1 + (1–Tc) × (D/E)] Unlevered Firm < Levered Equity Remember: RE > R0 > RD 8-22 What if Beta of debt 0? L = U + [(1–Tc) × (U – D) × (D/E)] L = levered equity U = unlevered equity (100% equity firm) D = debt E = equity 8-23