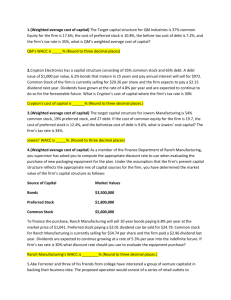

Part 4 - Firm Cost of Capital

advertisement

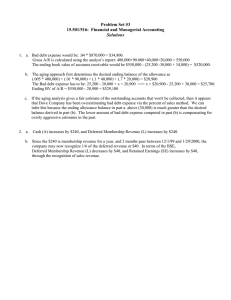

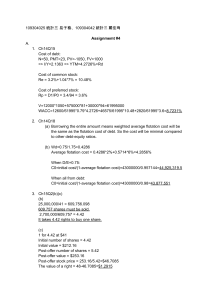

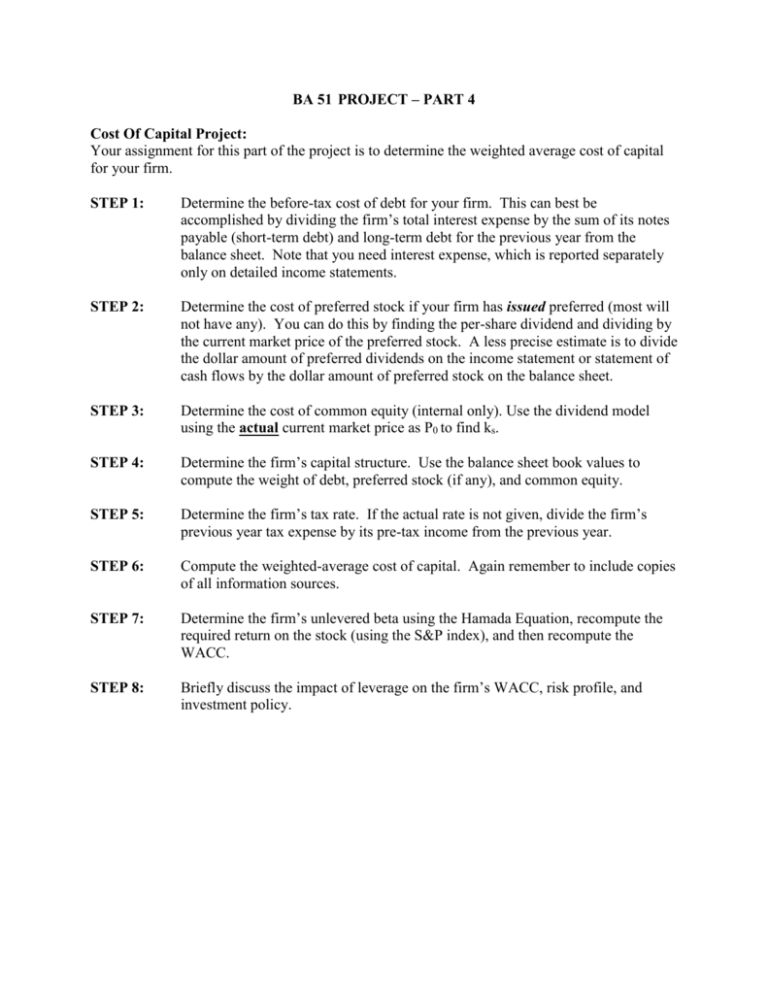

BA 51 PROJECT – PART 4 Cost Of Capital Project: Your assignment for this part of the project is to determine the weighted average cost of capital for your firm. STEP 1: Determine the before-tax cost of debt for your firm. This can best be accomplished by dividing the firm’s total interest expense by the sum of its notes payable (short-term debt) and long-term debt for the previous year from the balance sheet. Note that you need interest expense, which is reported separately only on detailed income statements. STEP 2: Determine the cost of preferred stock if your firm has issued preferred (most will not have any). You can do this by finding the per-share dividend and dividing by the current market price of the preferred stock. A less precise estimate is to divide the dollar amount of preferred dividends on the income statement or statement of cash flows by the dollar amount of preferred stock on the balance sheet. STEP 3: Determine the cost of common equity (internal only). Use the dividend model using the actual current market price as P0 to find ks. STEP 4: Determine the firm’s capital structure. Use the balance sheet book values to compute the weight of debt, preferred stock (if any), and common equity. STEP 5: Determine the firm’s tax rate. If the actual rate is not given, divide the firm’s previous year tax expense by its pre-tax income from the previous year. STEP 6: Compute the weighted-average cost of capital. Again remember to include copies of all information sources. STEP 7: Determine the firm’s unlevered beta using the Hamada Equation, recompute the required return on the stock (using the S&P index), and then recompute the WACC. STEP 8: Briefly discuss the impact of leverage on the firm’s WACC, risk profile, and investment policy.