SOLVAY BUSINESS SCHOOL

advertisement

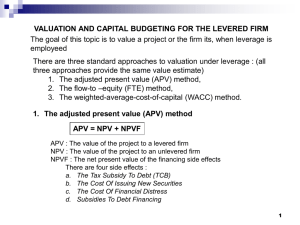

SOLVAY BUSINESS SCHOOL MBA Finance André Farber CHEM-CAL CORPORATION The main issue raised in the case is to find a cutoff rate to be used for the analysis of investment projects. Mr Cochran is willing to apply what he learned recently in a management program. Unfortunately, there is room for improvement in his grasp of finance. Moreover, since 1979, academic have gained a better understanding of the issues raised in the case: they now more cautious about using the textbook weighted average of capital. The current capital structure of Chem-Cal is the following (to simplify the analysis, preferred stocks are included in debt): Exhibit 1: Current capital structure (USD millions) Book value Equity 80 Debt 35 Total 115 Market value 50 30 80 % 63% 37% Notice that the company is not in excellent shape: market value of equity is less then book value. The first step is to calculate the cost of equity. A starting point (in the absence of data about the beta of the stocks) is the current stock price ($25) relative to EPS ($4.25). Assuming that the present value of growth opportunity is zero: P EPS 4.25 rs 17% rs 25 There is another way to obtain the same result based on the simplest version of the Dividend Discount Model: Div rs g g ROE(1 Payout) P If the NPV of new investment is zero (PVGO = 0), then ROE = r and: P Div Div EPS rs rs (1 Payout) rs Payout rs The second step is to find the unlevered cost of capital We know that the cost of equity of a levered firm is higher than the cost of equity of an unlevered firm (r 0) because of financial risk. The relation between rS and r0 is (MM Proposition II with corporate taxes): rS r0 ( r0 rB )(1Tc ) B S With rS = 17%, rB = 10.5%, TC = 50% and B/S= 0.6, we get r0 = 15.5%. This is the discount rate to use to calculate the value of the projects for an unlevered firm. The third step is to calculate the NPV of the unlevered projects To do this we need to know the expected unlevered cash flows of each project. Assume that the UCF of each project is constant. Then: NPV(10%) = - Cost + UCF Annuity factor(10%, Project life) Project A B C D E F InvestmentLife 800 3,000 3600 600 4800 1800 8 20 10 2 15 6 NPV(10%) UCF 920 322 4,200 846 1680 859 66 384 1140 781 108 438 NPV(15.5%) 623 2,151 632 20 -342 -164 Project A, B C and D have all positive NPVs: they should be accepted. E and F are more problematic. They should be rejected if financed through equity. The fourth step is to incorporate side effect of financing. Two main approaches: 1) Calculate APV for each project by adding PVTS to NPV 2) Discount UCF at a weighted average cost of capital 1. APV calculations for E and F Assume that each project is financed with debt and, for simplicity, that the debt is repaid at the end of the project (other assumptions are, of course, possible but this one is simple to implement). The annual tax shield is : TS = TC rB Debt PVTS = TS Annuity factor(10.5%, Project life) This leads to the following calculations: Project E F Debt Life 4,800 1,800 15 6 Annual tax shield 252 94.5 NPV PVTS APV -342 -164 1,863 406 1,521 242 Both project have positive APV: they should be undertaken (before a final decision, some additional calculations might be useful based on the exact timing of repayment). 2. Weighted average cost of capital The weighted average cost of capital for Chem-Cal as a whole is: rwacc 17% 50 30 105 . % (105 . ) 12.6% 80 80 This discount rate could be used to calculate the APV of projects E and F assuming that the funding of these project is similar to the funding of the firm as a whole Project E F APV =NPV(12.6%) 353 - 29 If the financing of each project is not a carbon copy of Chem-Cal financing, another calculation of the weighted average cost of capital might be used In addition, we might wish to take into account the finite life of the projects (see Taggart for detailed explanation). We would have to specify a leverage ratio L (=B/V) and, for instance, we might use Taggart’s formula 2C.3 (valid for finite of perpetual life, debt tax shields uncertain): rwacc r0 rBTC L For L = 0.4, for instance, we obtain rwacc = 15.5 - 10.5 0.5 0.4 = 13.4 Project F would still not be profitable