Introduction to Dollar Cost Averaging

advertisement

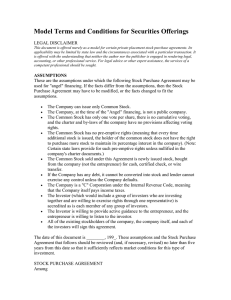

Prepared by George Oviedo 320 Palisade Avenue Bogota, NJ 07603 Tel: 201-489-1118 Fax: 201-457-1082 What is a Mutual Fund? What is DCA? What if Markets Go Up ? What if Markets Go Down? Summary Definitions Disclosure A mutual fund is a pooling of assets investing in diversified stocks or bonds. Advantages to investing in mutual funds include diversification, professional management, high liquidity and accessibility for people with a smaller amount of capital. Dollar Cost Averaging (DCA) is a systematic way to invest in mutual funds on a monthly basis. Many times large initial investment contributions are waived in light of a monthly stream of investments. Some mutual fund families are willing to start an investment plan with as little as $25 dollars per month. If markets go up, the investments will rise accordingly based on the underlying investment’s performance of the holdings of the fund. For a younger investor a more aggressive position may be encouraged but factors such as risk tolerance, investment experience and time horizon for use of such funds have to be taken in consideration. Markets go up and down. Investors tend to get nervous when the markets turn dramatically to the downside. The use of a DCA program can benefit an investor in rough or uncertain times. As prices for the underlying funds drop DCA investors would be able to purchase more shares at a lower price. If the markets turn positive, the benefit from buying low can be stunning. * Relationship between the price per share and cost per share to the investor. Past performance does not guaranteed future results The figures on page 7 are actual investments into the Alger Capital Appreciation fund for the year of 2008 The client kept putting away monies even through what seemed to be a desperate period in the stock markets The graph on page 8 represents the accumulation of shares over a longer period in the Alger fund When the price drops in the underlying fund the amount of shares increases over time You are able to build a nice base of shares at lower prices If the DCA plan is un-interrupted during down markets both the value and average cost will decline as well If the markets start to turn positive, as evidenced in the Gain versus Loss Graph, the value of the account can have dramatic gains In the case of the Alger Fund during 2008 and beyond the loss seen in 2008 was completely reversed A consistent program of investing can help one achieve specific goals A financial representative can help a novice investor prepare to face their goals “When the Markets Go Down” impulsive selling could cause an investor to miss the upside Working with a professional representative can help ease the mind of an investor during weak markets Stocks: A stock is an ownership interest in a business. There are over 10,000 corporations that are publicly traded. Bond: A bond represents a debt or an IOU from the issuing party. Bonds are issued by governments and corporations. The amount of loan is known as the principal and interest is the compensation given to the lenders. IRA's: Individual Retirement Accounts- are vehicles designed to provide for the "golden years". The two types of IRA's are Traditional IRA's and Roth IRA's. Educational IRA's are also a vehicle that can be utilized for a child's education. Annuity: A contract between an individual and an insurance company in which the individual pays money into an account in exchange for a guaranteed payment at a later date. Annuities offer tax-deferred growth. Securities offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. One Lincoln Center, Syracuse, NY 13202. Telephone number: 315.471.2191 Performance figures displayed herein represent past performance and are not predictive of future results. The investment return and principal value of an investment will fluctuate so that An investor’s shares/units, when redeemed, may be worth more or less than the original cost. Investment securities are not FDIC-insured, nor are they deposits of, or guaranteed by, a bank or any other entity. The information has been gathered from sources believed to be reliable, however, Cadaret, Grant does not guarantee the accuracy or completeness of the information. The cost basis of securities positions is being provided by the account holder and neither the representative not Cadaret, Grant makes any representations as to the accuracy of such cost basis. The cost basis information provided is meant as a general guide and should not be relied upon as tax or legal advice. Securities offered through Cadaret, Grant & Co. Inc. Member FINRA/SIPC New Horizon Financial Group & Cadaret, Grant are separate entities. The figures contained herein are for illustrative purposes only and have been derived from sources deemed to be reliable. There are no assurances that any particular method or strategy will achieve a desired result. Past performance is not indicative of future results.