pp Bank reconciliation

advertisement

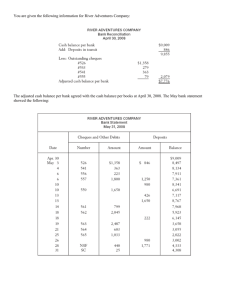

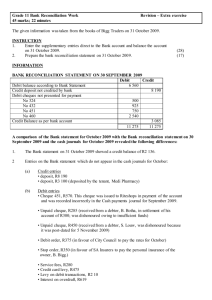

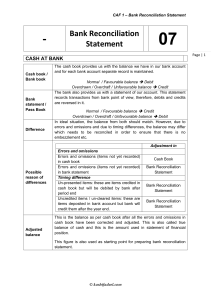

Banking & Bank Reconciliation Looking at the cash book and bank statement, identifying the difference between the values Cash Book • The Cash Book is used as a Book of Prime Entry and/or part of the double entry system • The cash book records all monetary transactions coming in or going out of the business • Receipts – debit side of the book • Payments – credit side of the book Cash Book v Bank Statement • The cash book demonstrates to the business, monies being received or paid out over time • The bank statement demonstrates the monies cleared by the bank for the business over a set time • We use the bank statement to ensure all transactions shown in the cash book have actually gone through the bank account. • To ensure accuracy Transactions used and shown on the statement • Monies paid into the bank account – Cash deposits via the bank counter or automated teller machines (ATM) – Cheque deposits via counter or ATM – Automated payments received • • • • • • Bank Giro Credit (BGC) Bank Automated Clearing System (BACS) Clearing House Automated Payment System (CHAPS) Faster Payment Standing Order (SO) Direct Debit (DD) – Interest received from the bank (deposit accounts) Transactions- Continuation • Amounts paid out of the bank account – Cheques issued to suppliers and presented by.. to the bank for payment – Debit card payments by phone, online and person – Automated payments paid (as shown on previous slide) – Interest and bank charges paid to the bank Bank Statement • At regular intervals the bank will produce a statement showing all transactions processed by the bank for the business. • The statement will show an end date and balance and the statement will have a sequence number that follows on from the last statement. • The bank will contact the business by best method – email with link or mail with copy of statement • The statement will show each transaction and the revised daily bank balance after the transaction Statement - cont • Counter Credit is the narrative used for deposits made over the bank counter • CHQ denotes a cheque written and presented by the supplier for payment • Dishonoured Cheque is a customer’s cheque that their bank cannot pay usually due to insufficient funds • REMEMBER the statement is a record of the banks transactions so: – A bank balance in the black is shown as a Credit – An Overdraft balance is shown as a Debit Bank reconciliation - reason • When the bank statement arrives the business will compare the statement balance against the cash book balance and find a difference. • The reasoning being: – automated transactions that have been recorded in the bank but not the cash book • Or – Transactions recorded in the cash book but not shown in the bank statement Methodology used to identify the difference • Compare the statement entries against the cash book. Where an entry is shown in both the cash book and the statement , tick them off. • Any unticked items shown on the statement must be checked and verified to ensure the bank has not made a mistake (if an error, contact the bank) • If the unticked item is valid, make an entry into the cash book to show the adjustment • Balance the cash book to achieve a revised balance to be used in the Trial Balance Difference - cont • After the adjustments in the cash book there could still be a difference • Usually caused by timing differences – Cheques sent to suppliers taking 3 working days to clear plus time to deliver – Cheques received by customers are banked but again take 3 working days to clear • To demonstrate the timing difference you will write up a Bank Reconciliation Statement Bank Reconciliation Statement – purpose • The purpose of the statement is to reconcile the adjusted cash book against the bank statement to show transactions still awaiting clearance through the bank account (items that will appear in next bank statement) Bank Reconciliation Statement • Balance as Bank Statement Plus Lodgements (customer receipts) Less Unpresented cheques (supplier payments) • Balance as per adjusted cash book The lodgement and unpresented cheque values will come from the cash book transactions unticked. The BRS final balance should agree with the cash book.