Grade 11 Bank Reconciliation Work

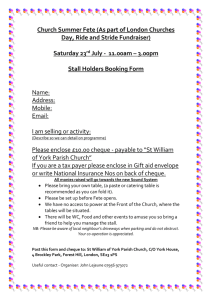

advertisement

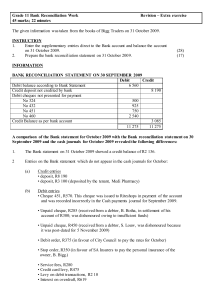

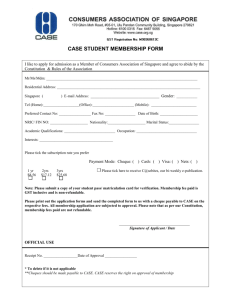

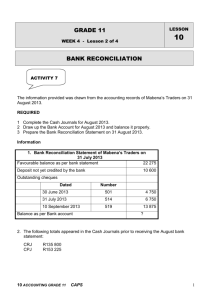

Grade 11 Bank Reconciliation Work 45 marks; 22 minutes Revision – Extra exercise The given information was taken from the books of Bigg Traders on 31 October 2009. INSTRUCTION 1. Enter the supplementary entries direct to the Bank account and balance the account on 31 October 2009. 2. Prepare the bank reconciliation statement on 31 October 2009. (28) (17) INFORMATION BANK RECONCILIATION STATEMENT ON 30 SEPTEMBER 2009 Debit Credit Debit balance according to Bank Statement 6 560 Credit deposit not credited by bank 8 190 Debit cheques not presented for payment No 324 500 No 432 925 No 451 750 No 460 2 540 Credit Balance as per bank account 3 085 11 275 11 275 A comparison of the Bank statement for October 2009 with the Bank reconciliation statement on 30 September 2009 and the cash journals for October 2009 revealed the following differences: 1. The Bank statement on 31 October 2009 showed a credit balance of R2 136. 2 Entries on the Bank statement which do not appear in the cash journals for October: (a) Credit entries • deposit, R8 190 • deposit, R3 100 (deposited by the tenant, Medi Pharmacy) (b) Debit entries • Cheque 451, R570. This cheque was issued to Riteshops in payment of the account and was recorded incorrectly in the Cash payments journal for September 2009. • Unpaid cheque, R285 (received from a debtor, B. Botha, in settlement of his account of R300; was dishonoured owing to insufficient funds) • Unpaid cheque, R450 (received from a debtor, S. Louw, was dishonoured because it was post-dated for 5 November 2009) • Debit order, R375 (in favour of City Council to pay the rates for October) • Stop order, R350 (in favour of SA Insurers to pay the personal insurance of the owner, B. Bigg.) • Service fees, R280 • Credit card levy, R475 • Levy on debit transactions, R2 10 • Interest on overdraft, R619 3. Entry in the Cash receipts journal for October 2009 which does not appear on the Bank statement: Deposit, R3 280 4 Entry in the Cash payments journal for October 2009 which does not appear on the Bank statement: Cheque 482, R1 700 (dated 27 October 2009) Cheque 489, R1 850 (dated 4 November 2009) Additional Information and errors discovered 1 Cheque 324 was issued as a donation to the WP Soccer Club on 13 July 2009. As the club no longer exists the cheque must be cancelled. 2 Cheque 432 was issued to Statsales Limited to pay for stationery. The cheque was lost in the post. It must be cancelled and replaced by cheque no. 491. 3 The totals of the bank columns of the cash journals before the comparisons were made were as follows: Cash receipts journal, R35 680 Cash payments journal, R34 930 BANK BANK RECONCILIATION STATEMENT ON ------------------------------------------Debit Credit MEMO BANK Oct 31 Total receipts CRJ 35680 Oct 1 Balance b/d 3085 CPJ 34930 3100 Total Payments Creditors Control 180 Debtors Control 285 Donation 500 Debtors Control 450 Stationery 925 Rates and Taxes 375 Drawings 350 Bank Charges 965 Interest on Overdraft 619 Stationery 925 Rent Income Balance c/d 1599 41984 41984 Nov 1 Balance b/d 1599 29marks BANK RECONCILIATION STATEMENT ON ----31 October 2009---Debit Credit Credit balance per bank statement 2136 Credit outstanding deposit 3280 Debit cheques not presented for payment: no. 482 1700 No. 489 1850 No. 491 925 No. 460 2540 Credit balance as per bank account 1599 7015 7015 16marks