Macroeconomics 142 Test 3 (from TinyCards)

This deck, custom-made for a class, contains material covered after Test 2 through Test 3. (V.6) (This deck used to be on an amazing spaced-learning service called Tinycards. You can see the original version in all its former glory here: https://web.archive.org/web/20200901050747if_/https://tinycards.duolingo.com/decks/PKTgNVsM/macroeconomics-142-test-3 (but you unfortunately can't study it from there).

-

functions of moneymedium of exchange, store of value, and unit of account

-

most important of the functions of moneymedium of exchange

-

characteristics of “good” moneydurability, divisibility, portability, and scarcity

-

the concept that makes money function/what backs up the U.S. dollaran agreement

-

M1official money supply of the U.S.; coins, currency, checking accounts

-

M2M1+small time deposits; closely related to M1

-

M3M2+large ($200,000) time deposits

-

type of money that drives policyM1

-

monetarily significant event that happened in 1914The Federal Reserve System (FED) was established.

-

FED characteristicsany profits go to the treasury and it promotes economic stability

-

FED functionscontrols the U.S. money supply, issues paper money, regulates banks, and is both the government’s bank and the bank’s bank

-

2019 chair of the FEDJerome Powell

-

BoGBoard of Governors

-

Number of members in the BoG7

-

method by which members of the BoG are chosenthey are appointed by the president and approved by Congress

-

BoG term length and expiry time14 years; one expires every two years

-

FOMCFederal Open Market Committee

-

number of members in the FOMC12

-

official who oversees the FOMCchairman of the FED

-

method by which the chairman of the FED is chosenappointed by the president

-

term length and appointment time of the chairman of the FED4 years; one is appointed by the president on even non-presidential election years

-

FDICFederal Deposit Insurance Corporation

-

function of the FDICinsuring the money in banks and federal deposits

-

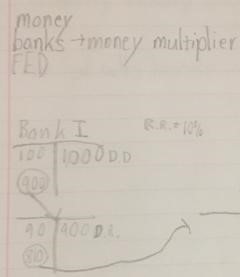

RRReserve Requirement

-

Reserve Requirement definitionthe percentage of deposited money that the FED requires banks to hold

-

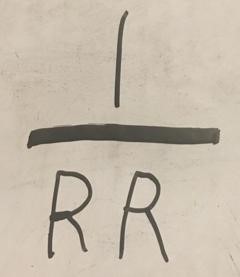

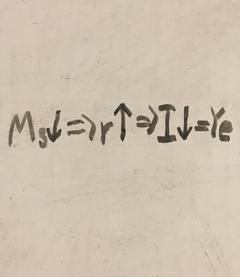

money multiplier formula

-

factors that can reduce the size of the money multiplierpeople keeping cash on hand or banks holding more money than they are required to hold

-

U.S. bondsunits of the U.S. debt that are sold when taxes do not raise enough money to fund the U.S. government

-

interest rate definitionthe percentage of money that consumers pay banks when they borrow money from them

-

discount rate definitionthe interest rate that the FED charges banks when banks borrow money from it; has an impact on the interest rate

-

Open Market Operations definitionthe buying and selling of U.S. bonds

-

Quantitative easing definitionsimilar to Open Market Operations, except that the government buys securities

-

Monetary Controlschanging RR, changing the discount rate, Open Market Operations, and Quantitative Easing

-

effect of the Reserve Requirement changingif it decreases, M1 increases; if it increases, M1 decreases

-

effect of the discount rate changingif it decreases, M1 increases; if it increases, M1 decreases

-

effect of Open Market Operationsif the FED buys bonds, M1increases; if the FED sells bonds, M1 decreases

-

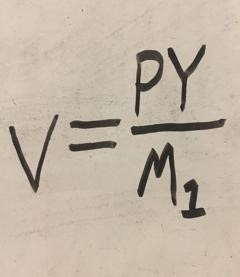

Quantity EquationMV=PY

-

M (Quantity Equation)M1

-

V (Quantity Equation)velocity of money

-

P (Quantity Equation)price level

-

Y (Quantity Equation)national output

-

PY (Quantity Equation)GDP

-

the two assumptions about the quantity equationV is stable and Y is equal to Y*

-

velocity of money definitionthe average number of times that each dollar is used

-

velocity of money equation

-

Policy Rule of Neoclassical Marketerslet the money supply grow 4-5% per year

-

Monetary policies to use to eradicate a recessionreduce the Reserve Requirement, reduce the discount rate, or buy bonds

-

Monetary policies to use to eradicate inflationraise the Reserve Requirement, raise the discount rate, or sell bonds

-

reason why raising the discount rate helps to eradicate inflationbanks will be less likely to borrow money

-

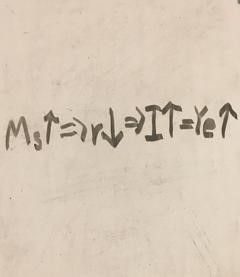

Monetary policy’s chain of effects in eradicating recessions

-

Monetary policy’s chain of effects in eradicating inflation

-

Weaknesses of Monetary Policythe liquidity trap and the fact that many things affect investment, not just the interest rate

-

liquidity trap definitionthe situation in which interest rates are so low that they do not respond to additional money stimulation

-

Characteristics of monetary policyit’s less effective during recessions (the worse the recession, the less effective it is) but works fine for inflation

-

economic condition in which fiscal policy is less effectivemild recession

-

Weakness of fiscal policycrowding out: government borrowing “crowds out" private spending because interest rates are higher

-

effect of crowding outthe government spends more money, which stimulates the economy, but that also causes higher interest rates, which causes firms to spend less money

-

best option for eradicating recessionscombining fiscal policy and monetary policy

-

Timing of policy’s types of lagrecognition lag, action lag, and impact lag

-

function of the 11 leading indicatorsthey can be used to predict recessions