functions of money

medium of exchange, store of value, and unit of account

most important of the functions of money

medium of exchange

characteristics of “good” money

durability, divisibility, portability, and scarcity

the concept that makes money function/what backs up the U.S. dollar

an agreement

M1

official money supply of the U.S.; coins, currency, checking accounts

M2

M1+small time deposits; closely related to M1

M3

M2+large ($200,000) time deposits

type of money that drives policy

M1

monetarily significant event that happened in 1914

The Federal Reserve System (FED) was established.

FED characteristics

any profits go to the treasury and it promotes economic stability

FED functions

controls the U.S. money supply, issues paper money, regulates banks, and is both the government’s bank and the bank’s bank

2019 chair of the FED

Jerome Powell

BoG

Board of Governors

Number of members in the BoG

7

method by which members of the BoG are chosen

they are appointed by the president and approved by Congress

BoG term length and expiry time

14 years; one expires every two years

FOMC

Federal Open Market Committee

number of members in the FOMC

12

official who oversees the FOMC

chairman of the FED

method by which the chairman of the FED is chosen

appointed by the president

term length and appointment time of the chairman of the FED

4 years; one is appointed by the president on even non-presidential election years

FDIC

Federal Deposit Insurance Corporation

function of the FDIC

insuring the money in banks and federal deposits

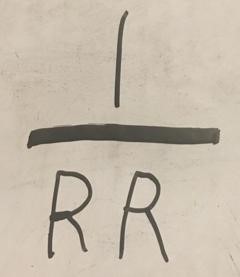

RR

Reserve Requirement

Reserve Requirement definition

the percentage of deposited money that the FED requires banks to hold

money multiplier formula

factors that can reduce the size of the money multiplier

people keeping cash on hand or banks holding more money than they are required to hold

U.S. bonds

units of the U.S. debt that are sold when taxes do not raise enough money to fund the U.S. government

interest rate definition

the percentage of money that consumers pay banks when they borrow money from them

discount rate definition

the interest rate that the FED charges banks when banks borrow money from it; has an impact on the interest rate

Open Market Operations definition

the buying and selling of U.S. bonds

Quantitative easing definition

similar to Open Market Operations, except that the government buys securities

Monetary Controls

changing RR, changing the discount rate, Open Market Operations, and Quantitative Easing

effect of the Reserve Requirement changing

if it decreases, M1 increases; if it increases, M1 decreases

effect of the discount rate changing

if it decreases, M1 increases; if it increases, M1 decreases

effect of Open Market Operations

if the FED buys bonds, M1increases; if the FED sells bonds, M1 decreases

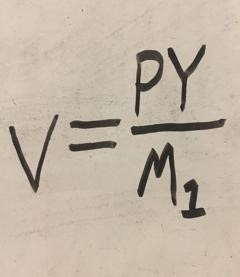

Quantity Equation

MV=PY

M (Quantity Equation)

M1

V (Quantity Equation)

velocity of money

P (Quantity Equation)

price level

Y (Quantity Equation)

national output

PY (Quantity Equation)

GDP

the two assumptions about the quantity equation

V is stable and Y is equal to Y*

velocity of money definition

the average number of times that each dollar is used

velocity of money equation

Policy Rule of Neoclassical Marketers

let the money supply grow 4-5% per year

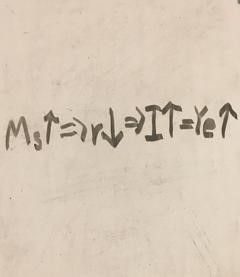

Monetary policies to use to eradicate a recession

reduce the Reserve Requirement, reduce the discount rate, or buy bonds

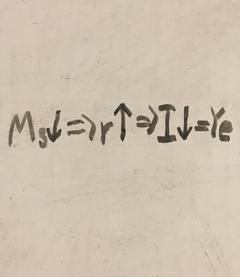

Monetary policies to use to eradicate inflation

raise the Reserve Requirement, raise the discount rate, or sell bonds

reason why raising the discount rate helps to eradicate inflation

banks will be less likely to borrow money

Monetary policy’s chain of effects in eradicating recessions

Monetary policy’s chain of effects in eradicating inflation

Weaknesses of Monetary Policy

the liquidity trap and the fact that many things affect investment, not just the interest rate

liquidity trap definition

the situation in which interest rates are so low that they do not respond to additional money stimulation

Characteristics of monetary policy

it’s less effective during recessions (the worse the recession, the less effective it is) but works fine for inflation

economic condition in which fiscal policy is less effective

mild recession

Weakness of fiscal policy

crowding out: government borrowing “crowds out" private spending because interest rates are higher

effect of crowding out

the government spends more money, which stimulates the economy, but that also causes higher interest rates, which causes firms to spend less money

best option for eradicating recessions

combining fiscal policy and monetary policy

Timing of policy’s types of lag

recognition lag, action lag, and impact lag

function of the 11 leading indicators

they can be used to predict recessions